Canada Business Corporations Act Form 17

A Repealed 2009 c. NI 51-102 means National Instrument 51-102 of the Canadian Securities Administrators entitled Continuous Disclosure Obligations and known in French as Règlement 51-102 sur les obligations dinformation continue published in both official.

3 11 16 Corporate Income Tax Returns Internal Revenue Service

3 11 16 Corporate Income Tax Returns Internal Revenue Service

Page 1 of 2.

Canada business corporations act form 17. Canada Business Corporations Act CBCA FORM 15 ARTICLES OF REVIVAL Section 209 I hereby certify that the request for revival is intended for legal purposes in good faith and in the interest of the applicant. Canada Business Corporations Act RSC 1985 c. Reduction of stated capital 2 If an amendment effects or requires a reduction of.

150 1 A person shall not solicit proxies unless a proxy circular in the prescribed form is made available in the prescribed manner to the auditor of the corporation to each shareholder whose proxy is solicited. Use of French or English form of name 2. 551 Certain Acts do not apply 3 The following do not apply to a corporation.

Purposes of Act. 17 Subsections 1501. Canada Business Corporations Act CBCA FORM 2 INITIAL REGISTERED OFFICE ADDRESS AND FIRST BOARD OF DIRECTORS Sections 19 and 106 To be filed with Articles of Incorporation Amalgamation or Continuance.

This means that PDF forms for most online services are no longer available for downloadThey are now available on request. Act means the Canada Business Corporations Actend of the taxation year. 344 a1 the Canada Not-for-profit Corporations Act.

The Canada Business Corporations Act CBCA is the federal law that regulates business structures in Canada. Set out its name in its articles in any language form and it may use and may be legally designated by any such form outside Canada. 15711 Sections of Canada Business Corporations Act applicable.

XML Full Document. 5 - Minimum and maximum number of directors. ISED-ISDE 2904E 201611 1 - Corporate name.

Subsection 2101 of the CBCA applies to a corporation that has not issued any shares. Canada Business Corporations Act RSC 1985 c. Diversity in corporations 1721 1 The directors of a prescribed corporation shall place before the shareholders at every annual meeting the prescribed information respecting diversity among the directors and among the members of senior management as defined by regulation.

15713 Powers of Director. Regulations made under this Act. Determining that Telesat Canada Need Not Apply for a Certificate of Continuance Under the Act Repealed SOR80-957.

17 No person is affected by or is deemed to have notice or knowledge of the contents of a document concerning a corporation by reason only that the. Canada Business Corporations Act 1513 KB Act current to. 16 rows From Corporations Canada Due to a high volume of requests applications are taking.

PART XIV1 Disclosure Relating to Diversity. Liability of shareholders after dissolution of company. Purposes 4 The purposes of this Act are to revise and reform the law applicable to business corporations incorporated to carry on business throughout Canada to advance the cause of uniformity of business corporation law in Canada and to provide a means of allowing an orderly transferance of certain federal companies incorporated under various.

2 Repealed 1991 c. Canada Business Corporations Act CBCA FORM 1 ARTICLES OF INCORPORATION Section 6 1 - Corporate name. Subsection 2102 of the CBCA applies to a corporation that has no property and no liabilities.

174 or 176 articles of amendment in the form that the Director fixes shall be sent to the Director. Policy on filing of annual returns Canada Business Corporations Act. The law acts as a kind of clearinghouse for Canadian corporate structures in that it defines what a corporation is how it should be organized and run what counts as a Canadian-owned business and thus deserves special tax breaks and how financing may be.

End of the taxation year Repealed SOR2010-128 s. On January 15 2020 Corporations Canada adopted a digital-first approach to forms for business and not-for-profit corporations. An Act to amend the Canada Business Corporations Act.

Federal laws of canada. The following must be filed once the corporation has been revived. Check only one box.

Canada Business Corporations Act 941 KB PDF Full Document. 427 Repealed regulations made under this Act. Canada Business Corporations Regulations 2001 SOR2001-512 Minister Designation Order Canada Business Corporations Act CRC c.

Any outstanding annual returns for the last two years. 3 1 This Act applies to every corporation incorporated and every body corporate continued as a corporation under this Act that has not been discontinued under this Act. Explains why you need to file an annual return.

Every corporation subject to the Canada Business Corporations Act CBCA must file an annual return with Corporations Canada every year. 3 - The classes and any maximum number of shares that the corporation is authorized to issue 4 - Restrictions if any on share transfers. 209 1 When a corporation or other body corporate is dissolved under this Part section 268 of this Act section 261 of the Canada Business Corporations Act chapter 33 of the Statutes of Canada 1974-75-76 or subsection 2976 of the Canada Not-for-profit Corporations Act any interested person may apply to the Director to have the dissolved.

FORM 17 ARTICLES OF DISSOLUTION Item 4 Indicate if the corporation is applying for a dissolution under section 210 or 211 of the CBCA.

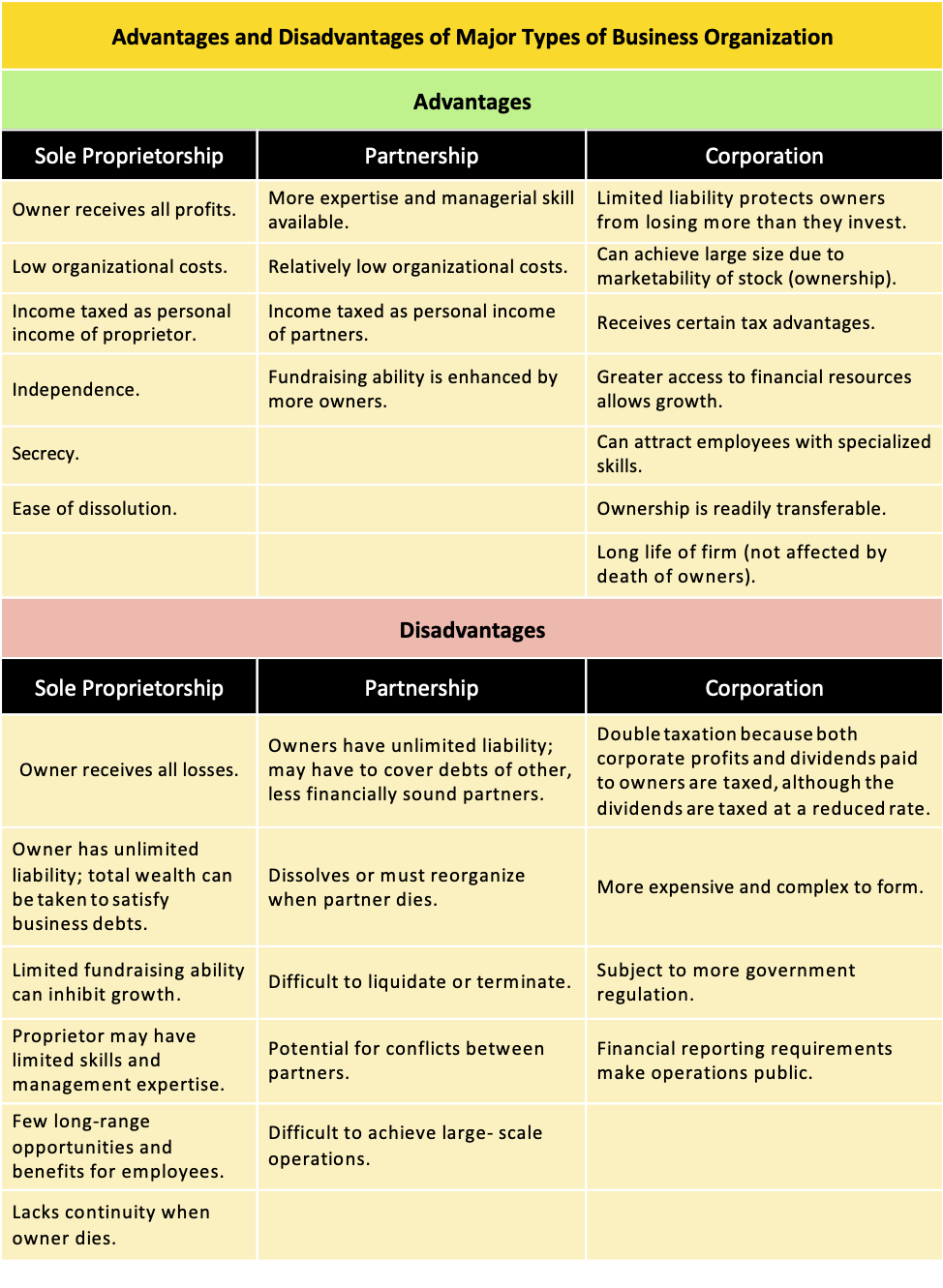

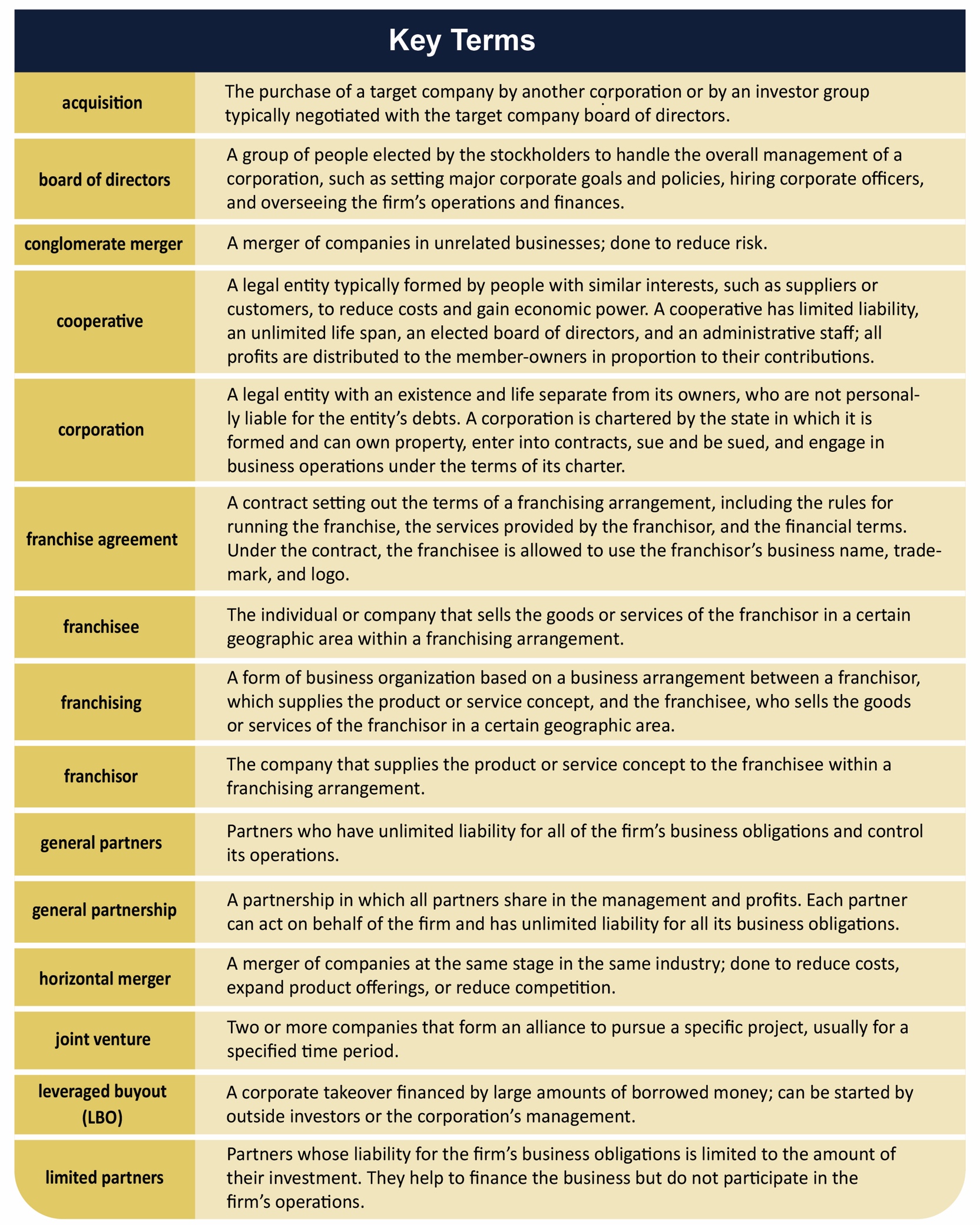

Chapter 4 Forms Of Business Ownership Introduction To Business

Chapter 4 Forms Of Business Ownership Introduction To Business

Pdf An Overview Of China S Corporate Law Regime

Pdf An Overview Of China S Corporate Law Regime

3 11 217 Form 1120 S Corporation Income Tax Returns Internal Revenue Service

3 11 217 Form 1120 S Corporation Income Tax Returns Internal Revenue Service

Americans Working In Canada And Taxes

3 11 217 Form 1120 S Corporation Income Tax Returns Internal Revenue Service

3 11 217 Form 1120 S Corporation Income Tax Returns Internal Revenue Service

Chapter 4 Forms Of Business Ownership Introduction To Business

Chapter 4 Forms Of Business Ownership Introduction To Business

3 11 217 Form 1120 S Corporation Income Tax Returns Internal Revenue Service

3 11 217 Form 1120 S Corporation Income Tax Returns Internal Revenue Service

3 11 217 Form 1120 S Corporation Income Tax Returns Internal Revenue Service

3 11 217 Form 1120 S Corporation Income Tax Returns Internal Revenue Service

3 11 217 Form 1120 S Corporation Income Tax Returns Internal Revenue Service

3 11 217 Form 1120 S Corporation Income Tax Returns Internal Revenue Service

3 11 16 Corporate Income Tax Returns Internal Revenue Service

3 11 16 Corporate Income Tax Returns Internal Revenue Service

3 11 16 Corporate Income Tax Returns Internal Revenue Service

3 11 16 Corporate Income Tax Returns Internal Revenue Service

Https Novascotia Ca Sns Pdf Ans Rjsc Companies Act Discussion Pdf

Chapter 4 Forms Of Business Ownership Introduction To Business

Chapter 4 Forms Of Business Ownership Introduction To Business

3 11 217 Form 1120 S Corporation Income Tax Returns Internal Revenue Service

3 11 217 Form 1120 S Corporation Income Tax Returns Internal Revenue Service

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Https Www Issgovernance Com File Policy Active Americas Canada Venture Voting Guidelines Pdf

3 11 217 Form 1120 S Corporation Income Tax Returns Internal Revenue Service

3 11 217 Form 1120 S Corporation Income Tax Returns Internal Revenue Service

Is Cannabis Safe To Use Facts For Youth Aged 13 17 Years Canada Ca

Is Cannabis Safe To Use Facts For Youth Aged 13 17 Years Canada Ca