What Is Business Interest Income For 163 J

Under new section 163 j of the Internal Revenue Code IRC the deduction for business. Refer to the Form 8990 instructions for more information on the filing requirements and calculations.

Final Business Interest Limitation Rules Present Opportunities 2020 Articles Resources Cla Cliftonlarsonallen

Final Business Interest Limitation Rules Present Opportunities 2020 Articles Resources Cla Cliftonlarsonallen

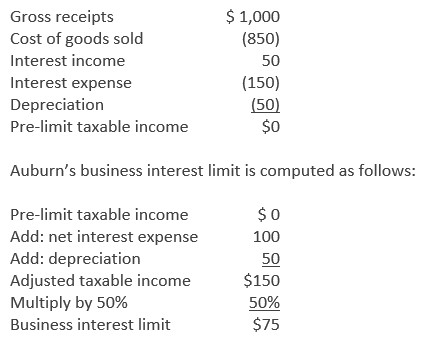

The limitation includes Business Interest Income BII and Floor Plan Financing Interest FPFI and Adjusted Taxable Income ATI.

What is business interest income for 163 j. Disallowed business interest expense is the amount of business interest expense for a tax year in excess of the amount allowed as a deduction for that tax year under the Sec. For tax years beginning on or after January 1 2018 Code Sec. 163 j limitation on business interest expense deductions.

163j limits the deduction of Business Interest Expense BIE. While investment interest is excluded from the definition of business interest income for purposes of IRC 163 j an exception is made under Prop. The amount of a taxpayers business interest expense that is properly allocable to excepted trades or businesses is not subject to limitation under section 163 j and the amount of a taxpayers other items of income gain deduction or loss including interest income that is properly allocable to excepted trades or businesses is excluded from the calculation of the taxpayers section 163 j.

This 50 ATI limitation does not apply to partnerships for tax years beginning in 2019. 163 j prior to being amended by the CARES Act provided that business interest expense in general was deductible by a taxpayer only to the extent the deduction was less than 30 of. The form calculates the section 163 j limitation on business interest expenses in coordination with other limits.

The guidance includes final and proposed regulations as well as a proposed revenue procedure with a safe harbor for operators of qualified residential living facilities and FAQs on the aggregation rules for. In general it limits a taxpayers interest expense deductions for a taxable year to the sum of 30 percent of adjusted taxable income ATI and its business interest income. IRS issues business interest expense limitation guidance.

Tax Business. The amount of a section 163j interest dividend that a shareholder may treat as interest income for purposes of section 163j would be limited to the excess of the amount of the RIC dividend that includes the section 163j interest dividend over the sum of the conduit amounts other than interest-related dividends under section 871kaC and section 163j interest dividends for example capital gain. BIE is interest paid or accrued on indebtedness properly allocable to a trade or business.

Instead a partner treats 50 of its. New section 163 j limits the taxpayers annual deduction of interest expense to the sum of. The new section 163 j business interest expense deduction and carryover amounts are reported on Form 8990.

The new law applies to interest on all business debt without a transition rule for debt in place prior to the enactment of the law. The Final Regulations retain and modify the anti-abuse rule that permits the IRS to recharacterize items as interest or non-interest for purposes of 163j if a principal purpose of structuring a transaction is to reduce the amount treated as. 1 business interest income 2 30 percent of the adjusted taxable income of the taxpayer and 3 the floor plan financing interest of the taxpayer for the taxable year.

The IRS issued a long-awaited package of guidance regarding the Sec. Solely for purposes of section 163j all interest paid or accrued or treated as paid or accrued by a C corporation is business interest expense and all interest includible in gross income by a C corporation is business interest income except to the extent such interest expense or interest income is allocable to an excepted trade or business. 1163 j-4 b to recharacterize investment interest allocated to a C corp partner as interest expense properly allocable to a trade or business of the C corp and thus subject to the business interest limitation under IRC 163 j.

30 of the taxpayers adjusted taxable income ATI for the year Its business interest income and Floor plan financing interest. Under Tax Cuts and Jobs Act TCJA for taxable years beginning after December 31 2017 the deduction for business interest expense is limited to sum of. The newly enacted version of section 163j limits deductions for business interest expense.

Business interest expense that may be deducted for tax years beginning in 2019 and 2020 by computing the section 163j limitation using 50 of your adjusted taxable income ATI instead of 30. For example a taxpayer that is a partnership without a corporate partner should still apply the section 448c gross receipts test for purposes of section 163j but apply the partnership definition of controlling interest for purposes of the aggregation rules under 152-1c2iii and d2iii of the Income. The Tax Cuts and Jobs Act TCJA created a new limitation on the deduction of business interest expense for tax years beginning after December 31 2017.

Income Report By Using The Irs 1099 Misc Form 1099 Tax Form Irs Forms Irs

Income Report By Using The Irs 1099 Misc Form 1099 Tax Form Irs Forms Irs

How To Assess A Real Estate Investment Trust Reit Real Estate Investment Trust Investing Reit

How To Assess A Real Estate Investment Trust Reit Real Estate Investment Trust Investing Reit

Largest Waste Management Glory Investing Show Dividend Investing Stock Market Investing Money Management Advice

Largest Waste Management Glory Investing Show Dividend Investing Stock Market Investing Money Management Advice

Client Required Contractor Details For Irs 1099 Tax Form E Filing 1099 Tax Form Tax Forms Irs Forms

Client Required Contractor Details For Irs 1099 Tax Form E Filing 1099 Tax Form Tax Forms Irs Forms

Instructions For Form 8990 05 2020 Internal Revenue Service

Instructions For Form 8990 05 2020 Internal Revenue Service

Pin By David Berger On Getting Crafty Grant Proposal Grant Writing Budget Template

Pin By David Berger On Getting Crafty Grant Proposal Grant Writing Budget Template

Blender Shortcut Cheat Sheet Chinese Infographic Uv Mapping Start Up

Blender Shortcut Cheat Sheet Chinese Infographic Uv Mapping Start Up

Fujimori S T Hasegawa T Masui K Takahashi D S Herran H Dai Y Hijioka And M Kainuma 2017 S Environmental Change Environmental Studies Pathways

Fujimori S T Hasegawa T Masui K Takahashi D S Herran H Dai Y Hijioka And M Kainuma 2017 S Environmental Change Environmental Studies Pathways

Instructions For Form 8990 05 2020 Internal Revenue Service

Instructions For Form 8990 05 2020 Internal Revenue Service

Client Required Contractor Details For Irs 1099 Tax Form E Filing Tax Forms 1099 Tax Form Irs Forms

Client Required Contractor Details For Irs 1099 Tax Form E Filing Tax Forms 1099 Tax Form Irs Forms

Https Www Irs Gov Pub Newsroom Lbi Tcja Participant Guide 163j 13301 Pdf

Josh Kuo Think In Possibilities Follow Themoneymakingpage Business Ideas Entrepreneur Startup Inspiration Entrepreneurship Startups

Josh Kuo Think In Possibilities Follow Themoneymakingpage Business Ideas Entrepreneur Startup Inspiration Entrepreneurship Startups

Business Interest Limitation Rules Section 163 J Where Do We Stand Baker Tilly

Business Interest Limitation Rules Section 163 J Where Do We Stand Baker Tilly

You Do Not Require To Provide A 1099 Return For Corporations Payments For Merchandise Telephone Freight Storage Payments To Real Estate B Irs Forms Form Irs

You Do Not Require To Provide A 1099 Return For Corporations Payments For Merchandise Telephone Freight Storage Payments To Real Estate B Irs Forms Form Irs

Instructions For Form 8990 05 2020 Internal Revenue Service

Instructions For Form 8990 05 2020 Internal Revenue Service

Non Profit Monthly Financial Report Template 8 Templates Example Templates Example Statement Template Financial Statement Financial Position

Non Profit Monthly Financial Report Template 8 Templates Example Templates Example Statement Template Financial Statement Financial Position

Lets Go To Hay Day Generator Site New Hay Day Hack Online 100 Works For Real Www Generator Help Personal Financial Statement Net Worth Statement Template

Lets Go To Hay Day Generator Site New Hay Day Hack Online 100 Works For Real Www Generator Help Personal Financial Statement Net Worth Statement Template

70 Mentions J Aime 0 Commentaires Christinas Pouch Business Christina Loves Planning Sur Instagram Love Th Best Planners Planner Journal Inspiration

70 Mentions J Aime 0 Commentaires Christinas Pouch Business Christina Loves Planning Sur Instagram Love Th Best Planners Planner Journal Inspiration

Solved Villa Tool Company Solutionzip Tool Company Solutions Cost Of Goods Sold

Solved Villa Tool Company Solutionzip Tool Company Solutions Cost Of Goods Sold