What Is The Average For Travel Reimbursement Per Mile

The rates above apply to all Canadian provinces except for the Northwest Territories Nunavut and Yukon. The reimbursement rate is the IRS standard rate of 0575 cents per mile Compare the cars odometer reading before and after the trip to calculate miles driven Employees must fill.

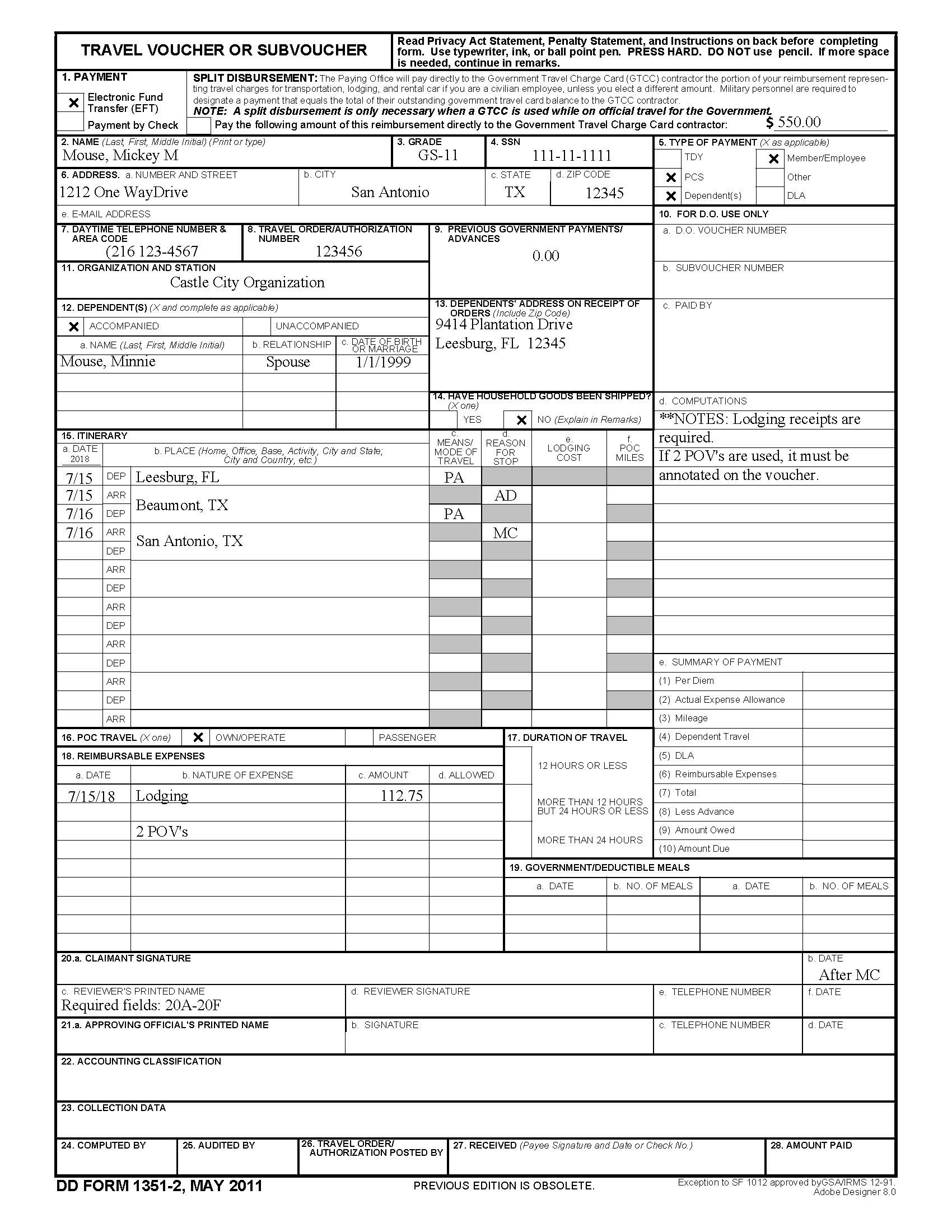

Defense Finance And Accounting Service Civilianemployees Civilian Permanent Change Of Station Pcs Civilian Pcs Entitlement Guide En Route Travel

Defense Finance And Accounting Service Civilianemployees Civilian Permanent Change Of Station Pcs Civilian Pcs Entitlement Guide En Route Travel

If the employer were to reimburse at the full IRS rate he would be giving the employee 2700 based on the 2016 rate of 54 cents per mile.

What is the average for travel reimbursement per mile. For 2021 the Standard Mileage Rate is set at 56 cents per mile traveled down from 575 cents per mile for 2020. 58 cents per mile driven for business use. 575 cents per mile for business miles driven down from 58 cents in 2019 17 cents per mile driven for medical or moving purposes down from 20 cents in 2019.

What are the 2020 CRA Mileage Rates and Tax Deduction Limits. The mileage reimbursement rate is 044 per mile for all business direct project miles driven. Up until 05 April 2011 the Approved Mileage Allowance Payment was 40p per mile.

GSA also provides mileage reimbursements. 2020 Personal Vehicle Mileage Reimbursement Rates Unless otherwise stated in the applicable MOU the personal aircraft mileage reimbursement rate is 127 per statute mile. This rate has not changed since and is still current in the 201819 tax year.

The mileage reimbursement rates for official travel via Privately Owned Vehicle decreased in 2021. GSA mileage reimbursements for moving are 18 cents per mile. Company Mileage Reimbursement Rates.

1 This fixed standard rate incorporates the cost of insurance registration gas oil and maintenance. As of January 1 2020 the IRS mileage reimbursement rates for cars vans pickups and panel trucks are. For 2020 the standard IRS mileage rates are.

From 06 April 2011 this rate was increased to 45ppm. Following are average per-mile costs as determined by AAA based on the driving costs for nine vehicle categories weighted by sales. 575 cents per mile driven for business use down one half of a cent from the rate for 2019 17 cents per mile driven for medical or moving purposes down three cents from the rate for 2019 and.

Beginning on January 1 2020 the standard mileage rates for the use of a car also vans pickups or panel trucks will be. Driving costs in each category are based on average costs for five top-selling 2019 models selected by AAA. Beginning January 1 2020 the standard mileage rates for the use of a car van pickup or panel truck will be.

The 2020 CRA Mileage Rate has increased by one cent to 59 cents per kilometer for the first 5000 kilometers driven and to 53 cents per kilometer for each additional kilometer. By category they are. Reimbursement rates cover all the costs related to driving for business.

2021 Personal Vehicle Mileage Reimbursement Rates Unless otherwise stated in the applicable MOU the personal aircraft mileage reimbursement rate is 126 per statute mile. This pence per mileage rate can be claimed for business mileage only. We use Bing Maps to calculate your mileage based on the fastest and shortest route from your home to the health care facility door to door.

We currently pay 415 cents 0415 per mile for approved health-related travel. For further information or verification of current rates regarding travel costs refer to the Indiana Department of Administration website at httpwwwingovidoa2459htm. For someone who drives a lot for work this can result in a significant deduction.

If you use a motorcycle for government work the mileage reimbursement is 515 cents per mile. 14 rows The following table summarizes the optional standard mileage rates for employees self. 20 cents per mile driven for medical or moving purposes.

575 cents per mile for regular business driving. For PCS travel the Mileage Allowance In Lieu of Transportation MALT rate is 016. 14 cents per mile driven in service of charitable organizations.

This is quite a bit more than the employee needs to be reimbursed unless the employer just wants to help with the car payment. For this year the mileage rate in 2 categories have gone down from previous years. This is the one that applies to most companies.

This 2020 rate is down from 2019s 58 cents. Also IRS Mileage reimbursements rates for employees are tax-free. 575 cents per mile for business miles 58 cents in 2019 17 cents per mile driven for medical or moving purposes 20 cents in 2019 14 cents per mile driven in service of charitable organizations.

And after 10000 business miles it drops to 25p per mile.

Gas Mileage Log And Calculator Mileage Log Printable Mileage Mileage Chart

Gas Mileage Log And Calculator Mileage Log Printable Mileage Mileage Chart

14 Free Employment Agreement Templates Professional Formats In Word Pdf Contract Template Contract Templates

14 Free Employment Agreement Templates Professional Formats In Word Pdf Contract Template Contract Templates

The 2019 Basic Allowance For Housing Bah Average Rate Increase Is 2 55 This Increase Is Slightly Below The Proposed 2 9 Military Benefits Allowance Basic

The 2019 Basic Allowance For Housing Bah Average Rate Increase Is 2 55 This Increase Is Slightly Below The Proposed 2 9 Military Benefits Allowance Basic

Mileage Log Form For Taxes Inspirational Free Mileage Log Templates Blog Business Plan Template Business Plan Template Mileage

Mileage Log Form For Taxes Inspirational Free Mileage Log Templates Blog Business Plan Template Business Plan Template Mileage

New Mileage Rates 2020 This Or That Questions Mileage Financial Services

New Mileage Rates 2020 This Or That Questions Mileage Financial Services

Gas Mileage Log Template Gas Mileage Mileage Log Printable Mileage Tracker

Gas Mileage Log Template Gas Mileage Mileage Log Printable Mileage Tracker

Aaa S Your Driving Costs Aaa Exchange

Aaa S Your Driving Costs Aaa Exchange

Gas Mileage Reimbursement Rates For 2020 And 2021 Workest

Gas Mileage Reimbursement Rates For 2020 And 2021 Workest

Aaa S Your Driving Costs Aaa Exchange

20 Overlooked And Unusual Tax Deductions You May Be Eligible For Infographic Pets Animal Tax Deductions Tax Deductions Business Tax Deductions Deduction

20 Overlooked And Unusual Tax Deductions You May Be Eligible For Infographic Pets Animal Tax Deductions Tax Deductions Business Tax Deductions Deduction

Per Diem Rates Military Government Travel

Per Diem Rates Military Government Travel

Mile Iq Dallas Organizer Mileage Record Mileage Tracker Mileage

Mile Iq Dallas Organizer Mileage Record Mileage Tracker Mileage

This Fuel Consumption Calculator Is An Excel Template To Calculate Average Cost And Mileage Per Liter Excel Templates Budget Template Free Spreadsheet Template

This Fuel Consumption Calculator Is An Excel Template To Calculate Average Cost And Mileage Per Liter Excel Templates Budget Template Free Spreadsheet Template

Per Diem Expense Report Template 6 Templates Example Templates Example Report Template Templates Per Diem

Per Diem Expense Report Template 6 Templates Example Templates Example Report Template Templates Per Diem

Gascubby Support And Information Mileage Tracker Oil Change Gas Mileage

Gascubby Support And Information Mileage Tracker Oil Change Gas Mileage

Gas Mileage Tracker Mileage Tracker Gas Mileage Mileage

Gas Mileage Tracker Mileage Tracker Gas Mileage Mileage

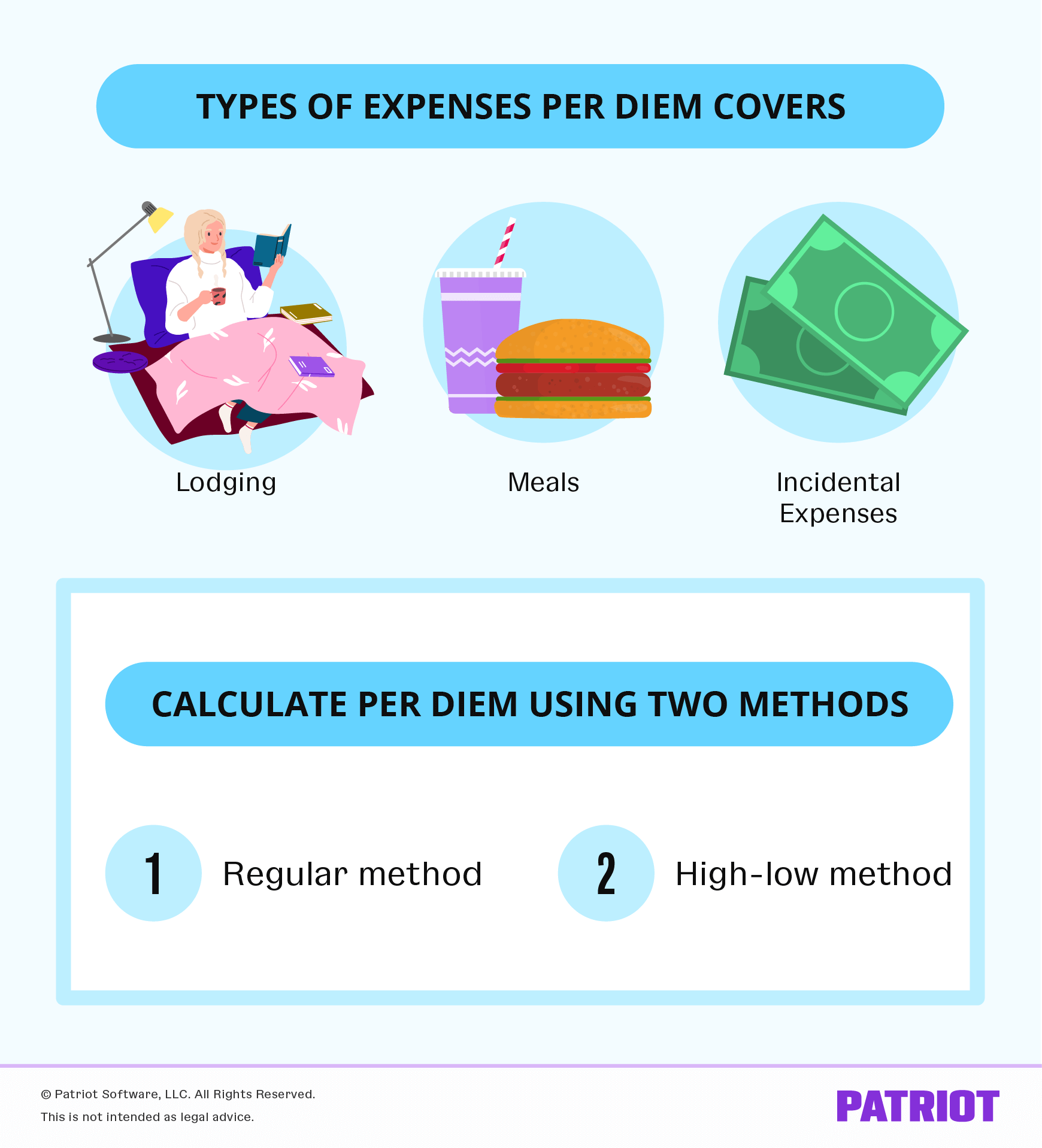

What Is Per Diem Definition Types Of Expenses More

What Is Per Diem Definition Types Of Expenses More

The Cost Of Business Travel Per Diem Rates In The U S A And Abroad

The Cost Of Business Travel Per Diem Rates In The U S A And Abroad