Qualified Business Use Of Home Expenses With A Loss

Under the simplified method the standard home office deduction amount is 5 per square foot up to 300 square feet of the area used regularly and exclusively for business. Some trusts and estates may also claim the deduction directly.

Printable Profit Loss Statement Auto Calculating Totals Interactive For Small Business And Ecommerce Editable 2 Page Pdf Download In 2021 Profit And Loss Statement Cost Of Goods Sold Cost Of Goods

Printable Profit Loss Statement Auto Calculating Totals Interactive For Small Business And Ecommerce Editable 2 Page Pdf Download In 2021 Profit And Loss Statement Cost Of Goods Sold Cost Of Goods

If you owned the home you would need to know the business use square footage and the total square footage.

Qualified business use of home expenses with a loss. If it exceeds your income you have an NOL. If your deductible expenses are greater than the income you have a loss and you can start the process of calculating a net operating loss NOL. If you are renting the home you would take the business use percentage and.

Oct 04 2017 This would depend if you owned or rented the home. Mar 24 2014 With either method you cannot take a home office deduction if it would cause your business to operate at a loss. Expense that is fully deductible.

If you do you may wish to take the income from your business the non-capital business loss and use it to offset your other income in effect claiming the business expenses. Apr 02 2020 You determine a business loss for the year by listing your business income and expenses on IRS Schedule C. To qualify you must use an area of your home regularly and exclusively for business.

Feb 18 2020 The Qualified Business Income QBI Deduction is a tax deduction for pass-through entities. If it applies to the entire home you will need to allocate the amount between the home office portion of your house and the personal use portion. To qualify to claim expenses for the business use of your home you must use part of your home for one of the following.

In general a taxpayer may not deduct expenses for the parts of their home not used for business. Jul 28 2020 To calculate the amount of the loss you add your business income and subtract business expenses on your business tax return. For example expenses for lawn care or painting a room not used for.

Oct 25 2019 Whether you get to use. Learn if your business qualifies for the QBI deduction of up to 20. FS-2019-8 April 2019 Many individuals including owners of businesses operated through sole proprietorships partnerships S corporations trusts and estates may be eligible for a qualified business income deduction also called the section 199A deduction.

Many owners of sole proprietorships partnerships S corporations and some trusts and estates may be eligible for a qualified business income QBI deduction also called Section 199A for tax years beginning after December 31 2017. Under the safe - harbor method no depreciation is deducted and qualified residence interest property taxes and casualty losses are deductible on Schedule A Itemized Deductions. You deduct such a loss on Form 1040 against any other income you have such as salary or investment income.

This business loss and claim the business expenses depends on whether or not you have other income. You make the allocation based upon your business use percentage. As it says this is a loss on your business operations not investments.

May 13 1993 If the loss occurs only to the home office treat it as a direct. The exclusive and regular place where you meet or deal with patients clients or customers in the normal course of your trade or business. The exclusive and regular principal place of business.

For more information regarding the Business Use of Your Home please review IRS Publication 587. The types of expenses that may be deducted are. The deduction may not exceed business net income gross income derived from the qualified business use of the home minus business deductions.

Nov 17 2016 Other expenses utilities and depreciation total 1000. Mar 12 2021 Deductible expenses for business use of your home include the business portion of real estate taxes mortgage interest rent casualty losses utilities insurance depreciation maintenance and repairs. If your costs exceed your income you have a deductible business loss.

You can deduct home office expenses up to your net income revenues minus other. Deductible expenses for business use of home normally include the business portion of real estate taxes mortgage interest rent casualty losses utilities insurance depreciation maintenance and repairs. The maximum deduction is 1500.

If you operate a business out of your home which many sole proprietors do the IRS allows you to take a home office deduction for some of your housing expenses. Taxpayers may use the prescribed rate of 5 per square foot of the portion of the home used for business up to a maximum of 300 square feet. The 1500 of mortgage interest and property taxes are fully deductible producing a business loss of 500 1000 of net income minus 1500.

The other 1000 of home-office expenses for utilities and depreciation are not currently deductible. The business part of expenses you could deduct even if you did not use your home for business such as mortgage interest mortgage insurance premiums real estate taxes and casualty losses attributable to a federally declared disaster if you itemize deductions on Schedule A Form 1040 or net qualified disaster losses if you claim the standard deduction. You would then be able to deduct this portion of mortgage interest repairs property taxes utilities and depreciation.

The deduction allows eligible taxpayers to deduct up to 20 percent of their qualified business income QBI plus 20 percent of qualified real estate investment trust REIT dividends and qualified.

Tax Planning Strategies To Save Taxes Strategies Health Savings Account Financial Freedom

Tax Planning Strategies To Save Taxes Strategies Health Savings Account Financial Freedom

Etsy Seller No Tax Manual Income Expense Bookkeeping Spreadsheet List Format Easy To Use Profit And Loss Excel Accounting Template In 2021 Bookkeeping Templates Small Business Bookkeeping Bookkeeping

Etsy Seller No Tax Manual Income Expense Bookkeeping Spreadsheet List Format Easy To Use Profit And Loss Excel Accounting Template In 2021 Bookkeeping Templates Small Business Bookkeeping Bookkeeping

Westside Barbell Program Spreadsheet Db Excel Com Education Grants Apply For Grants Spreadsheet

Westside Barbell Program Spreadsheet Db Excel Com Education Grants Apply For Grants Spreadsheet

Profit And Loss Projection Template Fresh Business Plan Profit And Loss Template Plans Underst Profit And Loss Statement Financial Statement Statement Template

Profit And Loss Projection Template Fresh Business Plan Profit And Loss Template Plans Underst Profit And Loss Statement Financial Statement Statement Template

January Income Expense Statement For A Cleaning Business Self Employment Income Statement Statement Template

January Income Expense Statement For A Cleaning Business Self Employment Income Statement Statement Template

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

Fillable Form 1040 Schedule C Ez 2017 Tax Guide Power Of Attorney Form Schedule

Fillable Form 1040 Schedule C Ez 2017 Tax Guide Power Of Attorney Form Schedule

Schedule E Business Use Percentage Calculation Schedulee

Schedule E Business Use Percentage Calculation Schedulee

Ira Withdrawal Planning Can Save On Taxes Business Tax Deductions Ira Business Tax

Ira Withdrawal Planning Can Save On Taxes Business Tax Deductions Ira Business Tax

Form 8995 A Schedule C Loss Netting And Carryforward K1 Schedulec Schedulee Schedulef

Form 8995 A Schedule C Loss Netting And Carryforward K1 Schedulec Schedulee Schedulef

Pro Forma Income Statement Example Unique Business Templates Project Timeline Template Income Statement Statement Template Profit And Loss Statement

Pro Forma Income Statement Example Unique Business Templates Project Timeline Template Income Statement Statement Template Profit And Loss Statement

Browse Our Example Of Commercial Real Estate Budget Template Cash Flow Statement Statement Template Budget Template

Browse Our Example Of Commercial Real Estate Budget Template Cash Flow Statement Statement Template Budget Template

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png) Schedule C Profit Or Loss From Business Definition

Schedule C Profit Or Loss From Business Definition

Instructions For Form 8995 2020 Internal Revenue Service

Instructions For Form 8995 2020 Internal Revenue Service

A Coach S Guide To Taxes Beachbody Coach Business Beachbody Coach Training Beachbody Coach

A Coach S Guide To Taxes Beachbody Coach Business Beachbody Coach Training Beachbody Coach

Small Business Financial Statement Template Lovely Statement Businessancial Template Format Personal Financial Statement Financial Statement Statement Template

Small Business Financial Statement Template Lovely Statement Businessancial Template Format Personal Financial Statement Financial Statement Statement Template

Schedule E Business Use Percentage Calculation Schedulee

Schedule E Business Use Percentage Calculation Schedulee

Fillable Form 1040 Schedule C 2019 In 2021 Sole Proprietor Tax Forms Benefit Program

Fillable Form 1040 Schedule C 2019 In 2021 Sole Proprietor Tax Forms Benefit Program

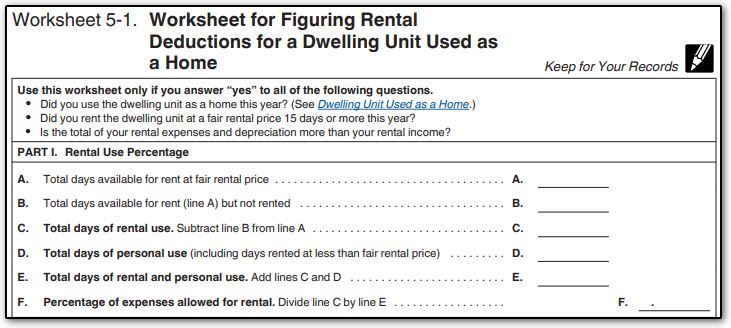

Http Www Thetaxbook Com Updates Thetaxbook Client 20tax 20tools Business Use Of Home Simplified Method Worksheet Pdf