How To Report Imputed Interest Income

Report interest income from an installment sale payment on Form 1040 US. When are you responsible for imputed interest.

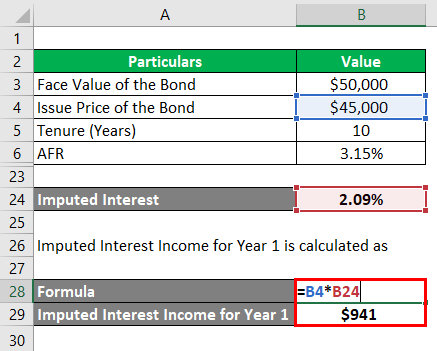

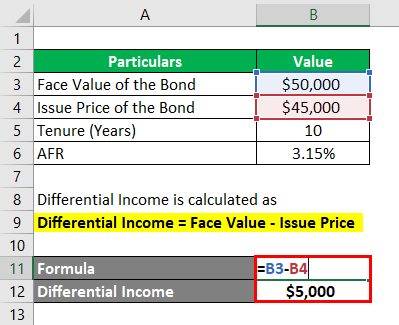

Imputed Interest Types Of Imputed Interest Advantages

Imputed Interest Types Of Imputed Interest Advantages

Admittedly imputed interest on a small loan isnt enough to break the bank when you pay your marginal tax rate on it but you must report and pay taxes on it even if you never received it as in the example above where the borrower never paid you any interest.

How to report imputed interest income. Expenses for entertainment amusement and recreational flights of Specified Individuals are now deductible only UP TO the amount of income imputed to or. Tax Return for Seniors. Nonresident Alien Income Tax Return.

Go to federalincome and expenses interest and dividendsinterest on 1099 INT. For example say you loan a friend 20000 for one year at 01 interest. You will then have a written record of your imputed interest.

Add all of your taxable interest income including your imputed interest income to find the total for the year. How to Report Imputed Interest Income. Use Form 6252 Installment Sale Income to report an installment sale in the year the sale occurs and for each year you receive an installment payment.

If the loan has a zero-interest rate or a rate lower than the AFRs you will be responsible for calculating the imputed interest and paying taxes on the amount. Todays presenter As counsel for Crawford Advisors Employee Benefits and Executive Compensation Group Mr. Report it as 1099 INT interest income.

To calculate the taxable portion of imputed interest for each tax year subtract the present value of the relevant payment from the gross payment amount. Put another way in the case of self-charged interest received from a nonpassive entity the amount of interest income that can be considered as being derived in the ordinary course of a nonpassive business and thus excluded from net investment income is the taxpayers allocable share of the nonpassive interest expense deduction being passed. Sutherland Lumber if income was imputed to the employee for the value of the flight eg SIFL New Law.

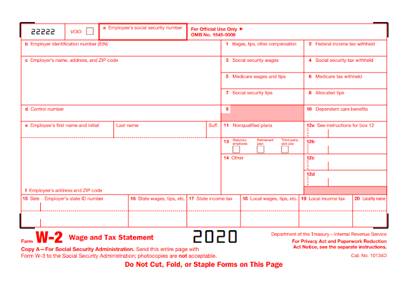

As each month or year goes by record this information on the ledger in clearly delineated columns. Report imputed income on Form W-2 for each applicable employee. To do this report your total imputed interest income on your tax return.

If your taxable interest income is more than 1500 be sure to include that income on Schedule B Form 1040 Interest and Ordinary Dividends and attach it to your. Imputed Income Reporting. Interest Income reported on Schedule K-1 will appear on Line 8a of Form 1040 of your personal tax return.

Also include the amount for imputed income in Boxes 1 3 and 5. This amount is then added to your taxable income for the year. Reporting imputed income.

You can normally identify receiving imputed income if you see box 12c on your W-2 filled in. Employers will account for imputed income under box 1 on form W-2. If available the preferred option for deriving imputed interest is to locate the established exchange price of the goods or services involved in the transaction and use that as the basis for calculating the interest rate.

That friend will pay you 20 in interest 20000 x001 20. Individual Income Tax Return Form 1040-SR US. You can record the name of the person who paid it but is not necessary to record the TIN as this isnt required for reporting interest income.

But if the AFR for that type of loan is 064 then you should have collected 86 20000 x0064 128. Haynes advises employers and plan sponsors in a variety of health and welfare benefit plan. Record imputed income on Form W-2 in Box 12 using Code C.

In order to properly report imputed income or fringe benefits you must first determine the value of the benefits your employee is receiving. You may need to attach Form 4797 Sales of Business Property and Schedule D Form 1040 to your Form 1040 US. Record the interest amount that would be paid whether monthly or annually.

Youll report the 100 00110000 as interest income on your tax return each year. If it is 1500 or less skip. To accurately show an employees taxable wage-related income you must include imputed income on Form W-2.

You must also include in income any interest as. Two very common reasons to report imputed income are life insurance coverage over 50000 and health insurance coverage provided to a non-marital spouse. The IRS requires that you report imputed interest as taxable income on your tax return each year.

The term demand loan means any loan which is payable in full at any time on the demand of the lender. Imputed interest is interest that the tax code assumes you collected but you didnt actually collect. Individual Income Tax Return or Form 1040-SR US.

Such term also includes for purposes other than determining the applicable Federal rate under paragraph 2 any loan if the benefits of the interest arrangements of such loan are not transferable and are conditioned on the future performance of substantial services by an individual. Tax Return for Seniors or Form 1040-NR US. The exchange price is presumed to be the price paid in a cash purchase.

If you have over 1500 in dividends and interest you may also have Schedule B and the interest income from Schedule K-1 will go there first.

What Is Imputed Income For Life Insurance Business Stock Photos Managing Your Money Money Habits

What Is Imputed Income For Life Insurance Business Stock Photos Managing Your Money Money Habits

Importing Data From Excel Into Sage 300 Construction And Real Estate Part 1 Of 4 Youtube Excel Data Real Estate

Importing Data From Excel Into Sage 300 Construction And Real Estate Part 1 Of 4 Youtube Excel Data Real Estate

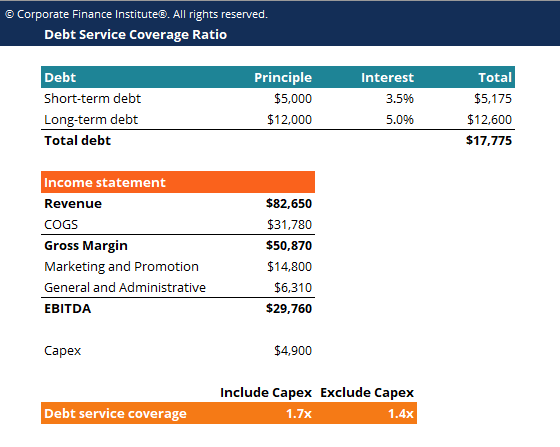

Debt Service Coverage Ratio Guide On How To Calculate Dscr

Debt Service Coverage Ratio Guide On How To Calculate Dscr

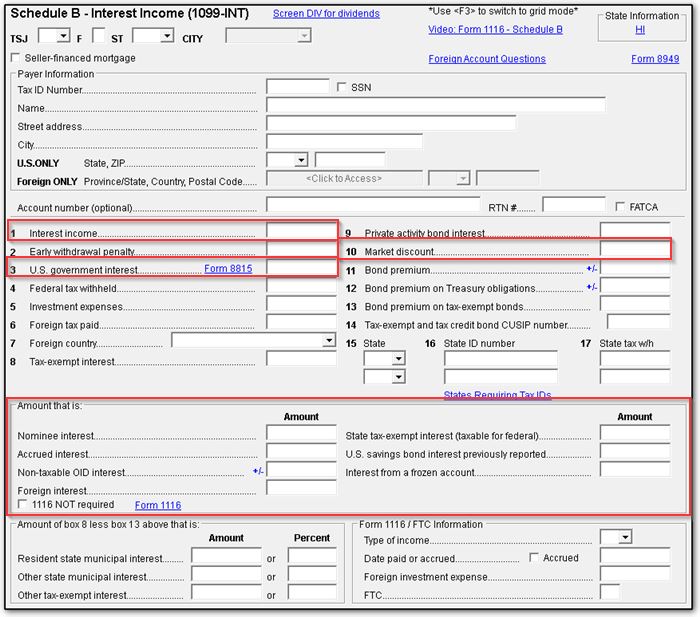

Interest Income Ef Messages 5378 And 5285

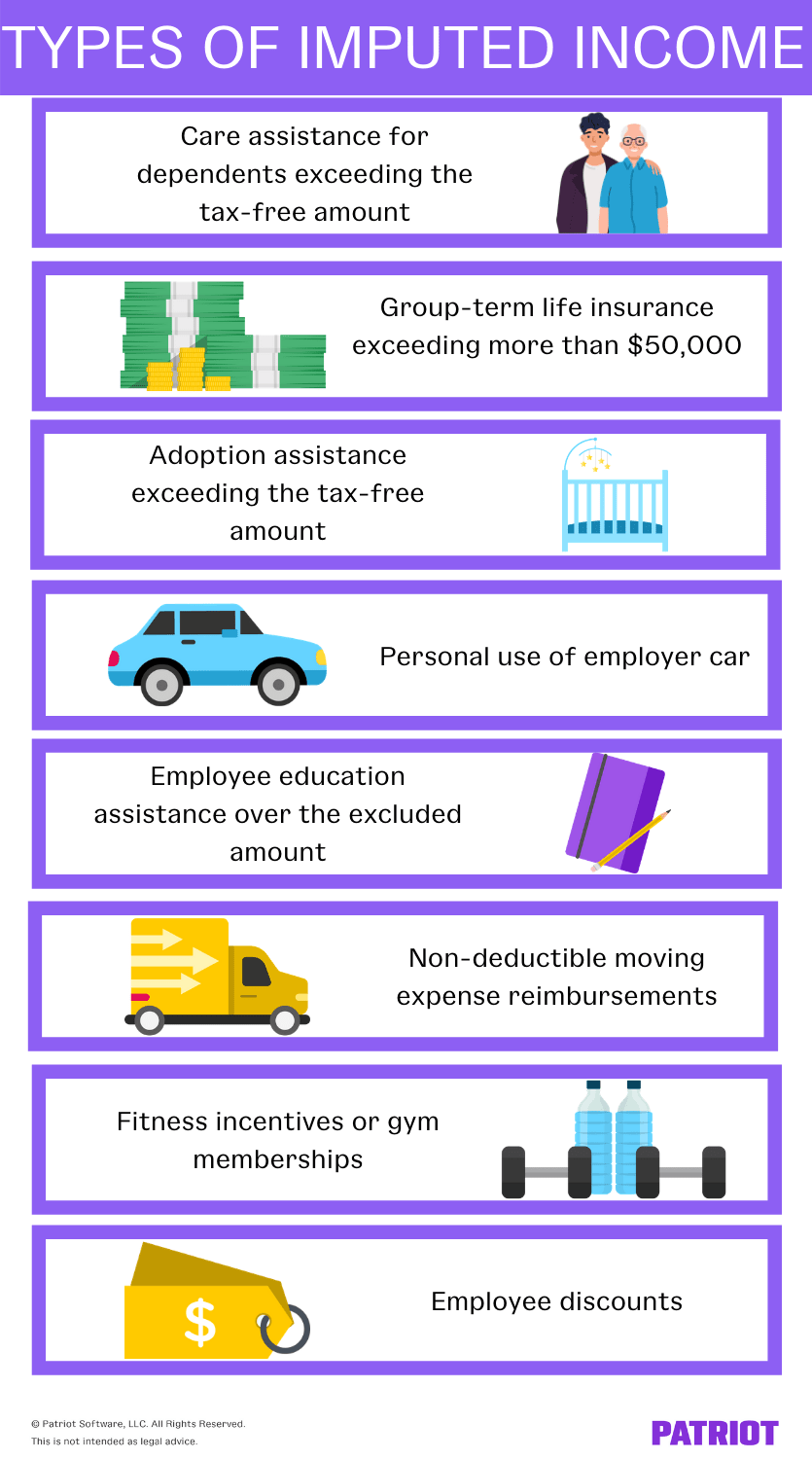

What Is Imputed Income Payroll Definition Examples

What Is Imputed Income Payroll Definition Examples

Romania Is A South Eastern European Country Known For The Forested Region Of Transylvania Ringed By The Carp Mixed Economy Human Development Index Forced Labor

Romania Is A South Eastern European Country Known For The Forested Region Of Transylvania Ringed By The Carp Mixed Economy Human Development Index Forced Labor

Reporting Foreign Trust And Estate Distributions To U S Beneficiaries Part 3

Reporting Foreign Trust And Estate Distributions To U S Beneficiaries Part 3

Cover Page Template Word Download For Report Or Project Cover Pages Lead Generation Real Estate Consulting Business Writing Services

Cover Page Template Word Download For Report Or Project Cover Pages Lead Generation Real Estate Consulting Business Writing Services

This Chatbot Could Help You Sue Equifax Data Breach Credit Monitoring Data

This Chatbot Could Help You Sue Equifax Data Breach Credit Monitoring Data

A Beginner S Guide To Imputed Income 2021 The Blueprint

A Beginner S Guide To Imputed Income 2021 The Blueprint

Gifts Of Partnership Interests

Gifts Of Partnership Interests

Icymi Why Every Net Lease Reit Should Strive To Be A Low Cost Leader Credit Score Capital Gain Credits

Icymi Why Every Net Lease Reit Should Strive To Be A Low Cost Leader Credit Score Capital Gain Credits

Imputed Interest Types Of Imputed Interest Advantages

Imputed Interest Types Of Imputed Interest Advantages

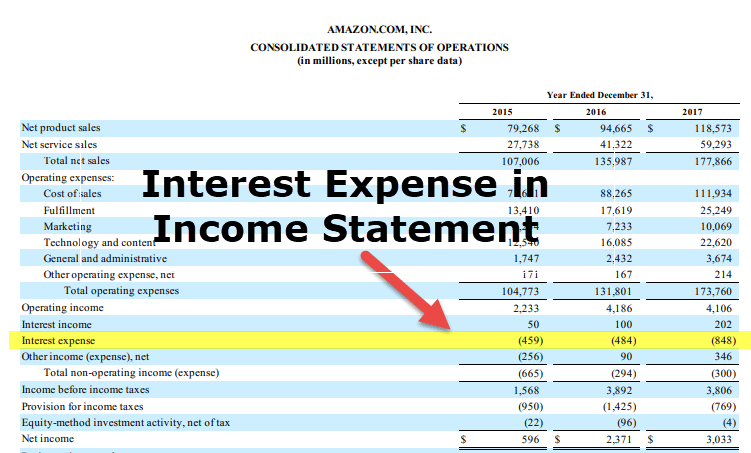

Interest Expense In Income Statement Meaning Journal Entries

Interest Expense In Income Statement Meaning Journal Entries

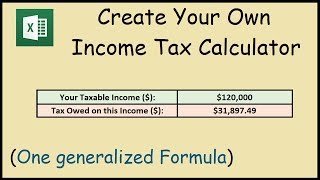

How To Create An Income Tax Calculator In Excel Youtube

How To Create An Income Tax Calculator In Excel Youtube

Imputed Income Wikipedia Income Wikipedia Payroll

Imputed Income Wikipedia Income Wikipedia Payroll

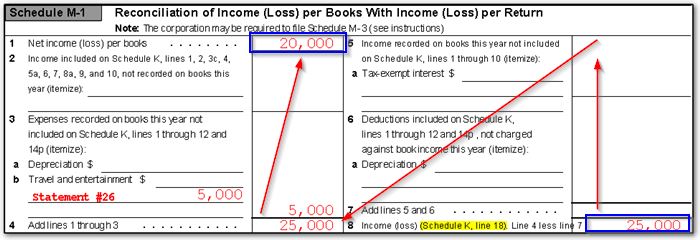

1120s Calculating Book Income Schedule M 1 And M 3 K1 M1 M3

1120s Calculating Book Income Schedule M 1 And M 3 K1 M1 M3

Interest Income Ef Messages 5378 And 5285

Interest Income Ef Messages 5378 And 5285

Reporting Foreign Trust And Estate Distributions To U S Beneficiaries Part 3

Reporting Foreign Trust And Estate Distributions To U S Beneficiaries Part 3