How To Get My 1099-sa Form

This will start a download of your 1099 form. IRS Form 8853 is used to file Medical Savings Account MSA contributions and distributions if you currently have an MSA or have transferred your MSA to an HSA.

A separate return must be filed for each plan type.

How to get my 1099-sa form. IRS Form 5498-SA is typically available around the end of January. Need a replacement copy of your SSA-1099 or SSA-1042S also known as a Benefit Statement. You can instantly download a printable copy of the tax form by logging in to or creating a free my.

1 which indicates normal tax-free distributions. If you have online access to your HSA account you may be able to access the Form 1099-SA through that account. The IRS requires Fidelity to issue a Form 1099-SA if you took a distribution from your Fidelity HSA.

Money you used reported in box 1. Medicare Advantage Medical Savings Account MA MSA. Get a copy of your Social Security 1099 SSA-1099 tax form online.

Visit the IRS at wwwirsgov or call 1-800-829-1040. File Form 8889 or Form 8853 with your Form 1040 or 1040-SR to report a distribution from these accounts even if the distribution isnt taxable. A Form 1099-SA will be sent by January 31 2020 if you received any distributions from your HSA account during 2019.

File Form 1099-SA to report distributions made from a. Click on the Tax Form and in the expanded view locate the Download Print Form option near the bottom. 0 1 1402 Reply.

For filing with the IRS follow the applicable procedures if you are required to file electronically. Using your online my Social Security account. IRS Form 1099-SA is typically available at the end of January.

A replacement SSA-1099 or SSA-1042S is available for the previous tax year after February 1. Health savings account HSA. IRS Form 1099-SA is provided for each HSA distribution you made in the current tax year.

Go to Sign In or Create an Account. If you currently live in the United States and you need a replacement form SSA-1099 or SSA-1042S we have a new way for you to get an instant replacement quickly and easily beginning February 1st by. You will receive a separate 1099-SA for each type of distribution made during the tax year.

Provided you only use the funds to pay qualified medical expenses box 3 should show the distribution code No. Click to see full answer. Local Social Security offices are currently closed to walk-in visits due to the COVID-19 pandemic.

If you live abroad contact your nearest Federal Benefits Unit. The distribution may have been paid directly to a medical service provider or to the account holder. Due to the very low volume of paper Forms 1099-SA and 5498-SA received and processed by the IRS each year these forms have been converted to an online fillable format.

If you dont have a My Social Security account you can call Social Security at 800-772-1213 or visit your local office to request a new SSA-1099 or SSA-1042S. Where to Mail Form 1099-SA There are three copies of the 1099-SA. You may fill out the forms found online at IRSgovForm1099SA and IRSgovForm5498SA and send Copy B to the recipient.

The financial institution managing the account files Copy A with the IRS sends you Copy B and retains Copy C. You will complete this form using IRS Forms 1099-SA and 5498-SA provided by HSA Bank. Health Savings Account HSA Archer Medical Savings Account MSA Medicare Advantage MA MSA.

This information is provided for your convenience. ADDITIONAL INFORMATION Frequently Asked Questions Why am I receiving a Form 1099-SA. From there click on the Tax Year at the top and select the appropriate year.

If you did not take any money out of the account then you wouldnt be receiving a form for 2017. If you live in the United States and you need a replacement form SSA-1099 or SSA-1042S simply go online and request an instant printable replacement form through your personal my Social Security account. Instructions for IRS Form 8853.

Instructions for Form 8889. If you are not sure who the account administrator is contact your employer or insurance provider. View solution in original post.

How To Understand Your 1099-SA Form Each year HSA providers are required to send a copy of Form 1099-SA by January 31 st to all HSA account holders who made withdrawals also called distributions in. IRS Form 8889 can be downloaded from IRSgov at any time. If you dont already have an account you can create one online.

Give them a call because you cant do your return without it unless you had no distributions in which case you skip it in the HSA interview in TurboTax. You will receive the IRS Form 1099-SA and IRS Form 5498-SA either by mail or electronically based upon your elected delivery preference. These IRS tax forms are also available in the Member Website.

You will receive a Form 1099-SA that shows the total amount of your annual distributions ie. The payer isnt required to compute the taxable amount of any distribution. A Form 5498-SA will be sent in May 2020 which will report contributions to your HSA account for 2019 and the fair market value of your HSA account as of 12-31-2019.

Form 1099-SA is used to show distributions from. It will be posted to your account and mailed if elected. If you did then that bank or financial institution owes you a form 1099-SA.

Archer Medical Savings Account Archer MSA.

1099 Int Software E File Tin Matching Tax Forms Envelopes Irs Forms Irs Efile

1099 Int Software E File Tin Matching Tax Forms Envelopes Irs Forms Irs Efile

Self Employed Tax Preparation Printables Instant Download Small Business Expense Tracking Accounting Tax Preparation Business Tax Tax Prep Checklist

Self Employed Tax Preparation Printables Instant Download Small Business Expense Tracking Accounting Tax Preparation Business Tax Tax Prep Checklist

1099 K Software E File Tin Matching Tax Forms Envelopes Irs Forms Tax Forms Money Template

1099 K Software E File Tin Matching Tax Forms Envelopes Irs Forms Tax Forms Money Template

How To Avoid An Irs Audit Debt Relief Programs Irs Credit Card Relief

How To Avoid An Irs Audit Debt Relief Programs Irs Credit Card Relief

1099 R Software To Create Print And E File Irs Form 1099 R Irs Irs Forms Annuity

1099 R Software To Create Print And E File Irs Form 1099 R Irs Irs Forms Annuity

Account Abilitys 1099 Div User Interface Dividends And Distributions Data Is Entered Onto Windows That Resemb Fillable Forms Irs Forms Letter Template Word

Account Abilitys 1099 Div User Interface Dividends And Distributions Data Is Entered Onto Windows That Resemb Fillable Forms Irs Forms Letter Template Word

1098 E User Interface Student Loan Interest Statement Data Is Entered Onto Windows That Resemble The Actual Forms Impo Irs Student Loan Interest Irs Forms

1098 E User Interface Student Loan Interest Statement Data Is Entered Onto Windows That Resemble The Actual Forms Impo Irs Student Loan Interest Irs Forms

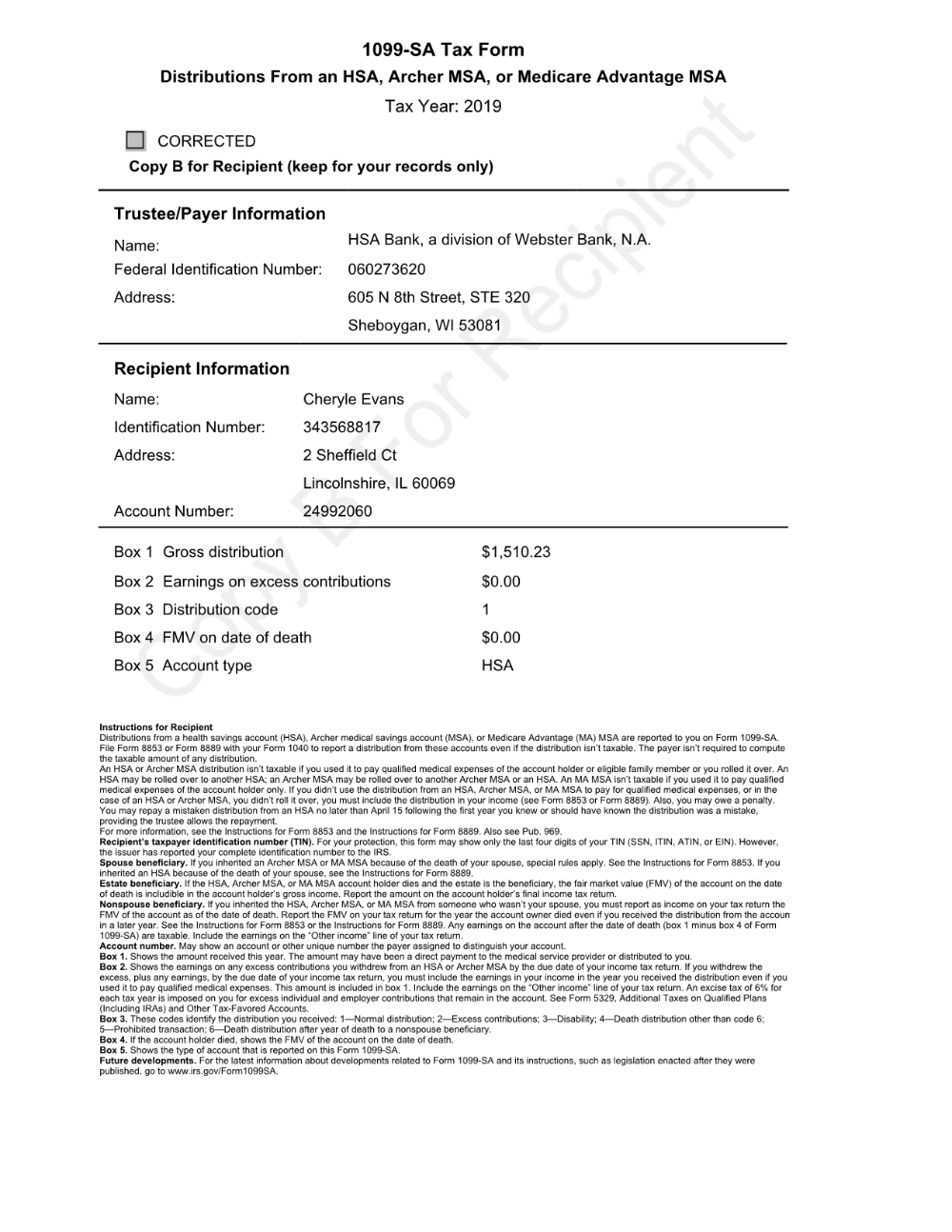

Hsataxform1099sa Health Savings Account Tax Forms Medicare Advantage

Hsataxform1099sa Health Savings Account Tax Forms Medicare Advantage

How To Find Your W2 Form Online Finding Yourself W2 Forms Online

How To Find Your W2 Form Online Finding Yourself W2 Forms Online

Submitters Of Annual Wage Reports W 2 W 2c Must Complete The Submitter Ssa Page Of The Transmitter Submitter I Employment Application How To Apply Efile

Submitters Of Annual Wage Reports W 2 W 2c Must Complete The Submitter Ssa Page Of The Transmitter Submitter I Employment Application How To Apply Efile

Form 1098 C Contributions Of Motor Vehicles Boats And Airplanes A Donee Organization Must File A Separate Form 1098 C Contributions O Irs Forms Irs Efile

Form 1098 C Contributions Of Motor Vehicles Boats And Airplanes A Donee Organization Must File A Separate Form 1098 C Contributions O Irs Forms Irs Efile

Account Abilitys 1099 A User Interface Acquisition Or Abandonment Of Secured Property Data Is Entered Onto Windows That Resemble The Ac Irs Irs Forms Efile

Account Abilitys 1099 A User Interface Acquisition Or Abandonment Of Secured Property Data Is Entered Onto Windows That Resemble The Ac Irs Irs Forms Efile

1099 Nec Software To Create Print And E File Irs Form 1099 Nec Credit Card Hacks Irs Irs Forms

1099 Nec Software To Create Print And E File Irs Form 1099 Nec Credit Card Hacks Irs Irs Forms

Account Ability Form 1098 User Interface Mortgage Interest Statement Data Is Entered Onto Windows That Resemble The Actual Accounting Spreadsheet Irs Forms

Account Ability Form 1098 User Interface Mortgage Interest Statement Data Is Entered Onto Windows That Resemble The Actual Accounting Spreadsheet Irs Forms

Due Dates For Your W 2 1099 Other Tax Forms In 2018 And What To Do If They Re Missing Tax Forms Student Loan Interest Finance Saving

Due Dates For Your W 2 1099 Other Tax Forms In 2018 And What To Do If They Re Missing Tax Forms Student Loan Interest Finance Saving

Where Are My Tax Forms Due Dates For Forms W 2 1099 1098 More Tax Forms Student Loan Interest Tax

Where Are My Tax Forms Due Dates For Forms W 2 1099 1098 More Tax Forms Student Loan Interest Tax

1099 B User Interface Proceeds From Broker And Barter Exchange Transactions Data Is Entered Onto Windows That Resemble The Actual Forms Irs Irs Forms Efile

1099 B User Interface Proceeds From Broker And Barter Exchange Transactions Data Is Entered Onto Windows That Resemble The Actual Forms Irs Irs Forms Efile