Do I Send A 1099 For A Donation

Most of the time no. The sponsor will send another copy of the form to the person by the end of January the following year.

Download A 1099 Form Irs Employee 1099 Form Free Download Irs Email Signature Templates Free Email Signature Templates

Download A 1099 Form Irs Employee 1099 Form Free Download Irs Email Signature Templates Free Email Signature Templates

How to find people willing to donate or help How to Start a Business With NO MONEY.

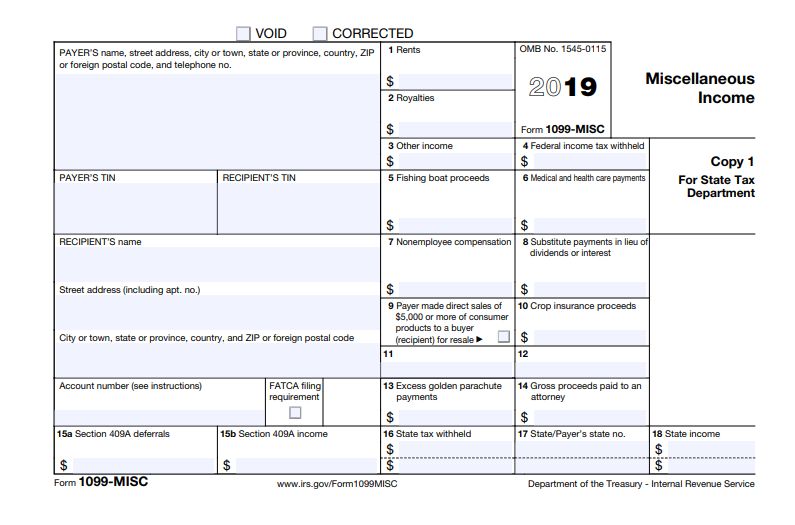

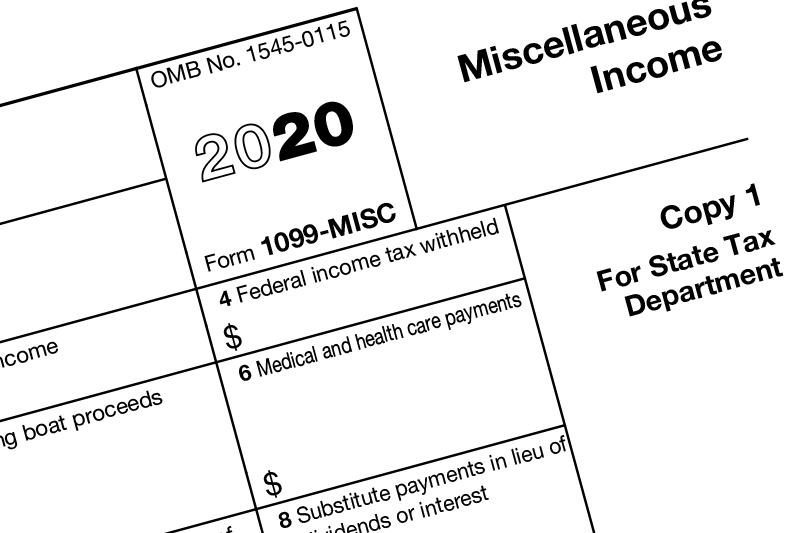

Do i send a 1099 for a donation. But if they ask for a refund and the original donation was over 600 do we need to issue a 1099. A political contribution is a NON-deductible gift. Generally if the organization pays at least 600 during the year to a non-employee for services including parts and materials performed in the course of the organizations business it must furnish a Form 1099-MISC Miscellaneous Income to that person by January 31 of the following year.

Notice 2006-1 PDF supplemented by Notice 2007-70 provides guidance on reporting obligations to donee organizations that receive contributions of qualified vehicles. This has the benefit of sidestepping the donors need to get a timely letter from the charity containing the magic words. However if the payments are being directly or indirectly received by another organization such as a missions.

1If the receiver of the gift provides ANY service board members musicians Sunday school teachers janitor etc see IRS Pub 15 series 2the amount given see IRS Pub 950 With a side noteif any are employees such as pastor their family than it would be added to the W-2. Charities can continue sending letters and disregard this proposal. You are giving up your plasma and BioLife is putting money on a debit card.

The IRS requires that businesses report any payments of 600 or more made for services. If you are a private person not a corporation you do not have to issue a 1099-MISC to anyone you might pay money to. A sponsor must report more than 600 in nonqualified payments made to a sponsored individual annually by filing Form 1099 MISC with the IRS.

Gifts are not reported on your tax return. In past years if your organization paid a person for services who was NOT an employee you may have needed to file a 1099-Misc for the total amount given over the year. Or they may choose not to attempt to classify the payments and simply send Form 1099-K to all recipients to make sure they are complying with their requirements as a payer.

Payment processors may misclassify a payment and send a Form 1099-K for a gift or donation. In general you are required to send an IRS Form 1099-MISC that reports taxable income in box 7 of the form if you have paid an evangelist or minister 600 or more during the calendar year AND those payments are not being accepted and reported upon by another organization. Just as important as knowing when you should issue a form 1099 your organization should know when you dont need to issue one.

For example in the case of scholarships or fellowship grants you wont need to issue a 1099. Did the places that bought your blood send you 1099 forms. This transaction is no different than a farmer milking a cow and selling the milk.

If the charity does issue then it must also forward a copy of the 1099s to the IRS. You may issue a 1099-MISC but you dont have to Relatedly you will need their SSN if you want to claim the dependent care credit for part of your childcare expenses. Your company needs to.

1099 -MISC says one thing and 1099 -K says something else. In general when a business pays someone 600 or more the business is supposed to file a 1099 with the IRS and give copies to the recipient of the money. It would depend on a few things the main 2 are.

Otherwise youre looking at a threshold of 600 per donation. Or the IRS could audit a recipient and find deposits that were not reported on the tax return. Whether they report the income and pay taxes is up to them.

Buy copy paper Xerox supplies paper cups mailing lists etc you will need to send 1099s to all vendors such as Wal-Mart Office Max Home Depot etc - pending future regulation to exclude certain vendors. This is because these funding sources are considered wages and are reported on a IRS Form W-2. You must report the plasma donation as income even if no 1099-Misc is received.

If the payment is being made in cash or check then payments over 600 in a year would have to be reported on a 1099-MISC and that assumes that the donation center would jeep the records to aggregate multiple donations. However donations do not qualify as payments for services unless you reap a benefit from your donation. Refunding Donations A parish has a restricted building fund and the parish has now decided not to move forward with the construction.

This was not a service I hope that they provided to your company. And GoFundMe says Donations made to GoFundMe campaigns are usually considered to be personal gifts which for the most part arent taxed as income. The 1099-Misc listed royalties rents and other miscellaneous items but its most common use was for payments to independent contractors.

In addition any payments aggregating 600 or more to any one payee for gross proceeds will require reporting on Form 1099-MISC. They are going to ask the donors if they will agree to redirect the funds.

Submit The Irs Form 1099 Misc Online Get Fillable And Printable Miscellaneous Income Template With Detailed Instructions E Fillable Forms Irs Forms Tax Forms

Submit The Irs Form 1099 Misc Online Get Fillable And Printable Miscellaneous Income Template With Detailed Instructions E Fillable Forms Irs Forms Tax Forms

1099 Form Complete Guide For Businesses Contractors Zipbooks

What Is The 1099 Nec For Contractors And Freelancers

What Is The 1099 Nec For Contractors And Freelancers

Do Nonprofits Or Churches Need To Complete 1099s Aplos Academy

Do Nonprofits Or Churches Need To Complete 1099s Aplos Academy

Top 25 1099 Deductions For Independent Contractors

Top 25 1099 Deductions For Independent Contractors

Pin On Fundraiser Event Flyers

Pin On Fundraiser Event Flyers

Form W9 Box 9 Never Underestimate The Influence Of Form W9 Box 9 Employment Application Irs Forms Business Names

Form W9 Box 9 Never Underestimate The Influence Of Form W9 Box 9 Employment Application Irs Forms Business Names

Twitch Streaming Taxes Twitch Insider

Twitch Streaming Taxes Twitch Insider

/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png) Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

Explore Our Sample Of Electronic Funds Transfer Deposit Form Template Doctors Note Template Templates Spreadsheet Template

Explore Our Sample Of Electronic Funds Transfer Deposit Form Template Doctors Note Template Templates Spreadsheet Template

Taxes Tips Donations And 1099s Everything You Need To Know Streamlabs

Taxes Tips Donations And 1099s Everything You Need To Know Streamlabs

Tax Forms Archives Delano Sherley Associates Inc

Tax Forms Archives Delano Sherley Associates Inc

The Claim Number Can Be Found On A Medicare Card Or 1099 Form Reference Letter A Formal Letter Learning Letters

The Claim Number Can Be Found On A Medicare Card Or 1099 Form Reference Letter A Formal Letter Learning Letters

Why Fill Out A W9 1040 1099 Oid Email Writing Moorish Science History Videos

Why Fill Out A W9 1040 1099 Oid Email Writing Moorish Science History Videos

Download W2 Form 2015 W2 For Quickbooks 1099 For Quickbooks Printable Job Applications Templates Resume Design Free

Download W2 Form 2015 W2 For Quickbooks 1099 For Quickbooks Printable Job Applications Templates Resume Design Free

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png) Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

Design Request Form Template Elegant Cash Advance Request Form Template Sign In Sheet Template Sign Up Sheets Business Template

Design Request Form Template Elegant Cash Advance Request Form Template Sign In Sheet Template Sign Up Sheets Business Template

:max_bytes(150000):strip_icc()/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg)