Can Your Employer Give You A W2 And 1099

Do you work at your bosss workplace or home. A shorthand way to consider this employment relationship is 1099 vs.

![]() Looking To Hire W2 Vs 1099 Which Is Best For Your Business

Looking To Hire W2 Vs 1099 Which Is Best For Your Business

See this article on worker classification for more information.

Can your employer give you a w2 and 1099. The first is if the worker performed duties as. If the employer arbitrarily decided to give you a 1099-MISC instead of a W-2 to avoid paying payroll taxes this would be illegal and you can contest the employers action through the IRS. Your employer is required to provide you with Form W-2 Wage and Tax Statement.

Its not usually legally required but doing so will protect your business. There are a lot of rules and requirements for switching a W2 employee to a 1099 independent contractor. Unlike a standard full- or part-time employee W2 employee 1099 employees are required to follow different laws and regulations and.

If your employer does not provide online access to your W-2 they must mail or hand. It also takes unusual circumstances for this type of dual filing to be legitimate. Every employer engaged in a trade or business who pays remuneration including noncash payments of 600 or more for the year all amounts if any income social security or Medicare tax was withheld for services performed by an employee must file a Form W-2 for each employee even if the employee is related to the employer from whom.

If they do they are telling you are getting paid twice while they are paying you once. Those rules tend to favor treating somebody as a W2 employee so your employer may have problems convincing the IRS that you really are a 1099 independent contractor and not a W2 employee. Often referred to as an independent contractor or consultant a 1099 employee is self-employed.

Do I need a written contract with a 1099 employee. 0 found this answer helpful 2 lawyers agree. W2 employees because contractors receive the 1099 tax form at the end of each year while employees receive a W2.

Not unless you worked as a full time employee during a portion of the year for W-2 and another portion of the year as a contract employee for 1099 They can not cut you a W-2 and 1099 for the same work you performed. If your employer refuses you can file Form SS-8 with the IRS. As such when an employer enters into a contract with a 1099 employee this individual remains responsible for their own hours tools taxes and benefits.

When you hire an employee to work for you you can either pay them as a contractor or as an employee. If the recipient is an employee the employer should always report wages salaries fees bonuses commissions tips and other compensation as income on the employees W-2 not on a 1099. Do you have to.

What happens if my employer sent a 1099 instead of a W2. ADP is here to help as much as we can but for most questions regarding Form W-2 Form 1099 and other tax issues we recommend you speak with your payroll or benefits department. Form W-2 and Form 1099 Guide for Employees.

There are two situations in which an independent contractor can receive both Forms 1099 and W2 from the same employer. Entities provide a Form 1099-Misc to independent contractors and Form W-2 to employees. For traditional employees file a W-2.

If you do not agree with this classification you can speak with your employer to request to be treated as an employee and given a W-2. Most doctors are going to take what we can get but the ideal scenario tax-wise is to have both W2 and 1099 income. For independent contractors file the 1099-MISC.

In many ways the answer to can an employee receive a w2 and a 1099 is a simple one. What if I incorrectly classify a worker. Companies that misclassify workers could pay huge fines and be liable for money owed to employees.

This will request the IRS to look at your employment situation and make an official determination as to whether you are an employee or an. Do you receive training from your boss or employer. Thats because this type of situation is a red flag and frequently results in a response from the IRS seeking further information.

If the recipient of the bonus is an independent contractor then the bonus is reported as part of the compensation paid to the independent contractor for the services that they provide. However there may be instances where a worker may be serving as an independent contractor and. Can you be fired.

You can save a five-figure sum in FICA taxes in 2021 by having both forms of income open up additional retirement contribution space and enjoy. Yes an employee can receive a W2 and a 1099 but it should be avoided whenever possible. Instead of being an employee of the company you are employed by your own business or self-employed Youve probably received a 1099 tax form instead of a W-2.

If a company treats you as an independent contractor in theory you are operating as an independent business. Can your job give you a 1099 and W2.

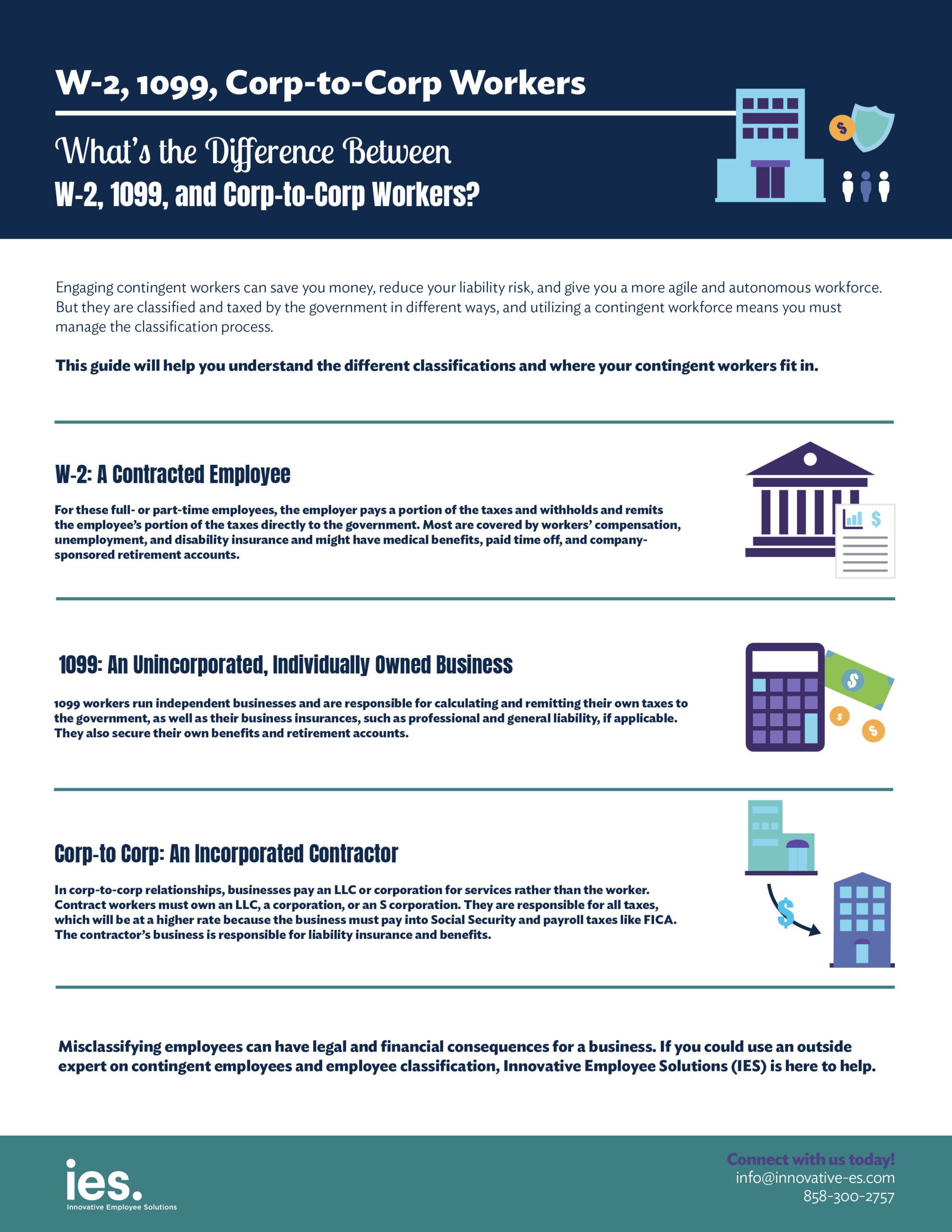

What S The Difference Between W 2 1099 And Corp To Corp Workers

What S The Difference Between W 2 1099 And Corp To Corp Workers

How To Find Your W2 Form Online Finding Yourself W2 Forms Online

How To Find Your W2 Form Online Finding Yourself W2 Forms Online

W4 Form Explained 4 Important Life Lessons W4 Form Explained Taught Us Tax Forms Income Tax W2 Forms

W4 Form Explained 4 Important Life Lessons W4 Form Explained Taught Us Tax Forms Income Tax W2 Forms

Pin By Bianca Kim On Quick Saves In 2021 Internal Revenue Service Tax Forms Fillable Forms

Pin By Bianca Kim On Quick Saves In 2021 Internal Revenue Service Tax Forms Fillable Forms

Hack Your Taxes With Our Tax Season Webinar Consolidated Credit In 2021 Tax Season Credit Consolidation Tax Forms

Hack Your Taxes With Our Tax Season Webinar Consolidated Credit In 2021 Tax Season Credit Consolidation Tax Forms

What S The Difference Between A W2 Employee And A 1099

What S The Difference Between A W2 Employee And A 1099

1099 Vs W2 Be Better At Business Podcast Eagle Employer Services

1099 Vs W2 Be Better At Business Podcast Eagle Employer Services

W2 Or 1099 Employee Or Contractor What S The Difference Loganville Ga Patch

W2 Or 1099 Employee Or Contractor What S The Difference Loganville Ga Patch

How Long Is Firefighter School Firefighter School Becoming A Firefighter Firefighter

How Long Is Firefighter School Firefighter School Becoming A Firefighter Firefighter

The Important Differences Between W 2 And 1099 Physician Income And Why It Matters Look For Zebras

The Important Differences Between W 2 And 1099 Physician Income And Why It Matters Look For Zebras

What Is A 1099 Employee What Is A W2 Infographic Small Business Bookkeeping What Is A 1099 Personal Finance Budget

What Is A 1099 Employee What Is A W2 Infographic Small Business Bookkeeping What Is A 1099 Personal Finance Budget

Everything You Need To Know 1099 Vs W2 Tax Season This Or That Questions Truck Driver

Everything You Need To Know 1099 Vs W2 Tax Season This Or That Questions Truck Driver

![]() Looking To Hire W2 Vs 1099 Which Is Best For Your Business

Looking To Hire W2 Vs 1099 Which Is Best For Your Business

How To Fill Out A W 4 Form Without Errors Pt Money Employee Tax Forms Job Application Form Math Models

How To Fill Out A W 4 Form Without Errors Pt Money Employee Tax Forms Job Application Form Math Models

What Is The Difference Between A W 2 And 1099 Aps Payroll

What Is The Difference Between A W 2 And 1099 Aps Payroll

What Is The Difference Between A W 2 And 1099 Aps Payroll

What Is The Difference Between A W 2 And 1099 Aps Payroll

![]() Looking To Hire W2 Vs 1099 Which Is Best For Your Business

Looking To Hire W2 Vs 1099 Which Is Best For Your Business

When To Switch Employees From A W2 To A 1099

When To Switch Employees From A W2 To A 1099

Beauty Store Business How To Classify Employees 1099 Or W2 Billionaire Lifestyle Luxury Private Jets Business Inspiration

Beauty Store Business How To Classify Employees 1099 Or W2 Billionaire Lifestyle Luxury Private Jets Business Inspiration