Where To Send 1099 Misc In Pennsylvania

Changes in the reporting of income and the forms box numbers are listed below. PA DEPARTMENT OF REVENUE PO BOX 280904 HARRISBURG PA 17128-0904 Mailing Address For Form 1099-R or 1099-MISC Showing Zero Withholding.

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

I know the software tells you during the interview that you need to send in your 1099R and 1099MISC but fails to mention that it is not necessary if you.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.11.14PM-13bca5b544274295ba7589b5618201fb.png)

Where to send 1099 misc in pennsylvania. PA Department of Revenue. Payer made direct sales of 5000 or more checkbox in box 7. For added convenience select the postal mailing option and allow ExpressEfile to handle all your recipient copies.

For more information refer to. Companies meeting the withholding requirements are required to apply for a 1099-MISC withholding account via Form PA 100 which can be done electronically at wwwpa100statepaus. Due to the creation of Form 1099-NEC we have revised Form 1099-MISC and rearranged box numbers for reporting certain income.

The given answer addresses federal IRS requirements not PA state. PA Department of Revenue PO. Request KellyG clarify her response and focus on PA state requirements.

The new rules are both difficult and complex. Does Pennsylvania participate in combined federal and state filing. If you still want to file 1099 forms by paper send the forms with a copy of 1096 and REV 1667 to the following mailing address.

7 rows If you live in PENNSYLVANIA. Payments of Pennsylvania source non-employee compensation or business income to a non-resident individual or disregarded entity that has a nonresident member and is reported on a 1099-MISC. PA Department of Revenue.

Does the company that issues the 1099-MISC have to report the Pennsylvania portion of the payments on the 1099-MISC submitted to Pennsylvania. And you are filing a Form. Recipients Tax Identification Number on 1099-MISC form is incorrect in relation to the recipient name on the 1099-MISC form The Compensation amount listed in Box 7 of the 1099- MISC form is inconsistent with the information provided on those claims received.

File a copy of the Federal Form 1099-MISC with the Department by January 31 of the next year. Box 3330 Jefferson City MO 65105-3330. New Mexico 1099 Mailing.

If the entity is issuing 9 or fewer paper 1099R with a premature distribution of a pension or profit-sharing plan or a 1099 MISCNEC that has zero PA withholdings the forms should be mailed to. Crop insurance proceeds are reported in. Follow these steps to meet your 1099-MISC deadline.

Payers of nonemployee compensation for Pennsylvania-based work or Pennsylvania-source oilgas lease payments are required to submit copies of federal forms 1099. ExpressEfile makes filing Form 1099-MISC online easy. PA Department of Revenue.

Mailing Address For Taxpayers Filing Less Than 10 Form 1099s with REV-1667. PO BOX 280904. When filing state copies of forms 1099 with Pennsylvania department of revenue the agency contact information is.

I think the above answer by KellyG is marginally helpful as the OP asks do I have to copy the form 1099-R for the PA Tax and send it with my return. And acted upon by MA during the tax year in question. Missouri Department of Revenue Taxation Division PO.

Transmit Form 1099-MISC Directly to the IRS. PA DEPARTMENT OF REVENUE BUREAU OF INDIVIDUAL TAXES. Mail your Pennsylvania state 1099 forms to.

You will need to file Form MO-96 with Forms 1099-MISC. However you cannot e-file if you do not have a Pennsylvania employer withholding account. The only option is paper.

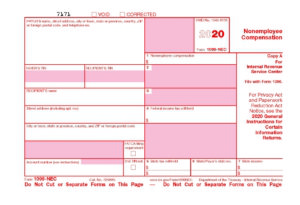

Even though the Pennsylvania Department of Revenue would prefer that Copy 1 For State Tax Department of the 1099-MISC be provided to them they will accept a copy of the Federal 1099-MISC. Pennsylvania only requires that. In alignment with the IRS the Pennsylvania Department of Revenue made changes to the 1099-MISC Income form and has implemented a new 1099-NEC Nonemployee Compensation form 1099-NEC for reporting nonemployee compensation starting with tax year 2020 filing.

A lessee of Pennsylvania real estate who makes a lease payment in the course of a trade or business to a non-resident lessor. HARRISBURG PA 17128-0904. Bureau of Individual Taxes.

Box 280412 Harrisburg PA 17128-0412. Paper 1099-Rs or 1099-MISC Showing Zero Withholding. Get your filing status instantly.

Taxpayers Filing Fewer Than 10 Paper 1099-Rs or 1099MISC Showing PA Tax Withheld Must include the REV-1667 Annual PA DEPARTMENT OF REVENUE. Beginning in 2018 anyone that pays Pennsylvania-source income to a resident or non-resident individual partnership or single member limited liability company and is required to file a Federal Form 1099-MISC is required to. Yes you need to file 1099s to Pennsylvanias Department of Revenue.

Enter your Information Easily. PO BOX 280509. Please contact us for personal assistance or any questions you have.

Irs Form 1099 Misc Irs Form 1099 Nec Lancaster Cpa Firm

Irs Form 1099 Misc Irs Form 1099 Nec Lancaster Cpa Firm

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

Businesses Have Feb 1 Deadline To Provide Forms 1099 Misc And 1099 Nec To Recipients Mychesco

Businesses Have Feb 1 Deadline To Provide Forms 1099 Misc And 1099 Nec To Recipients Mychesco

Pennsylvania Form 1099 Misc Filing Requirements Gyf

Pennsylvania Form 1099 Misc Filing Requirements Gyf

Filing Form 1099 Nec Beginning In Tax Year 2020 Leone Mcdonnell Roberts Professional Association Certified Public Accountants

Filing Form 1099 Nec Beginning In Tax Year 2020 Leone Mcdonnell Roberts Professional Association Certified Public Accountants

1099 G Tax Form Why It S Important

1099 G Tax Form Why It S Important

This Article Will Provide You The Instructions On How To Conveniently File Your 940 941 Or 944 Tax Forms Electronically Quickbooks Payroll Quickbooks Payroll

This Article Will Provide You The Instructions On How To Conveniently File Your 940 941 Or 944 Tax Forms Electronically Quickbooks Payroll Quickbooks Payroll

Degree In Business Businessdegree Scholarships For College Wharton Business School Business Degree

Degree In Business Businessdegree Scholarships For College Wharton Business School Business Degree

1099 Misc Form Template Irs 1099 Misc Template Free Software And Ware Templates Obituaries Template Form

1099 Misc Form Template Irs 1099 Misc Template Free Software And Ware Templates Obituaries Template Form

Open Prison Cells Criminal Justice Solitary Confinement Department Of Corrections

Open Prison Cells Criminal Justice Solitary Confinement Department Of Corrections

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.11.14PM-13bca5b544274295ba7589b5618201fb.png) Form 1099 Patr Taxable Distributions Received From Cooperatives Definition

Form 1099 Patr Taxable Distributions Received From Cooperatives Definition

Airbnb 1099 Forms Everything You Need To Know Shared Economy Tax

Airbnb 1099 Forms Everything You Need To Know Shared Economy Tax

1099 Misc Template 2016 Word Elegant 30 Free W2 Template New Regarding Social Social Security Disability Benefits Social Security Disability Disability Benefit

1099 Misc Template 2016 Word Elegant 30 Free W2 Template New Regarding Social Social Security Disability Benefits Social Security Disability Disability Benefit

Main Floor Plan Traditional House Plan House Plans Monster House Plans

Main Floor Plan Traditional House Plan House Plans Monster House Plans

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block