How To Get W2 From Previous Employer Workday

Former Employee 3 years ago Once the W2 website comes available its usually posted here. Steps to accessing your W-2 via Workday Please follow the stepssnapshots shown below to get to your W-2.

Workday And Citymd Read Customer Success Stories

Workday And Citymd Read Customer Success Stories

Youll also need this form from any former employer you worked for during the year.

How to get w2 from previous employer workday. At the bottom of the VIEW side there is the word More 2 click on that. My Benefits Resources layer. Ask for the W-2 to be sent to you.

For employees on leave and former employees. Your employer first submits Form W-2 to SSA. Complete and mail Form 4506 Request for Copy of Tax Return along with the required fee.

Contacting a current or former employer is the easiest way to get a W2 from a previous employer. If neither you nor the IRS can get your actual W-2 the IRS will tell you to complete a Form 4852 Substitute Form W-2 and 1099-R. If you have previously logged into the ADP portal to get your paystub or W-2 from your former employer you can try and access your information.

The payroll department of your employer or former employer should be saving important tax information such as W-2s. The Work Number layer BAC Code 10375. The easiest way to get a copy of a lost W-2 is to contact the employer who issued it.

Check the box for Form W-2 specify which tax year s you need and mail or fax the completed form. If you cant get your Form W-2 from your employer and you previously attached it to your paper tax return you can order a copy of the entire return from the IRS for a fee. The Workday self-service portal is easy to use tools that provide your pay statements and w2 information and can be accessed 24 hrs a day 7 days a week.

The PDF is your official payslip. Once you find your employer simply follow the instructions to have an electronic online copy of your W-2 form sent to HR Block. Allow 5 to 10 days from the IRS received date to receive the transcript.

To make it easier for the IRS give them your previous companys Employer Identification Number. NOTE - if this is your first time accessing The Work Number you will be guided through some additional steps. You will need your last pay stub to create the substitute W-2.

If you are unable to log in your former employer may have removed your online account. You will need to contact your former company HR or Payroll department to request a copy of your W-2. For years 2018 and prior you may access W-2s in your legacy system Oracle for the Academic Division UltiPro for University Physicians Group and PeopleSoft.

Get your W-2 from previous employer. You will have to contact your states department of revenue to get the wage and income transcript in order to complete your state return. If employers send the form to you be sure they have your correct address.

Use the below information to log in. For active employees From the Pay icon click Payslips under the View menu. Youll need to remember your employee ID and if you got a W2 from there before a password but thats it.

You should first ask your employer to give you a copy of your W-2. Access Workday As an employee of Panera Bread LLC you will be automatically enrolled in the Workday self-service portal. After SSA processes it they transmit the federal tax information to the IRS.

The IRS will then send a reminder notice to your previous employer. You can find this in your last pay stub or last years W-2 if you received one from the company. If you have reason to believe you will not get your W-2 in time for you to meet the tax-filing deadline request a filing extension from the IRS.

File Your Taxes No Matter What. 1 Sign into Workday and on your Home Page click on the Personal Information Worklet circle 2 This opens up 2 sets of columns CHANGE and VIEW. Search for your employers name or your companys Federal Employer Identification Number FEIN and select it from the generated list.

My friend got hers after quitting this way and didnt have to contact HR at all. The IRS is the next alternative if you cant reach the employer or you do not wish to contact them again. Getting Prior Years W2s If you file a prior-year tax return there may be complications such as missing W-2s and other forms.

Update Your Direct Deposit Choices In Workday University Payroll U Va

Payroll Tax What If Employer Didn T Pay Withheld Tax To Irs Payroll Taxes Payroll Tax Services

Payroll Tax What If Employer Didn T Pay Withheld Tax To Irs Payroll Taxes Payroll Tax Services

Workday University Of Mississippi Medical Center

Workday University Of Mississippi Medical Center

Workday Is Working For Penn State Penn State University

Workday Is Working For Penn State Penn State University

Workday Scu Technology At Scu Santa Clara University

Workday Scu Technology At Scu Santa Clara University

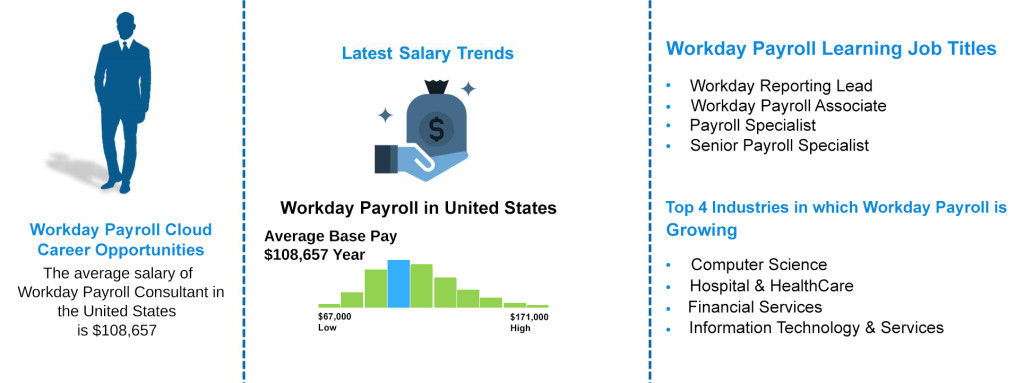

Workday Payroll Training 1 On Youtube Zarantech

Workday Payroll Training 1 On Youtube Zarantech

Https Dallascityhall Com Departments Humanresources Workday Documents W 2 20job 20aid 202020 Pdf

Workday Hcm Training Rated 1 On Youtube Zarantech

Workday Hcm Training Rated 1 On Youtube Zarantech

Now Hiring Business Analyst Job Opening Network Engineer

Now Hiring Business Analyst Job Opening Network Engineer

Job Title Workday Consultant Location New York City Ny No Opt Cpt And Tn Visa Accepted W2 Only Job Opening We Are Hiring Jobs For Freshers

Job Title Workday Consultant Location New York City Ny No Opt Cpt And Tn Visa Accepted W2 Only Job Opening We Are Hiring Jobs For Freshers

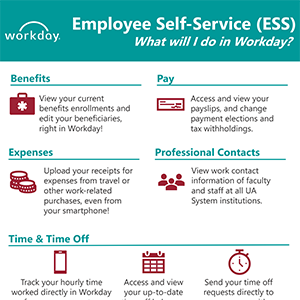

Workday Resources Page Human Resources University Of Arkansas

Workday Resources Page Human Resources University Of Arkansas

View And Print Pay Slips New Payroll Folder Under Workday Youtube

View And Print Pay Slips New Payroll Folder Under Workday Youtube

Workday Nshe Helpful Workday Information For Nshe Workers

Workday Nshe Helpful Workday Information For Nshe Workers