How To Get A Military 1099 R

If you are having a hard time finding your military or retirement W-2 or 1099R dont worry they are always available online on the Defense Finance and. Establish change or stop an allotment to an organization.

You can get the general instructions at General Instructions for Certain Information Returns or wwwirsgovform1099r or wwwirsgovform5498.

How to get a military 1099 r. You can request your 1099R be sent either to your current address or to a new address using an online form. Retirees seeking their 1099R have three options. Select option 1 for Military Retired and Annuitant Pay.

Familiarize yourself with the password requirements. Need to obtain a 1099-R for a deceased veteran that died 31117 in order for 2017 taxes to be completed. Use the following instructions to access your 1099R through myPay.

How to request your 1099-R tax form by mail Sign in to your account click on Documents in the menu and then click the 1099-R tile. Click on Federal Taxes Personal using Home and Business Click on Wages and Income Personal Income using Home and Business Click on Ill choose what I work on if shown Scroll down to Retirement Plans and Social Security On IRA 401 k Pension Plan. You can verify or change your mailing address by clicking on Profile in the menu and then clicking on.

It is a fast and secure way to access your tax statement and manage your retirement or annuity account day to day. Well send your tax form to the address we have on file. See Table 1 for allowable combinations.

Use Services Online Retirement Services to. We use cookies to give you the best possible experience on our website. Members can also request additional copies of their 1099-R tax statements in several different ways.

Retirees who did not receive their 1099-R have questions about their 1099-R form or need to update their mailing address may contact Defense Finance and. Change your mailing address. Specific Instructions for Form 1099-R File Form 1099-R Distributions From Pensions Annuities Retirement or Profit-Sharing Plans IRAs Insurance Contracts etc for each person to whom you have made.

Only three numeric combinations are permitted on one Form 1099-R. Retrieve it online from their MyPay account use the Defense Finance and Accounting Service DFAS website replacement tax. Codes 8 and 1 8 and 2 or 8 and 4.

Is there a - Answered by a verified Military Lawyer. If you need a statement of benefits paid please contact your VA. If two or more other numeric codes are applicable you must file more than one Form 1099-R.

Telephone Self-Service Telephone Self-Service is an automated option that makes it easy for military retirees to have their 1099-R mailed to the mailing address DFAS has on record. Retrieve it from their MyPay account or call the DFAS Retiree and Annuitants customer service telephone line at 1. Please note that 1099-R reissues requested through AskDFAS cannot be mailed prior to February 10 2021.

Change your Personal Identification Number PIN for accessing our automated systems. Plus you can request prior year 1099Rs. Select option 1 To Use our automated self-service system and reissue a 1099R Select option 1 to request a 1099-R 24 hours a day seven days a week without waiting to speak to a customer service representative.

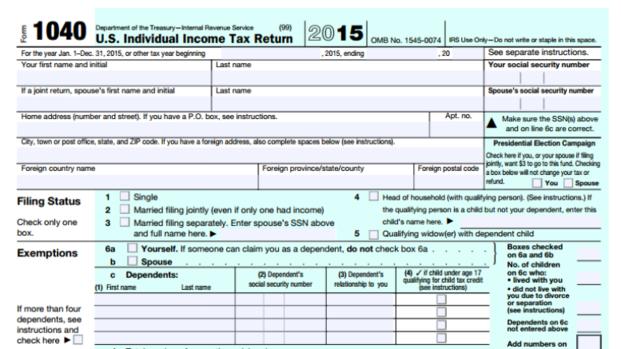

Enter a maximum of two alphanumeric codes in box 7. Start change or stop Federal and State income tax withholdings. How do I enter military retirement 1099-r.

Therefore VA does not send out 1099 forms. VA benefits are not taxable. There is no need to speak with a representative wait on hold or even use a computer.

You will receive your 1099R in the mail in seven to ten business days. Military retiree and annuitants can obtain copies of their 1099-R through myPay. Getting Your 1099-R Military retirees and annuitants receive a 1099-R tax statement either electronically via myPay or as a paper copy in the mail each year.

How do I obtain a 1099 form from VA. Retirees seeking their 1099R have two options. This option can be used 24 hours a day 7 days a week.

Request a duplicate tax-filing statement 1099R.

Tax Statements For Separated Troops Military Com

Tax Statements For Separated Troops Military Com

Maximize Your Tax Refund Tax Refund How To Get Smarter Think Big

Maximize Your Tax Refund Tax Refund How To Get Smarter Think Big

Income Taxes And The Military Department Of Taxation

Income Taxes And The Military Department Of Taxation

2021 Retired Military Pay Dates Annuitant Pay Schedule

2021 Retired Military Pay Dates Annuitant Pay Schedule

3 Reasons Not To File Your Tax Return Yet Military Com

3 Reasons Not To File Your Tax Return Yet Military Com

Taxable Income From Retired Pay Military Com

Taxable Income From Retired Pay Military Com

Reporting Tricare On Your Tax Return Military Com

Reporting Tricare On Your Tax Return Military Com

Ukrainian Armor Varta Novator Military Vehicles Armored Fighting Vehicle Army Vehicles

Ukrainian Armor Varta Novator Military Vehicles Armored Fighting Vehicle Army Vehicles

8 Of The Best States For Military Retirees 2021 Edition Ahrn Com

8 Of The Best States For Military Retirees 2021 Edition Ahrn Com

Pakistan Private Infantry 1971 Pin By Paolo Marzioli Military Diorama Army Uniform Military Uniform

Pakistan Private Infantry 1971 Pin By Paolo Marzioli Military Diorama Army Uniform Military Uniform

Department Of The Army Retirement Planning Briefing

Department Of The Army Retirement Planning Briefing

How To Report Backdoor Roth In Turbotax Turbotax Roth Disability Payments

How To Report Backdoor Roth In Turbotax Turbotax Roth Disability Payments

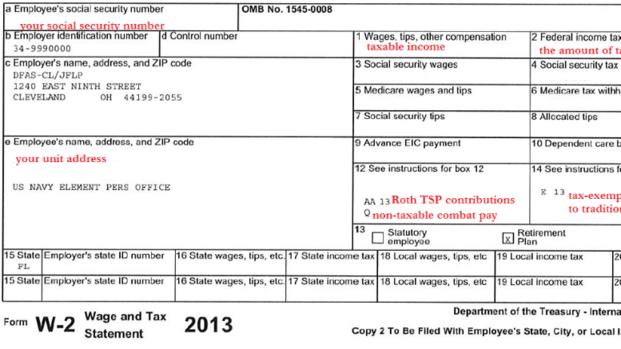

Get A Replacement W 2 Or 1099r Military Com

Get A Replacement W 2 Or 1099r Military Com

First Crusade Siege Of Jerusalem 1099 Ad Youtube Jerusalem Crusades Military History

First Crusade Siege Of Jerusalem 1099 Ad Youtube Jerusalem Crusades Military History

Turbotax Offers Free Tax Filing For Military Active Duty And Reserve The Turbotax Blog

Turbotax Offers Free Tax Filing For Military Active Duty And Reserve The Turbotax Blog