Do S Or C Corporations Get A 1099 Irs

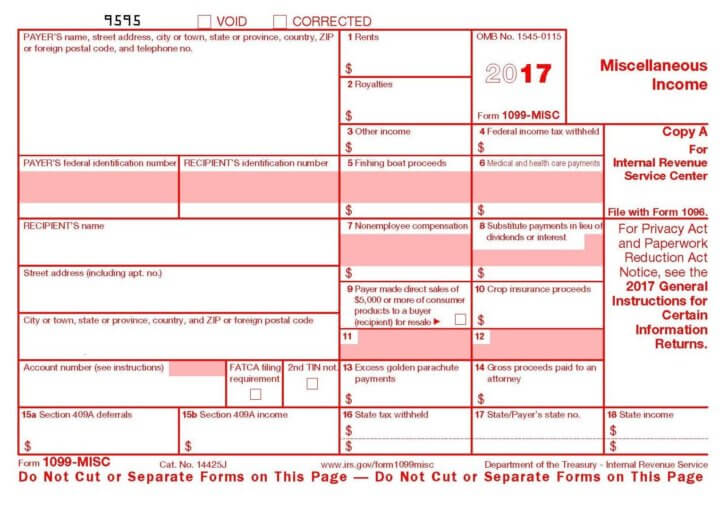

The general rule is that business owners must issue a Form 1099-NEC to each person to whom they have paid at least 600 in rents services including parts and materials prizes and awards or other income payments. Corporations are exempt recipients but a 1099-MISC may be required under certain circumstances.

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Most corporations dont get 1099-MISCs Another important point to note.

Do s or c corporations get a 1099 irs. Instead they are treated similarly but not identically to partnerships for tax purposes. An easy way to remember the IRS rule is that corporations do not receive 1099 forms regardless of whether they are S or C corporations. Sole proprietors partnerships and unincorporated contractors do.

Payments for which a Form 1099-MISC is not required include all of the following. Was an S corporation any gain or loss would be reported on the shareholders Schedules K-1 Form 1120-S Shareholders Share of Income Deductions Credits etc. It depends on the type of payment.

Information Returns Forms 1099 A tax-exempt organization must file required information returns such as Form 1099-MISC PDF. You dont need to issue 1099s for payment made for personal purposes. Exception to the general rule.

Generally payments to a corporation including a limited liability company LLC that is treated as a C or S corporation. Scottrade recommends referring to the monthly statements to gather any needed information for. A 1099-MISC form is primarily used to report payments made to non-employees like a contractor or service provider.

Certain payments to corporations are reportable on Forms 1099-MISC. C realizes a gain of 10000 on the distribution 30000 cash received 20000 tax basis and B realizes a 20000 loss 70000 cash received 90000 tax basis. However S-Corporations may receive tax forms and C-Corporations can be subject to 1099-MISC reporting andor a Widely Held Fixed Investment Trust WHFIT statement.

The following payments made to corporations generally must be reported on Form 1099-MISC. Lawyers operating as a C or S corporation need a 1099. Corporations that have filed a special election with the IRS.

You do not need to send a Form 1099-MISC to. Keep in mind the distinction between a C and an S corporation is purely with regard. You may be able to override the tax software to show that this 1099 income is not Qualified Business Income.

There is no need to send 1099-MISCs to corporations. This includes S-Corporations and C-Corporations -- they also dont receive 1099 1099-MISCs. You should also issue 1099-MISC forms for.

Some payments do not have to be reported on Form 1099-MISC although they may be taxable to the recipient. Companies must issue these 1099s to any partnerships sole proprietors and LLCs for amounts paid that exceeded 600 but the IRS specifically exempts corporations except in. The funny part about this is that if you are the one issuing a Form 1099-MISC you will have no way to tell if the vendor you are issuing to is an s-corporation since the business name will only include LLC in the title.

They are not subject to corporate income tax. Starting in 2018 the amount that is on the 1099 which will be reported on the shareholders Schedule C now will have the 199A deduction applied to it. An organization does not withhold income tax or social security and Medicare taxes from or pay social security and Medicare taxes or federal unemployment tax on amounts it pays to an independent contractor non-employee.

1099-MISCs should be sent to single-member limited liability company or LLCs or a one-person Ltd. Although most payments to corporations are not 1099-MISC and 1099-NEC reportable there are some exceptions. For-profit medical and health care providers organized as a.

There are a few exceptions where corporations must receive a Form 1099-MISC. This is the same for both C and S corporations. See above and payments for medical or health care services see page 6 of the instructions.

Do S corps get 1099 forms sent to them. A limited liability company that has elected to be taxed as a C corporation. In most cases these forms do not need to be sent to corporations.

An LLC will not receive a 1099 if taxed as an s-corporation. A professional corporation except for law firms. What we normally consider regular corporations that are subject to the corporate income tax.

From IRSs 1099-Misc instructions. Generally payments to a corporation including a limited liability company LLC that is treated as a C or S corporation do not have to be reported on a 1099-Misc.

Facts About Online Filing Of Form 1099 Misc Irs Forms Irs Tax Forms

Facts About Online Filing Of Form 1099 Misc Irs Forms Irs Tax Forms

Free Download W9 Form W 9 Form Fillable Printable Download Free 2018 Tax Forms Letter Templates Free Professional Resignation Letter

Free Download W9 Form W 9 Form Fillable Printable Download Free 2018 Tax Forms Letter Templates Free Professional Resignation Letter

Irs Form 1099 Misc Alizio Law Pllc

Irs Form 1099 Misc Alizio Law Pllc

S Corp Vs C Corp Business Structure Accounting Services Tax Accountant

S Corp Vs C Corp Business Structure Accounting Services Tax Accountant

Important Changes For 2019 And 2020 Filing Forms 1099 Misc Irs Forms Irs Efile

Important Changes For 2019 And 2020 Filing Forms 1099 Misc Irs Forms Irs Efile

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

Determining Who Gets A 1099 Misc Form And When It S Due Tax Forms 1099 Tax Form Form

Determining Who Gets A 1099 Misc Form And When It S Due Tax Forms 1099 Tax Form Form

C Corporation Updated 628x1024 Jpg 628 1024 S Corporation Tax Guide Quickbooks

C Corporation Updated 628x1024 Jpg 628 1024 S Corporation Tax Guide Quickbooks

Efile Form 1099 Misc Online Through Taxseer Irs Forms Efile Irs

Efile Form 1099 Misc Online Through Taxseer Irs Forms Efile Irs

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Do Llcs Get A 1099 During Tax Time Incfile

Do Llcs Get A 1099 During Tax Time Incfile

What Is A 1099 C Form And Why Did I Get It Credit Repair Services What Is A 1099 Credit Education

What Is A 1099 C Form And Why Did I Get It Credit Repair Services What Is A 1099 Credit Education

What Is An Irs Schedule C Form And What You Need To Know About It

What Is An Irs Schedule C Form And What You Need To Know About It

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

What Is Irs Form 1040 Income Tax Return Tax Return Income Tax

What Is Irs Form 1040 Income Tax Return Tax Return Income Tax

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

Does An S Corp Get A 1099 Misc Or 1099 Nec Infographic

Does An S Corp Get A 1099 Misc Or 1099 Nec Infographic

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099