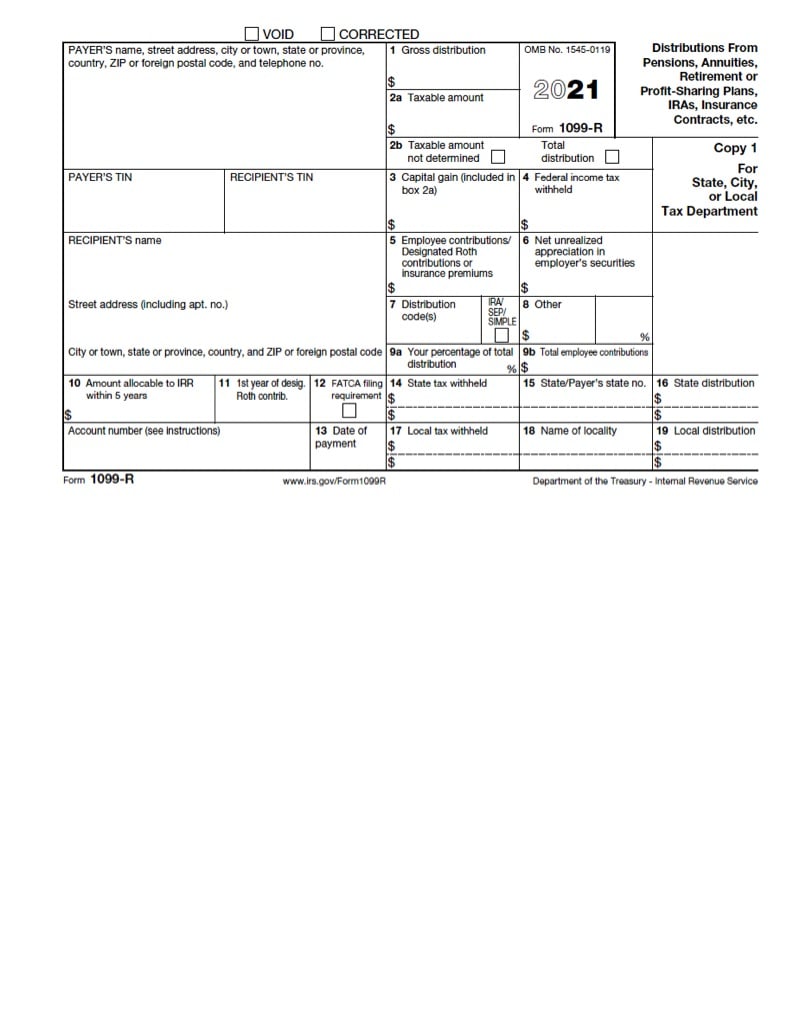

1099-r Pa State Taxes

While SERS payments are exempt from PA state and local taxes they may be subject to state and local income taxes where you live. Do not also send in federal Form 1099-R.

Irs Appeals Irs Taxes Irs Appealing

Irs Appeals Irs Taxes Irs Appealing

You can only access the PA Personal Income.

1099-r pa state taxes. Pennsylvania Extends Personal Income Tax Filing Deadline to May 17 2021. PA-40IN -- 2020 Pennsylvania Personal Income Tax. You can review your PA return TurboTax with the following steps.

PA-1 -- Online Use Tax Return. The Form 1099-R is to be used by you for the preparation of your annual federal income tax return. For tax years beginning on or after January 1 2005 any amounts reported in gross income for Federal Income Tax purposes for a retirement annuity that is not an employer sponsored retirement annuity reported as Codes 1D 2D 3D 4D or 7D in Box 7 beginning with 2013 Forms 1099-R are reported as interest income on PA Schedule A regardless of whether the annuity payments.

We do not provide 1099-R forms to any state or local tax authority. 1 day agoPennsylvanias deadline for filing state income tax returns is tied to the federal deadline and on March 18 the Department of Revenue announced the state deadline would also be May 17. If you live outside of Pennsylvania you should contact the tax bureau where you live for pension distribution tax rules in your state.

1099-R 1099-MISC 1099-NEC and any other documents reporting compensation must be included with the tax return. Federal and state income taxes are collected on 1099 retirement income. Special notes for those who.

DPO-86 -- File Your PA Personal Income Tax Return Online For Free With myPATH. This may delay processing of your return. You can access your personal PSERS account information and print duplicates of your 2010.

Form 1099-R Filing. IRS Form 1099-R reports all of the distributions youve taken from your IRA or 401k retirement accounts during a calendar year whether or not those amounts are taxable. How do I receive additional copies of Form 1099-R.

That explains Pennsylvanias income tax and many of its differences from federal tax rules. If so you will be required to file Copy 2 of your 1099-R form with your state andor local tax office. The PA state return will exclude the taxable portion of the distribution due to death and you will receive a refund or credit for the amount of PA tax withheld on the 1099R.

You will want to verify the code in box 7 of your paper 1099-R matches that which was entered into the program. Detailed Explanation To assist you PSERS will include an explanation of the information appearing in each box on the 1099-Rs PDF. Contact your state and local tax offices or a qualified tax.

Keep it for your records. PA-40 -- 2020 Pennsylvania Income Tax Return. You will want to verify the code in box 7 of your paper 1099-R matches that which was entered into the program.

You could receive more than one 1099-R from us in any one tax year if you retired that year and chose to withdraw any of your contributions and interest in a lump sum you received a payment from your own SERS pension and also received a survivor or beneficiary payment from a deceased SERS members pension or you turned 595 during that tax year. The state income tax rate for 2020 is 307 percent 00307. While in your TurboTax account select Tax Tools in the left margin.

A safe convenient online filing option available from reputable vendors that allows qualifying individuals to file their state and federal returns for free. Pennsylvania does tax early distributions in certain situations. PA-19 -- PA Schedule 19 - Taxable Sale of a Principal Residence.

The form shows a breakdown of the money you received from PSERS during the previous calendar year as well as the federal income tax withheld the Investment in Contract recovered during the year if applicable and appropriate distribution code. Proudly founded in 1681 as a place of tolerance and freedom. If the code was a 1 or 2 this would indicate an early distribution.

A secure state-only electronic filing system offered exclusively through the Department of Revenue which allows most taxpayers to prepare and submit their Pennsylvania personal income tax return for free. Select View a Tax Summary. The code entered in box 7 of the 1099-R will determine the taxability on the PA return.

No beginning with tax year 2015 if the 1099-R shows NYS NYC or Yonkers tax withheld you must copy the required information from federal Form 1099-R onto the New York State Form IT-1099-R Summary of Federal Form 1099-R Statements and submit it with your return. Harrisburg PA The Department of Revenue today announced the deadline for taxpayers to file their 2020 Pennsylvania personal income tax returns and. The code entered in box 7 of the 1099-R will determine the taxability on the PA return.

If the code was a 1 or 2 this would indicate an early distribution. Pennsylvania does tax early distributions in certain situations.

Pa Tax Update Good News For Taxpayers In 912m Pandemic Relief Bill

Pa Tax Update Good News For Taxpayers In 912m Pandemic Relief Bill

Turbotax Free Military Taxes 2020 2021 Online Tax Filing For Active Duty Military And Reserves

Turbotax Free Military Taxes 2020 2021 Online Tax Filing For Active Duty Military And Reserves

Https Onesourcesupport Onesourcelogin Com Attach 2016 Guides Business 2016 1065 1120 State E File Guide Gosystem Pdf

Irs What To Do If Form W 2 And Form 1099 R Is Not Received Or Is Incorrect Irs Taxes Irs Internal Revenue Service

Irs What To Do If Form W 2 And Form 1099 R Is Not Received Or Is Incorrect Irs Taxes Irs Internal Revenue Service

1099 Nec Pressure Seal Forms Copy B 2 2up 11 Z Fold Discount Tax Forms

1099 Nec Pressure Seal Forms Copy B 2 2up 11 Z Fold Discount Tax Forms

Irs Miscellaneous Expenses Income Tax Return Irs Taxes Deduction

Irs Miscellaneous Expenses Income Tax Return Irs Taxes Deduction

Https Www Raymondjames Com Media Rj Dotcom Files Wealth Management Why A Raymond James Advisor Client Resources Tax Reporting 2020 Composite Form 1099 Guide Pdf

Http Hfco Com Wp Content Uploads 2020 06 2020 Payroll Tax Highlight Pdf

Dd Form 2870 Blank Download Dd Form 2870 Authorization For Disclosure Rental Agreement Templates Statement Template Job Application Form

Dd Form 2870 Blank Download Dd Form 2870 Authorization For Disclosure Rental Agreement Templates Statement Template Job Application Form

1099 Misc Form Copy B Recipient Discount Tax Forms

1099 Misc Form Copy B Recipient Discount Tax Forms

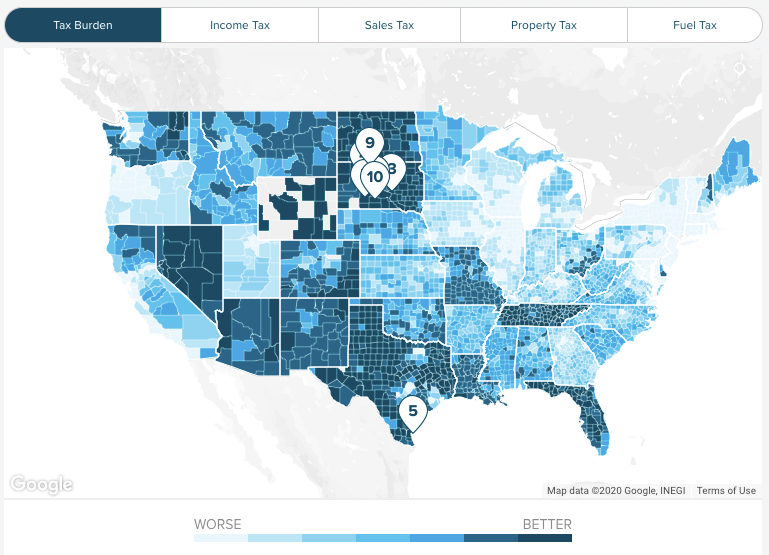

West Virginia Income Tax Calculator Smartasset

West Virginia Income Tax Calculator Smartasset

Ny State Tax Extension Form It 201 Vincegray2014

Ny State Tax Extension Form It 201 Vincegray2014

1099 Nec Pressure Seal Forms Copy B 2 2up 11 Z Fold Discount Tax Forms

1099 Nec Pressure Seal Forms Copy B 2 2up 11 Z Fold Discount Tax Forms

How To Fill Out And Print 1099 Nec Forms

How To Fill Out And Print 1099 Nec Forms

2021 Pennsylvania Payroll Tax Rates Abacus Payroll

2021 Pennsylvania Payroll Tax Rates Abacus Payroll

How To Fill Out And Print 1099 Nec Forms

How To Fill Out And Print 1099 Nec Forms

W 2 Vs Last Pay Stub What S The Difference Aps Payroll

W 2 Vs Last Pay Stub What S The Difference Aps Payroll