What Types Of Services Get A 1099

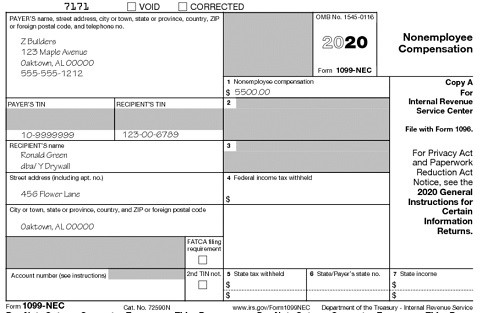

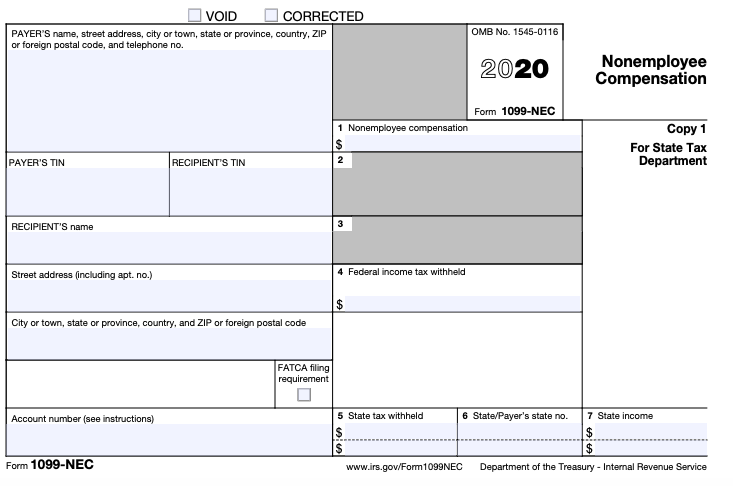

Operating for gain or profit. NEC stands for Nonemployee Compensation and Form 1099-NEC is taking the place of what used to be recorded in Box 7 of Form 1099-MISC.

1099 Form Fillable 1099 Misc Tax Basics Irs Forms 1099 Tax Form Tax Forms

1099 Form Fillable 1099 Misc Tax Basics Irs Forms 1099 Tax Form Tax Forms

Include oil and gas payments for a working interest whether or not services are performed.

What types of services get a 1099. A trust of a qualified employer pension or profit-sharing plan. File Form 1099-MISC for each person to whom you have paid during the year. What Are Common Types of 1099 Forms.

Contact us 316-869-0948. Other types require 10 as the reporting amount for things like royalties awards and prizes. Form 1099-MISC is intended to report the income of taxpayers who are not employees such as independent contractors freelancers sole-proprietors and self-employed individuals.

IRS Authorized 247 support Secure Filing. 1099-R Distributions From Pensions Annuities Retirement or Profit-Sharing Plans IRAs Insurance Contracts etc. Under section 6045f report in box 10 payments that.

Are made to an attorney in the course of your trade or business in connection with legal services but not for the attorneys services for example as in a settlement agreement. However a few exceptions exist that require a. At least 10 in royalties or broker payments in lieu of dividends or tax-exempt interest.

Business owners have to file form 1099 as a record of payments they made to independent contractors over the course of the tax year. Reportable in box 1 of Form 1099-NEC under section 6041Aa1. You may see this if you sold certain securities in the.

Typically this form is issued to independent contractors janitorial services third-party accounts and any other worker paid for services who is not on the payroll. So who gets a 1099-NEC. 1099-SA Distributions From an HSA Archer MSA or Medicare Advantage MSA Fortunately most taxpayers need only worry about receiving a few of these different forms.

File Form 1099-R for each person to whom you have made a designated distribution or are treated as having made a distribution of 10 or more from. Like 1099 R1099 A1099 K1099 Div1099 Int1099 Misc1099 NEC etc. A 1099-MISC is for Miscellaneous Income and it is the type of 1099 that is used when others dont apply.

This means that if any of your vendors fall into the categories above you dont need to issue them a 1099 if you havent paid them 600 or more. Freelance and independent contractors receive these types of forms after getting at least 600 in payment. Profit-sharing or retirement plans.

Permanent and total disability payments under life insurance contracts. Include fees commissions prizes and awards for services performed as a nonemployee other forms of compensation for services performed for your trade or business by an individual who is not your employee and fish purchases for cash. IRS Provides Different types of 1099 Forms.

A non-profit organization including 501 c3 and d organizations. This form records income received from brokerage transactions and barter exchanges. Who Must Send a 1099-MISC Form.

Gross proceeds paid to attorneys. The form is also. If you had more than 600 worth of debt canceled the.

Backup Withholding all amounts. Any individual retirement arrangements IRAs. Independent contractors use a 1099 form and employees use a W-2.

A widely held fixed investment trust. A non-exempt farmers cooperative. Contractors are responsible for paying their own payroll taxes and submitting them to the government on a quarterly basis.

Annuities pensions insurance contracts survivor income benefit plans. Rent or prizes and awards that are not for service 600 or more and royalties 10 or more. 600 or more for services performed for a trade or business by people not treated as employees.

Due to the high level of administrative reporting for corporations the IRS exempts corporations from needing to receive a Form 1099-MISC. For W-2 employees all payroll taxes are deducted automatically from the paycheck and paid to the government by the employer. At least 600 in.

A Form 1099 MISC must be filed for each person to whom payment is made of. The 2017 1099-MISC threshold is 600 per year with the exception of payments for royalties. If a business buys or rents products or services that amount to more than 600 from one person or LLC during the year it has to file a 1099 for that contractor or vendor.

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

How To Read Your 1099 Justworks Help Center

How To Read Your 1099 Justworks Help Center

1099 S Software E File Tin Matching Print And Mail 1099 S Forms And Envelopes Data Is Entered Onto Windows That Resemble The Actu Irs Forms Efile Irs

1099 S Software E File Tin Matching Print And Mail 1099 S Forms And Envelopes Data Is Entered Onto Windows That Resemble The Actu Irs Forms Efile Irs

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

1099 Tax Return Contractors Small Business Freelancer Bookkeeping Business Business Tax Small Business Bookkeeping

1099 Tax Return Contractors Small Business Freelancer Bookkeeping Business Business Tax Small Business Bookkeeping

Irs 1099 Form Frequently Asked Questions Tax Relief Center Irs How To Get Money Tax Help

Irs 1099 Form Frequently Asked Questions Tax Relief Center Irs How To Get Money Tax Help

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Form 1099 Misc Vs Form 1099 Nec How Are They Different

Form 1099 Misc Vs Form 1099 Nec How Are They Different

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

What Is The Difference Between A W 2 And 1099 Aps Payroll

What Is The Difference Between A W 2 And 1099 Aps Payroll

I Am A Business Owner Do I Need To File 1099 Misc For My Independent Contractors Irs Forms Irs Tax

I Am A Business Owner Do I Need To File 1099 Misc For My Independent Contractors Irs Forms Irs Tax

1099 Misc Minimum Discrepancy Sabrina S Admin Services Business Small Business Small Business Owner

1099 Misc Minimum Discrepancy Sabrina S Admin Services Business Small Business Small Business Owner

5 Things You Need To Know As A 1099 Employee Consulting Business Irs Forms Paying Taxes

5 Things You Need To Know As A 1099 Employee Consulting Business Irs Forms Paying Taxes

:max_bytes(150000):strip_icc()/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

1099 Int Software E File Tin Matching Tax Forms Envelopes Irs Forms Irs Efile

1099 Int Software E File Tin Matching Tax Forms Envelopes Irs Forms Irs Efile

1099 Misc Form Template 1099 Misc Template 1099 Tax Form Doctors Note Template Tax Forms

1099 Misc Form Template 1099 Misc Template 1099 Tax Form Doctors Note Template Tax Forms

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It