What Does Disregarded Entity Name Mean

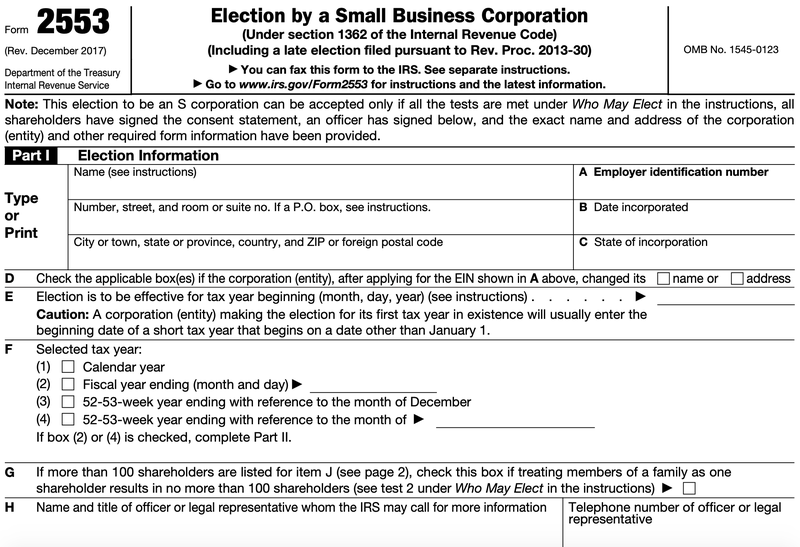

Federal tax purposes an entity that is disregarded as an entity separate from its owner is treated as a disregarded entity See Regulations section 3017701-2 c 2 iii. 1 It also treats subsidiaries of S corporations called QSubs as disregarded entities.

A Beginner S Guide To Pass Through Entities The Blueprint

A Beginner S Guide To Pass Through Entities The Blueprint

A disregarded entity is a business entity considered separate from the owner when it comes to liability and the same as the owner for tax purposes.

What does disregarded entity name mean. A Limited Liability Company LLC is an entity created by state statute. The term disregarded entity refers to a business entity thats a separate entity from its owner but that is considered to be one in the same as the owner for federal tax purposes. Another way to say this is that the business is not separated from the owner for tax purposes.

This means that the owner of the SMLLC is taxed like a sole proprietorship. If an LLC meets certain requirements it qualifies as a disregarded entity by the US. The term disregarded entity refers to how a single-member limited liability company LLC may be taxed by the Internal Revenue Service IRS.

A disregarded entity is a legal entity thats ignored for federal and some state income tax purposes. A disregarded entity is a single-member LLC. A disregarded entity refers to a business entity with one owner that is not recognized for tax purposes as an entity separate from its owner.

This means that you and the business are combined for income taxes. A disregarded entity is a tax classification reserved for single-member limited liability companies LLC. For federal and state tax purposes the entity is disregarded meaning the entity does not file a separate tax return.

The IRS uses the disregarded entity designation for single-member limited liability companies LLCs that dont elect to be taxed as a corporation. Determining Disregarded Entity Status. A disregarded entity is a business that is separate from its owner but which elects to be disregarded as separate from the business owner for federal tax purposes.

As for the disregarded entity part if you dont know what it is you probably arent one. An LLC is typically considered as a separate entity from the owners. A sole proprietorship is a one-owner business thats personally owned by the proprietor aka the owner and its the simplest way to organize and run any business.

That means the business is not required to file its own tax return and instead the owner reports their business profits on their personal return. If your LLC is deemed a disregarded entity it simply means that in the eyes of the IRS your LLC is not taxed as an entity separate from you the owner. However an LLC with only one member is disregarded as separate from its owner for income tax purposes.

Depending on elections made by the LLC and the number of members the IRS will treat an LLC either as a corporation partnership or as part of the owners tax return a disregarded entity. In other words these entities are regarded as separate in terms of liability but disregarded as separate in terms of taxation. A disregarded entity is an incorporated business that is considered separate from the owner for liability purposes Point 1 above but is considered the same as the owner for tax purposes Point 2.

A single-member LLC SMLLC for example is considered to be a disregarded entity. The answer is disregarded entity which is basically a fancy way of saying that the IRS pretends that the LLC doesnt exist. Is a disregarded entity the most advantageous tax classification for your single-member LLC SMLLC.

Internal Revenue Service IRS meaning it is taxed like a. The most common disregarded entity type is a single-member limited liability company. The owner claims the business on personal taxes but when liability issues arise the owners personal assets are protected.

Enter the owners name on line 1. The business owner essentially wants the IRS to disregard the fact that the business is a. This is because the IRS disregards that the owner and business are separate from each other.

1 If this sounds like a double negative it is. A disregarded entity is a one-person business structure thats not taxed separately from its owner.

How To Fill Out A W 9 For An Llc Disregarded Company Legalzoom Com

How To Fill Out A W 9 For An Llc Disregarded Company Legalzoom Com

Properly Completing Irs Form W 9 For Your Ira Llc Or Checkbook Control Ira Self Directed Ira Handbook

Properly Completing Irs Form W 9 For Your Ira Llc Or Checkbook Control Ira Self Directed Ira Handbook

Correctly Set Up W 9 And 1099 Forms In Quickbooks To Avoid Irs Notices

Correctly Set Up W 9 And 1099 Forms In Quickbooks To Avoid Irs Notices

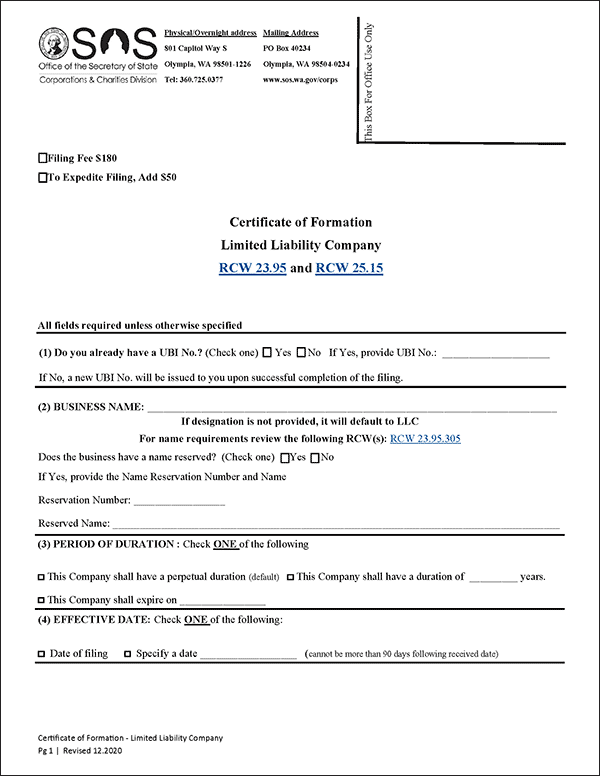

Llc Washington State How To Start A Washington State Llc Truic Guides

Llc Washington State How To Start A Washington State Llc Truic Guides

What Is Form 941 And How Do I File It Ask Gusto

What Is Form 941 And How Do I File It Ask Gusto

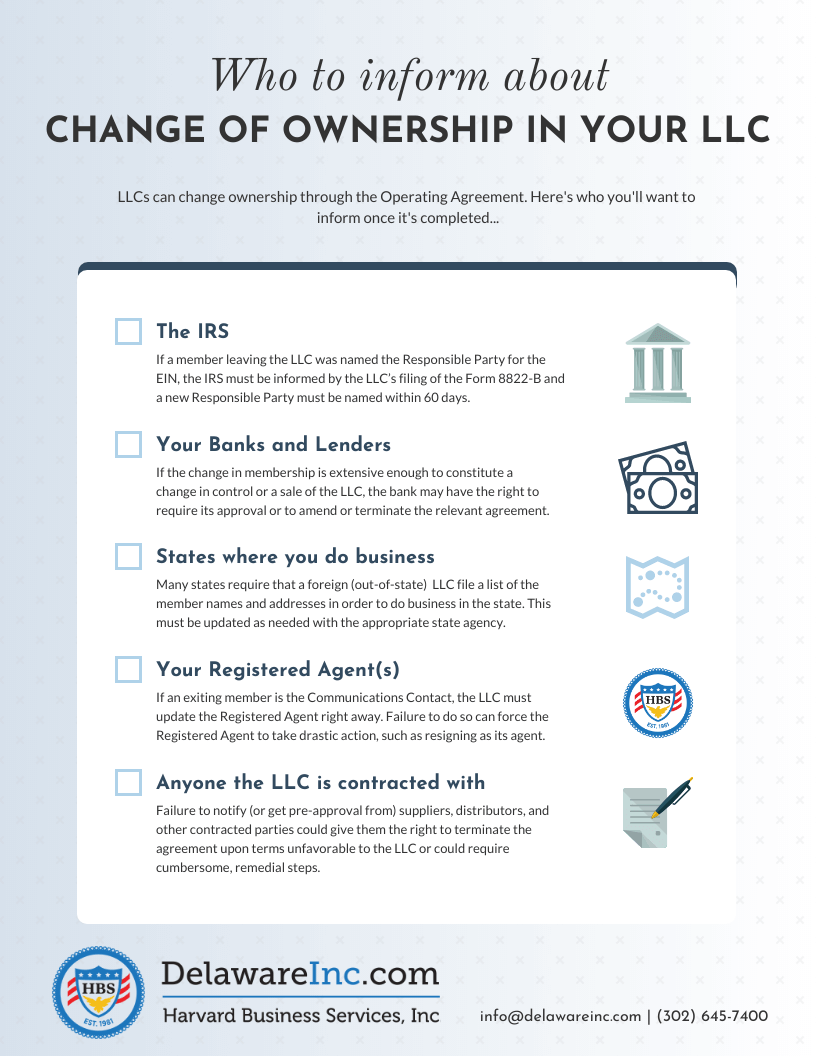

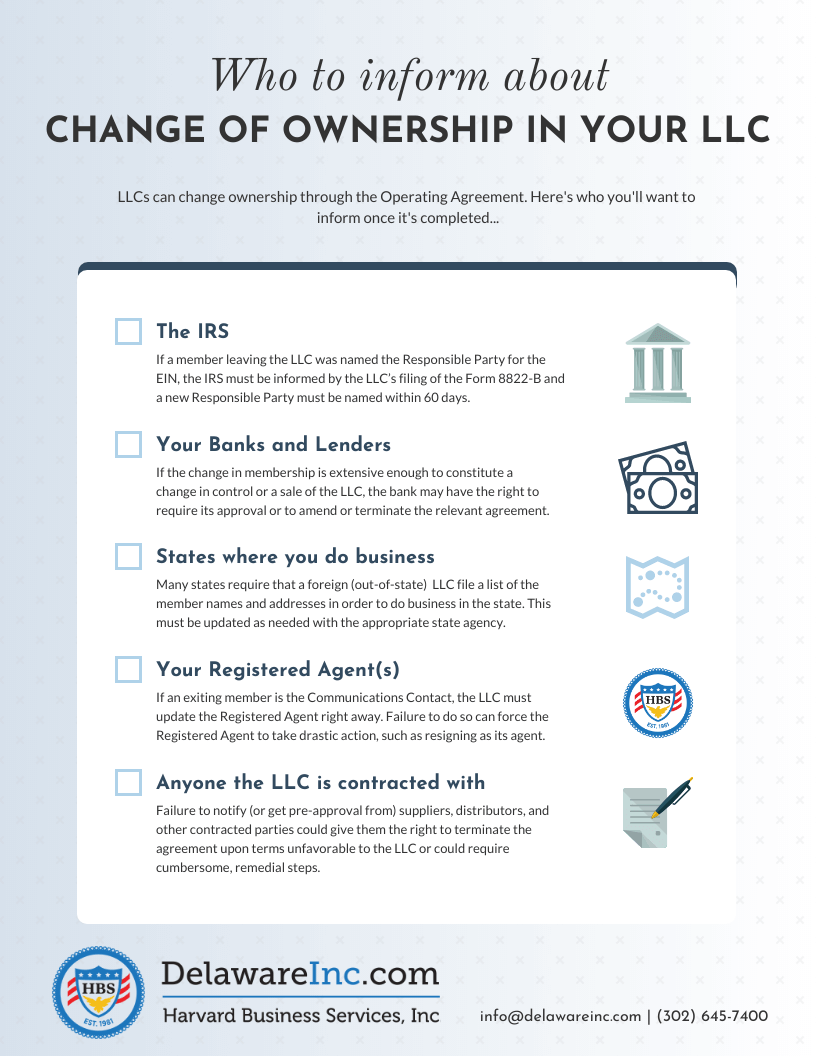

Who To Inform About Your Llc Change Of Ownership Harvard Business Services

Who To Inform About Your Llc Change Of Ownership Harvard Business Services

Do I Have To Register As A Foreign Business Entity A Guide To Doing Business In Arizona Law Firm Income Tax Business Perspective

Do I Have To Register As A Foreign Business Entity A Guide To Doing Business In Arizona Law Firm Income Tax Business Perspective

W9 Form To Download W9 The Rev Rental Agreement Templates The Body Book

W9 Form To Download W9 The Rev Rental Agreement Templates The Body Book

Learn How To Fill Out A W 9 Form Correctly And Completely

Learn How To Fill Out A W 9 Form Correctly And Completely

How To Fill Out Mca Documents Mca Motor Club Of America In This Video I Explain How To Correctly Fill Out Your Mca Document Mca First Step Referral Program

How To Fill Out Mca Documents Mca Motor Club Of America In This Video I Explain How To Correctly Fill Out Your Mca Document Mca First Step Referral Program

Pros And Cons Of Being A Disregarded Entity Legalzoom Com

Pros And Cons Of Being A Disregarded Entity Legalzoom Com

The Gadget Nerds Tech Reviews From Tech Geeks Just Like You Loan Mortgage Leaks

The Gadget Nerds Tech Reviews From Tech Geeks Just Like You Loan Mortgage Leaks

Is Owning An Llc Considered Self Employment In 2021 The Blueprint

Is Owning An Llc Considered Self Employment In 2021 The Blueprint

Disregarded Entity Irs Form Instructions W9manager

Disregarded Entity Irs Form Instructions W9manager

Change Your Business Name With The Irs Harvard Business Services

Change Your Business Name With The Irs Harvard Business Services

What Is A Disregarded Entity And How Are They Taxed Ask Gusto

What Is A Disregarded Entity And How Are They Taxed Ask Gusto

Advance Notice Business Name And Address To Be Displayed On The Seller Profile Page Starting September 1 2020 Us Announcements Amazon Seller Forums

Advance Notice Business Name And Address To Be Displayed On The Seller Profile Page Starting September 1 2020 Us Announcements Amazon Seller Forums

Reminder Notice Business Name And Address To Be Displayed On Seller Profile Page Starting September 1 2020 Us Announcements Amazon Seller Forums

Reminder Notice Business Name And Address To Be Displayed On Seller Profile Page Starting September 1 2020 Us Announcements Amazon Seller Forums

What Is A Disregarded Entity And How Does It Affect Your Taxes

What Is A Disregarded Entity And How Does It Affect Your Taxes