How To Register A Company On Sars Efiling

HOW TO FILE YOUR INCOME TAX RETURN ITR12 HELPING YOU MAKE SOUTH AFRICA GREAT. To set up a new eFiling profile for a company you will need to ensure that you have all your valid documents ready to use during the process.

The SARS tax number 4.

How to register a company on sars efiling. The registration number 5. If you do not register for eFiling SARS will send you a. This free service allows taxpayers tax practitioners and businesses to register free of charge and submit returns and declarations make payments and perform a number of other interactions with SARS in a secure online environment.

Click the Login button Enter your username and password Click on the Home button followed by User and then Pending Registration This will tell you what else is needed to process your eFiling. Click on the eFiling logo on wwwsarsgovza. A company can be registered using Form IT77C.

For more information on RLA go to wwwsarsgovza Customs. A Log on to the SARS website. The address and contact number 3.

Your tax registration numbers. On the Individual portfolio select Home to find the SARS Registered Details functionality. Profit Articles of Incorporation Non-Profit Articles of Incorporation.

On the Tax Practitioner and Organisations eFiling profiles the SARS Registered Details functionality is under the Organisations menu tab. Identify Your Type of Business. If you need some more help with the registration fill out this form and get in contact with a SARS consultant.

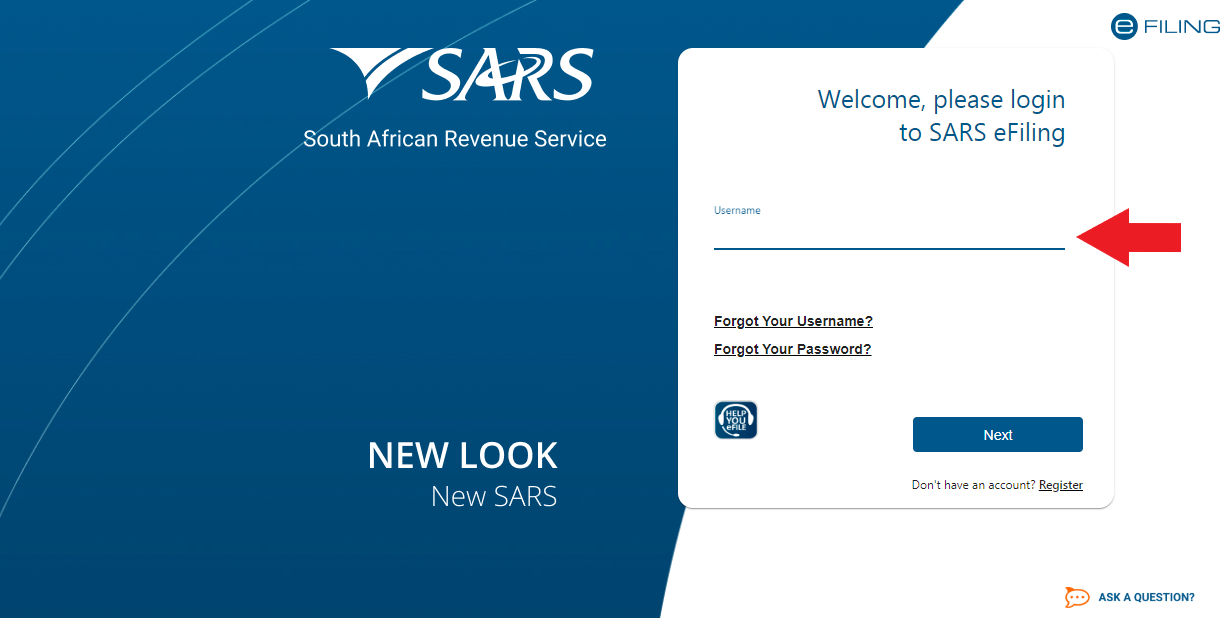

Your ID number. NEW USERS You will need to register as an eFiler before you can file your income tax return electronically. General disclaimerThese tutorial videos are provided to help taxpayers understand their obligations and entitlements under the tax Acts administered by the C.

You will need the following. REGISTRATION FOR eFILING 1. The year end of the company.

Getting Started with a Florida Business. To register as a branch separately from the main branch an EMP102e form Payroll Taxes Application for Branch Registration must be filled in and sent to SARS. Welcome please login to SARS eFiling.

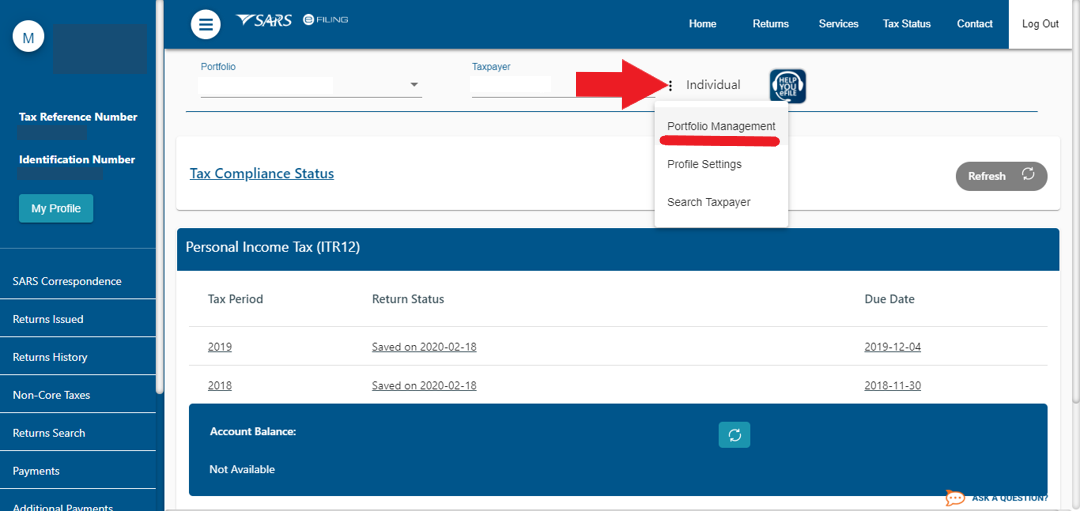

Go to the Organizations main menu 4. Registration for and the use of eFiling is free. On the top right side of the home page is a list of SARS eFiling options.

SARS eFiling is a free online process for the submission of returns and declarations and other related services. The companys banking details 6. If you already have an efiling profile it should be easier to just add the company to your.

Research Starting a Business. Login to SARS eFiling 3. Click SARS Registered details on the side menu 5.

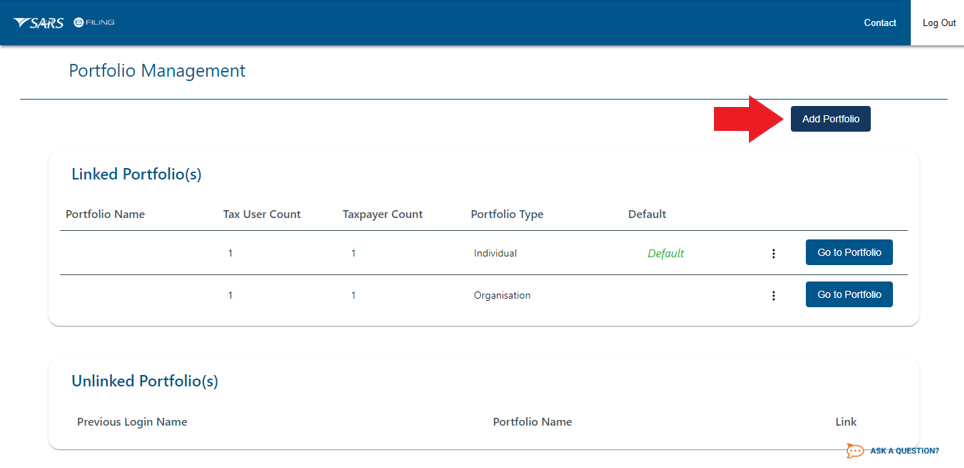

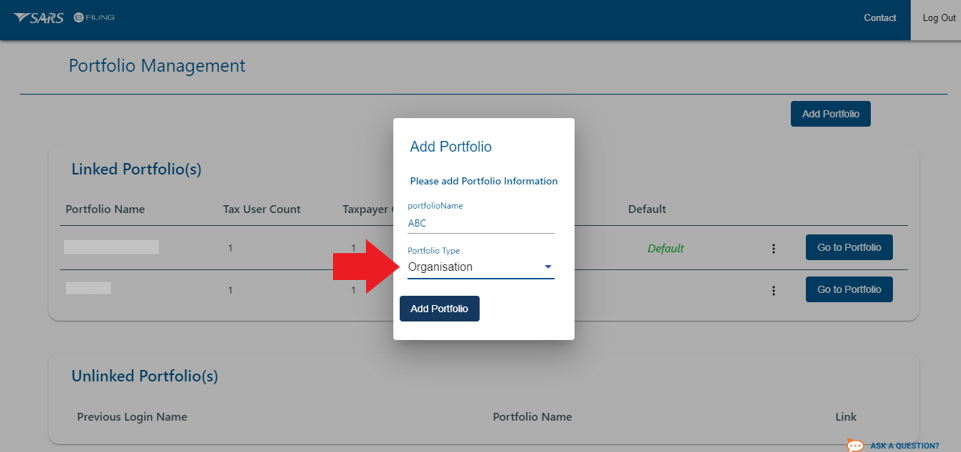

This free service allows taxpayers tax practitioners and businesses to register free of charge and submit returns and declarations make payments and perform a number of other interactions with SARS in a secure. Form a Profit or Non-Profit Corporation. You can then add an organisation to your profile.

South African Revenue Service New Customs Registration applications can now be submitted via eFiling. To register go to wwwsarsefilingcoza Click Register Select. Select The eFiling Register screen will display.

Select Notice of Registration 6. SARS eFiling is a free online process for the submission of returns and declarations and other related services for more information visit the eFiling Services page. Or For Tax Practitioners.

Select Maintain SARS Registered. Change of registered details An employer must let SARS know within 21 business days of any changes in registered particulars eg. B Do the following.

All you need is internet access. Decide on a Corporate Structure. Then a SARS eFiling registration form will open up wherein you will need to input your personal information to authenticate your claim.

EFilers will register as Please select and click on the appropriate option below. Welcome to the new SARS eFiling Landing Page. The efiling profile must be created for an individual.

Once you have been registered for tax and given your tax number you can register for eFiling on wwwsarsefilingcoza and file income tax returns online when tax season starts. You will also provide your identification number as well as your cell phone number before clicking on Register. The following is a quick guide on how to register as a new Customs client type using the RLA system on eFiling.

Follow these easy steps. VAT vendors can also request and obtain a VAT Notice of Registration on eFiling. Name of the company 2.

Change of name address or when no longer operating as an employer etc. To complete the registration process you will need at hand. Start a Business Step 1.

How To Register Your Company For Sars Efiling Taxtim Sa

How To Register Your Company For Sars Efiling Taxtim Sa

How To Register For Vat On Efiling

How To Register For Vat On Efiling

How To Register For Paye On Efiling

How To Register For Paye On Efiling

How To Access My Compliance Profile

How To Access My Compliance Profile

How To Update Your Sars Registered Details On Sars Efiling Youtube

How To Update Your Sars Registered Details On Sars Efiling Youtube

How To Register Your Company For Sars Efiling Taxtim Sa

How To Register Your Company For Sars Efiling Taxtim Sa

Sars Organisation Option How To Add Your Business On Efiling Youtube

Sars Organisation Option How To Add Your Business On Efiling Youtube

How To Register Your Company For Sars Efiling Taxtim Sa

How To Register Your Company For Sars Efiling Taxtim Sa

E Filing Sars Register Page 1 Line 17qq Com

E Filing Sars Register Page 1 Line 17qq Com

Sars Efiling How To Register Youtube

Sars Efiling How To Register Youtube

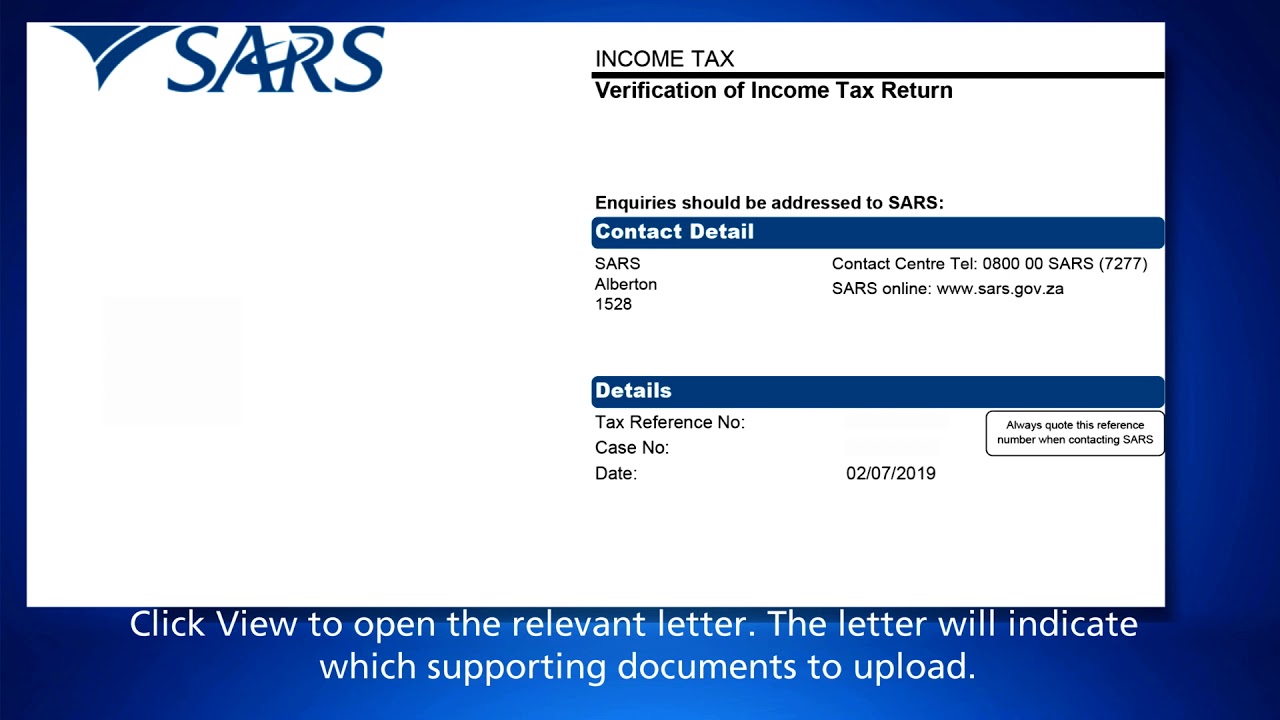

Sars Efiling How To Submit Documents Youtube

Sars Efiling How To Submit Documents Youtube

How To Register Your Company For Sars Efiling Taxtim Sa

How To Register Your Company For Sars Efiling Taxtim Sa

Www Sars Gov Za Clientsegments Tax Practitioner

Www Sars Gov Za Clientsegments Tax Practitioner

How To Register For Sars Efiling Youtube

How To Register For Sars Efiling Youtube

How To Register Your Company For Sars Efiling Taxtim Sa

How To Register Your Company For Sars Efiling Taxtim Sa

Adding Clients To An Efiling Profile

Adding Clients To An Efiling Profile

How To Use Sars Efiling To File Income Tax Returns Taxtim Sa

How To Use Sars Efiling To File Income Tax Returns Taxtim Sa

Sars Efiling How To Submit Your Itr12 Youtube

Sars Efiling How To Submit Your Itr12 Youtube

How To Use Sars Efiling To File Income Tax Returns Taxtim Sa

How To Use Sars Efiling To File Income Tax Returns Taxtim Sa