How To Record Business Expenses Paid By Owners Personal Cash

Feb 13 2019 How to record business expense paid by owner as Shareholder loan. We do not care about the personal bank account only the business bank account.

Expense Tracking Form Expense Accounting Form Good For Rental Expenses Expenses Printable Small Business Expenses Expensive

Expense Tracking Form Expense Accounting Form Good For Rental Expenses Expenses Printable Small Business Expenses Expensive

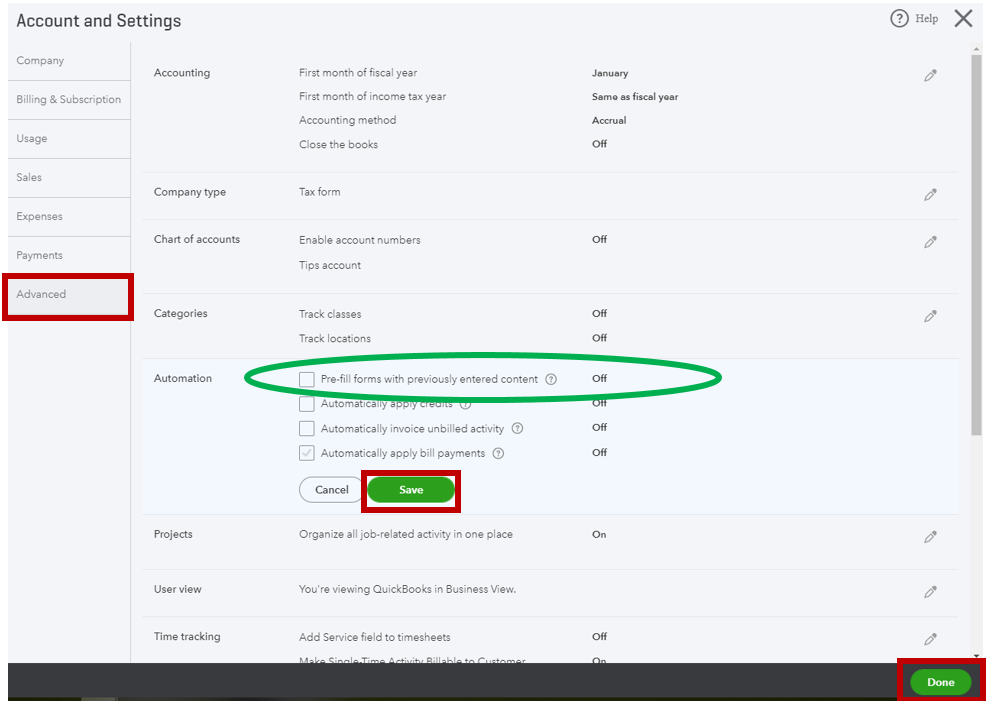

To record a business expense that was paid for by a partner or owners personal funds in QuickBooks Desktop QBDT.

How to record business expenses paid by owners personal cash. While the expenses paid will be debited the account to be credited can vary depending on the legal structure of the business. For this transaction the Accounting equation is shown in the following table. Oct 20 2018 1.

Record the business expense you paid for with personal funds. In most cases where you see a payment or a receipt of cash the bank account will obviously be affected. If for example an owner pays business travel expenses of 150 using a personal credit card then the.

Sep 26 2017 To accurately record how much money the company owes the owner or vice versa every transfer of cash or transaction must be reported. Mar 12 2019 To record a business expense paid for by personal funds you have to first record the expense and then record the partner or owners reimbursement for that expenditure. If the owner cannot reimburse themselves in the short term a journal entry can record the expenditures.

When you are finished the balance will be negative make a deposit for the total amount and in the account block select owner equity or better owner equity investment. Nov 15 2019 The Accounting Equation Assets Liabilities Owners Equity means that the total assets of the business are always equal to the total liabilities plus equity of the business. Mar 02 2021 Step 1.

This is because from paying business expenses from personal cash the owner is increasing the amount of capital in hisher business or else we can say that heshe is introducing additional capital. Line two the shareholder loan account and the same amount as a negative number. May 28 2020 How Much to Take From Your Business.

Jun 09 2009 So in the reverse when you spend your own money on business expenses record the expense and select the bookkeeping account Owners EquityInvestment so you can track the money you put into the company. But in this case it is not the business bank account. Building a Paper Trail With all business expenses paid in cash get a receipt.

Enter the same purchase amount in the Credits column. When you are finished the balance will be negative make a deposit for the total amount and in the account block select. In this case a liability accounts payable increases as the owner has used the.

Dec 10 2016 Firstly you need to set up a GL Account Code called Loan - Business Owner with the type being a credit card. It is paid from his personal bank account. In the journal you will debit the relevant expenses listing them out one after the other with the amounts next to each and code them to the relevant expense accounts in the bookkeeping software and on the last line credit Owners Drawings.

The IRS is also interested in transactions between companies and their owners in order to make sure that the correct amount of. Even if theres no canceled check or credit card statement to back you up the IRS sees a receipt as an effective to. Business owners who take a draw or distribution of profits can take any amount they want from their business.

If the client is paying the expenses immediately users can write a check to reimburse the owner for the business expenditures paid for with personal funds. Because we are purchasing goods and this is for the. How you record it depends if the business reimburses the owner or not.

Next time you are out of cash and you reach for your business cards to pay for that dinner or manicure go for it. Of course you shouldnt take money that will be needed to pay employees pay off business loans or pay other bills of the business. The entry for Business Expenses paid from personal cash would be.

Oct 16 2018 Create a dummy bank account called owners use write checks do not print them they are just a form for entering transactions on that account to enter and pay the billsexpenses. Create a dummy bank account called owners use write checks do not print them they are just a form for entering transactions on that account to enter and pay the billsexpenses. Create a liability account called something like shareholder loan - name use an expense transaction.

So we do not have to record anything for bank. Go to the Company menu. However if the owner of the business has paid business expenses using a personal credit card then they need to be recorded as expenses of the business in the accounting records.

If they prefer to be paid later for cash flow reasons enter the purchase as a bill. Aug 09 2019 Its always better to separate personal and business expenses as it simplifies the bookkeeping. Select Save and close.

Line one the expense account for what you are paying for and the amount. If the owner is reimbursed If the owner wants to be reimbursed immediately simply write them a check. On the second line select Partners equity or Owners equity.

By making the type a credit card it will allow you to post spend moneyor purchase payments for your purchases where you have used. On the first line select the expense account for the purchase. For a sole proprietor - owner equity or better owner.

Business Expenses Ac Dr. Enter the purchase amount in the Debits column. This is true at any time and applies to each transaction.

For the description write to bring in business expenses paid for with owners personal funds.

Free Business Tracking Printable Templates Business Organization Printables Business Printables Small Business Organization

Free Business Tracking Printable Templates Business Organization Printables Business Printables Small Business Organization

Why Keep Personal And Business Expenses Separate The Sensible Business Owner Business Expense Small Business Bookkeeping Tax Time

Why Keep Personal And Business Expenses Separate The Sensible Business Owner Business Expense Small Business Bookkeeping Tax Time

How To Record Business Expenses Paying With Owner Funds Quickbooks On Quickbooks Online Quickbooks Youtube Business

How To Record Business Expenses Paying With Owner Funds Quickbooks On Quickbooks Online Quickbooks Youtube Business

An Expense Report Is Commonly Used For Recording Business Travel Expenses Such As Transportation Food Lodging A Expense Sheet Spreadsheet Template Templates

An Expense Report Is Commonly Used For Recording Business Travel Expenses Such As Transportation Food Lodging A Expense Sheet Spreadsheet Template Templates

Personal Expenses And Drawings Double Entry Bookkeeping

Personal Expenses And Drawings Double Entry Bookkeeping

How To Record Personal Cash Used For Business Expenses In Wave Accounting James Krener Youtube

How To Record Personal Cash Used For Business Expenses In Wave Accounting James Krener Youtube

8 Daily Accounting Tasks For Business Owners Accounting Cloud Accounting Business Management

8 Daily Accounting Tasks For Business Owners Accounting Cloud Accounting Business Management

How To Track Your Income And Expenses Every Week Small Business Finance Business Finance Finance

How To Track Your Income And Expenses Every Week Small Business Finance Business Finance Finance

Pay For Business Expenses With Personal Funds

Pay For Business Expenses With Personal Funds

Excited To Share The Latest Addition To My Etsy Shop Petty Cash Log Printable Pdf Us L Bookkeeping And Accounting Bookkeeping Small Business Accounting

Excited To Share The Latest Addition To My Etsy Shop Petty Cash Log Printable Pdf Us L Bookkeeping And Accounting Bookkeeping Small Business Accounting

What To Bring To Your Tax Appointment Tax Appointment Business Tax Tax Organization

What To Bring To Your Tax Appointment Tax Appointment Business Tax Tax Organization

Browse Our Example Of Commercial Real Estate Budget Template Cash Flow Statement Statement Template Budget Template

Browse Our Example Of Commercial Real Estate Budget Template Cash Flow Statement Statement Template Budget Template

How To Record Business Expenses Paid With Personal Funds In Quickbooks Youtube

How To Record Business Expenses Paid With Personal Funds In Quickbooks Youtube

Inventory Management And Business Expenses Cash Flow Tracker Etsy In 2021 Business Expense Cost Of Goods Sold Small Business Planner

Inventory Management And Business Expenses Cash Flow Tracker Etsy In 2021 Business Expense Cost Of Goods Sold Small Business Planner

Using Personal Credit Card For Business Expenses Double Entry Bookkeeping

Using Personal Credit Card For Business Expenses Double Entry Bookkeeping

Free Printable Income And Expense Worksheet Pdf From Vertex42 Com Budgeting Worksheets Expense Tracker Printable Household Budget Worksheet

Free Printable Income And Expense Worksheet Pdf From Vertex42 Com Budgeting Worksheets Expense Tracker Printable Household Budget Worksheet