How To Work Out Business Mileage Calculator

For example imagine that your employee drove 15 miles to get from your office to a temporary work location. Use HMRC s MAPs working sheet if you need.

Advantages Of Ifta Mileage Calculator In 2021 Mileage Calculator Trucking Business

Advantages Of Ifta Mileage Calculator In 2021 Mileage Calculator Trucking Business

If youre using the mobile app you.

How to work out business mileage calculator. You could claim 8400 for the year using the standard mileage rate method. Your mileage reimbursement would be 12880 224 X 575 cents 12208. Find the shortest routes between multiple stops and get times and distances for your work or a road trip.

Save gas and time on your next trip. Get online driving directions you can trust from Rand McNally. To compute mileage calculations multiply the applicable mileage rate by the number of miles the employee drove.

If youve travelled under 10000 miles in the current tax year you can use this simple calculator to work out how much you can claim back in expenses for your trip. For the 2020 tax year the standard mileage rate is 575 cents per mile. Multiply the number of business miles driven by the reimbursement rate.

If you drove 1000 miles and get reimbursed50 cents per mile your reimbursement would be 500 1000 X50 500. To get a specific figure you need to check which of your work journeys are eligible for tax relief by considering things like if youre going to a temporary workplace and which mileage. Multiply 15000 by the mileage deduction rate of 56 cents 15000 X 056.

10000 x 45 5000 x 25. To determine what your miles are worth multiply the miles driven by the mileage rate set by your employer. According to the current AMAP rates you can claim 45p per mile on the first 10000 business miles and 25p per mile on anything over this limit.

Use the Free Mileage Tax Relief Calculator to find out how much your Tax Mileage rebate is worth and how to Claim Mileage back for the last four tax years. So to calculate your mileage deduction youd multiply your mileage as follows. Have you checked the AMT calculator for knowing if you need to file form 6521.

Simply add your current location - postcode or place - into the A category and details of your destination into the B category. The Business Mileage Calculator gives you an estimated amount of business mileage tax rebate that you could be owed. Mileage calculator Enter your route details and price per mile and total up your distance and expenses.

Use a simpler calculation to work out income tax for. Claim your Business Developer Resources Jobs. The distance in miles and kilometers will display for the straight line or flight mileage along with the distance it would take to get there in a car driving mileage.

To find out your business tax deduction amount multiply your business miles driven by the IRS mileage deduction rate. Something like a mileage-tracking app will help you keep track of your drives. Been on a business trip lately.

Routes are automatically saved. You used up 15000 miles on personal journeys while the remaining 15000 were business miles. Work out the value To calculate the approved amount multiply your employees business travel miles for the year by the rate per mile for their vehicle.

15 miles x 058 reimbursement rate 870 due in reimbursement. Easily enter stops on a map or by uploading a file. The overall driving distance will be displayed in miles and kilometres and the driving time will also be shown.

The mileage calculator is easy to use. You may also be able to claim a tax deduction for mileage in a few other specific circumstances including if youre an armed forces reservist qualified performance artist or traveling for charity work or medical reasons. Its relatively simple to calculate mileage reimbursement.

Calculation Method for mileage deduction In order to compute the deductible business moving medical or charitable expense you simply multiply the standard mileage rates by the number of miles travelled. Simply bash in the to and from postcodes Tripcatcher will then use Google Maps to plot the route and work out the mileage. For example lets say you drove 224 miles last month and your employer reimburses at the Standard Mileage Rate for 2020 of 575 cents per business mile.

Calculate your vehicle expenses using a flat rate for mileage instead of the actual costs of buying and running your vehicle for example. Plan your trips and vacations and use our travel guides for reviews videos and tips. To deduct business mileage using the standard mileage rate multiply the actual business miles driven by the standard mileage rate published by the Internal Revenue Service IRS for the tax year the driving occurred.

You can improve your MPG with our eco-driving advice. Lets say you drove 15000 miles for business in 2021. Enter a start and end point into the tool and click the calculate mileage button.

The mileage tax deduction rules generally allow you to claim 0575 per mile in 2020 if you are self-employed. You need to remove the miles covered for personal purposes. Position your mouse over the map and use your mouse-wheel to zoom in or out.

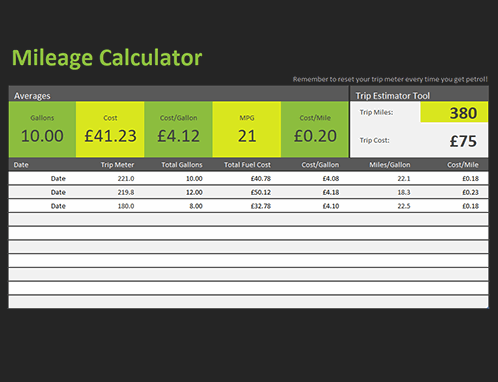

Gas Mileage Calculator Mileage Educational Technology Tools Gas Mileage

Gas Mileage Calculator Mileage Educational Technology Tools Gas Mileage

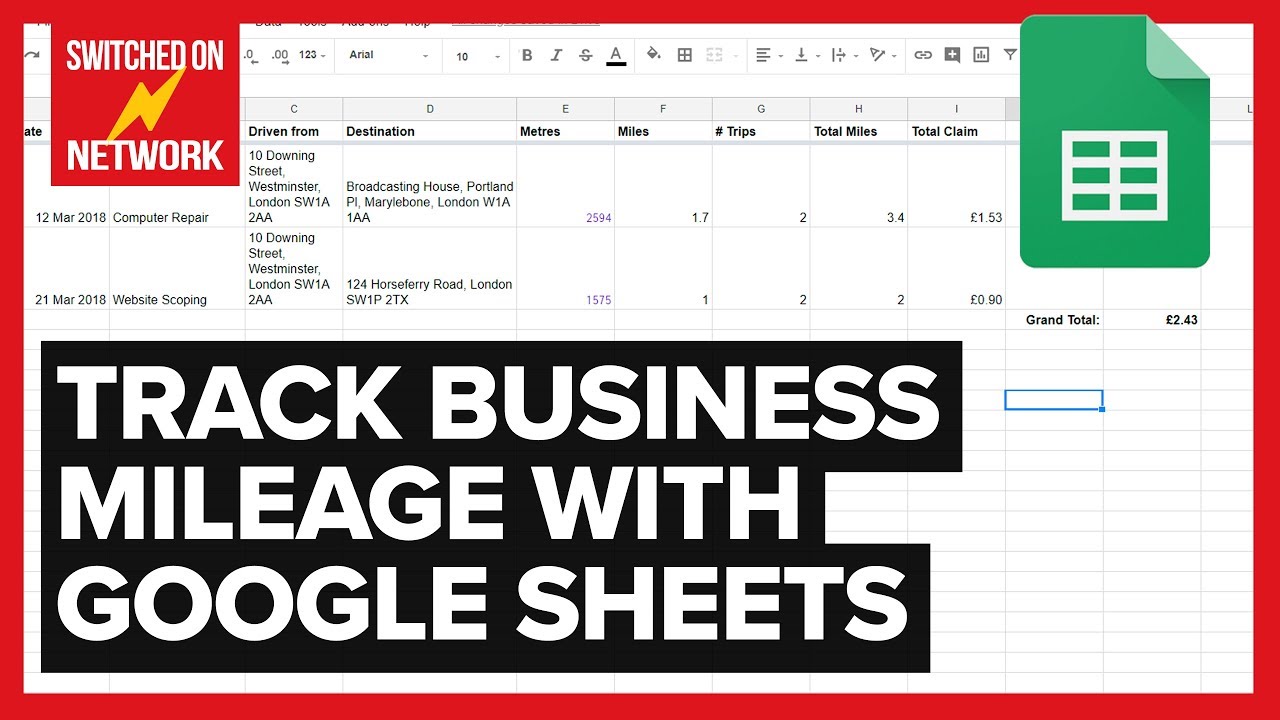

How To Calculate Track Your Business Mileage Automatically With Google Sheets Youtube

How To Calculate Track Your Business Mileage Automatically With Google Sheets Youtube

Daily Mileage Worksheet Printable Worksheets And In Gas Mileage Expense Report Template Great Cretive Templates Professional Templates Gas Mileage Mileage

Daily Mileage Worksheet Printable Worksheets And In Gas Mileage Expense Report Template Great Cretive Templates Professional Templates Gas Mileage Mileage

Gas Mileage Expense Report Template 5 Professional Templates

Gas Mileage Expense Report Template 5 Professional Templates

Printable Mileage Calculator Mileage Chart Spending Log Mileage

Printable Mileage Calculator Mileage Chart Spending Log Mileage

Mileage Log Template For Self Employed Impressive Blank Mileage Form Log Forms Of 38 Luxury M Mileage Log Printable Mileage Monthly Budget Template

Mileage Log Template For Self Employed Impressive Blank Mileage Form Log Forms Of 38 Luxury M Mileage Log Printable Mileage Monthly Budget Template

Personal Vehicle Mileage Log Mileage Log Printable Mileage Tracker Printable Business Mentor

Personal Vehicle Mileage Log Mileage Log Printable Mileage Tracker Printable Business Mentor

Rideshare Deductions Standard Mileage Vs Actual Vehicle Expenses Rideshare Uber Car Mileage

Rideshare Deductions Standard Mileage Vs Actual Vehicle Expenses Rideshare Uber Car Mileage

This Fuel Consumption Calculator Is An Excel Template To Calculate Average Cost And Mileage Per Liter Excel Templates Budget Template Free Spreadsheet Template

This Fuel Consumption Calculator Is An Excel Template To Calculate Average Cost And Mileage Per Liter Excel Templates Budget Template Free Spreadsheet Template

Mileage Log Template Free Mileage Tracker Printable Mileage Log Printable Mileage Tracker

Mileage Log Template Free Mileage Tracker Printable Mileage Log Printable Mileage Tracker

Premium Vehicle Auto Mileage Expense Form Mileage Tracker Mileage Tracker Printable Mileage Tracker App

Premium Vehicle Auto Mileage Expense Form Mileage Tracker Mileage Tracker Printable Mileage Tracker App

Business Mileage Tracking Log Business Mileage Mileage Logging Daycare Business Plan

Business Mileage Tracking Log Business Mileage Mileage Logging Daycare Business Plan

Free 25 Printable Irs Mileage Tracking Templates Gofar Mileage Log For Taxes Template Excel Report Template Professional Templates Business Template

Free 25 Printable Irs Mileage Tracking Templates Gofar Mileage Log For Taxes Template Excel Report Template Professional Templates Business Template

Vehicle Mileage Log Expense Form Free Pdf Download Mileage Log Printable Mileage Tracker Printable Mileage

Vehicle Mileage Log Expense Form Free Pdf Download Mileage Log Printable Mileage Tracker Printable Mileage

Vehicle Mileage Log Form Mileage Tracker Mileage Log Printable Mileage

Vehicle Mileage Log Form Mileage Tracker Mileage Log Printable Mileage

Free Printable Vehicle Expense Calculator Microsoft Excel Templates Printable Free Business Tax Deductions Mileage Log Printable

Free Printable Vehicle Expense Calculator Microsoft Excel Templates Printable Free Business Tax Deductions Mileage Log Printable

Gas Mileage Log And Calculator Mileage Log Printable Gas Mileage Mileage Chart

Gas Mileage Log And Calculator Mileage Log Printable Gas Mileage Mileage Chart