How Do I Lodge My Business Activity Statement

To lodge a new activity statement select Lodge activity statement. Through the ATOs online business portal.

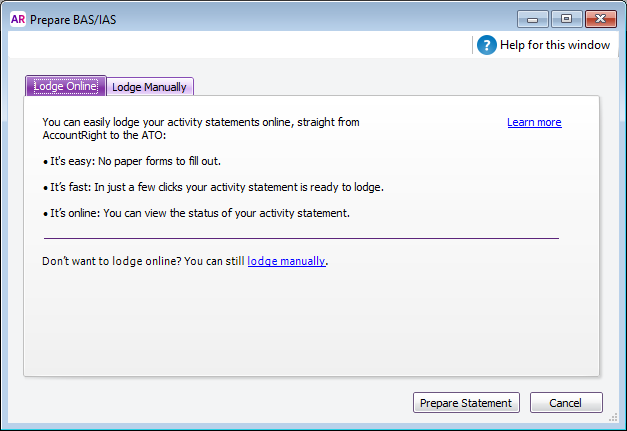

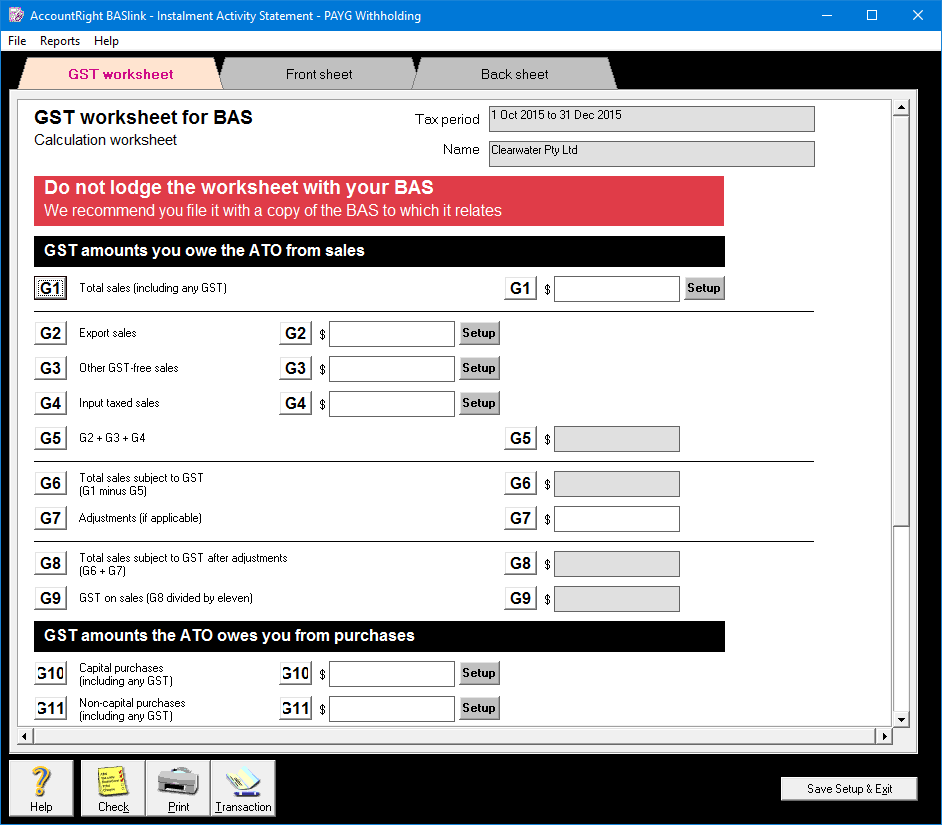

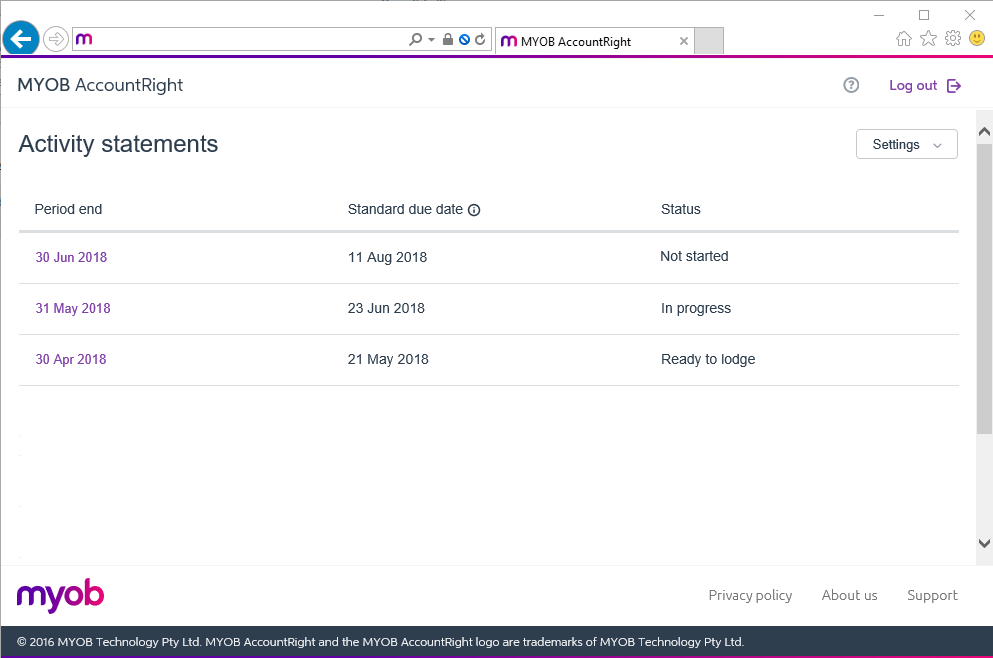

Prepare Your Activity Statement Online Myob Accountright Myob Help Centre

Prepare Your Activity Statement Online Myob Accountright Myob Help Centre

My understanding is that a Business Owner has 6 weeks to lodge and pay if using the Business Portal or lodging electronically.

How do i lodge my business activity statement. Then lodge your activity statement and pay 341 by 28 October the due date for the first quarter. How do I lodge and pay my Business Activity Statement. If you have an accountant or bookkeeper this is a task that they can take care of for you.

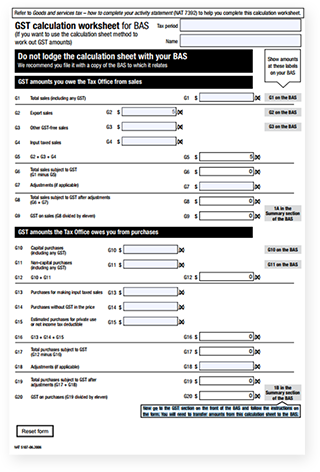

T1 T2 20100 17 34170. To avoid penalties you need to lodge and pay on time. The instalment rate on your activity statement shown at T2 is 17.

To set up your online activity statement. You need the Submit BAS user permission to lodge an Activity Statement. If your file isnt online yet see Put your company file online.

To view or revise an already lodged activity statement select View or revise. Once its past the due date activity statements will display as overdue. You can lodge a nil business activity statement BAS from the Prepare activity statement screen.

Select Tax and then Activity statements from the menu. Online through your myGov account linked to the ATO only if youre a sole trader by phone for nil statements only by mail. Even if you cant pay lodge on time to avoid this extra cost.

Log in to the Business Portal The Business Portal is a free secure website for managing your business tax affairs with us. Lodge BAS statement online through the ATOs Business Portal. Online through the Business Portal or Standard Business Reporting SBR software.

Your BAS will help you report and pay your. A Business Owner has 8 weeks to lodge and pay if the BAS is lodged electronically by a TaxBAS Agent. Enter 341 at both T11 and 5A.

How to lodge a BAS You can lodge your BAS online. Most businesses that lodge their own BAS choose an online option. Via your online accounting software.

How to lodge online. You can lodge your BAS online through MyGov or through a registered tax agent. You can lodge your BAS electronically by mail or for nil lodgments over the phone.

Your company file must be online before you can start this process. You can lodge your BAS. You can pay electronically by mail or in person at Australia Post.

You have several options for lodging your business activity statements BAS and reporting your goods and services tax GST to us. Use it to lodge activity statements request refunds and more. As a Tax Agent who lodges BAS I do a BAS Reconciliation for the FY before lodging the Q4 BAS.

Its an automated service and you. Use it to lodge activity statements request refunds and more. Make sure youve entered your ABNTFN and your ABN Branch in AccountRight.

Goods and services tax GST pay as you go PAYG instalments. You calculate the instalment amount as follows. To complete your current activity statement click on it under Description.

When you click Lodge to ATO the status of the Activity Statement will update to Sent to ATO. You can access your activity statement through our online services for individuals or our Business Portal even if your agent is managing them on your behalf. There are three main ways to lodge your BAS.

Top 3 takeaways A Business Activity Statement BAS summarises the tax that your business has paid. By having a registered tax or BAS agent generally an accountant or bookkeeper submit it for you. Lodge by phone for nil business activity statements only If you have nothing to report you must lodge a nil business activity statement.

You can also engage a. Through a registered tax or BAS agent. A penalty may apply if you dont lodge on time.

Lodge your Activity Statement To send your Activity Statement to the ATO click Lodge to ATO within the form. Business activity statements BAS If you are a business registered for GST you need to lodge a business activity statement BAS. Through your myGov account if youre a sole trader.

You can lodge your nil BAS over the phone by calling 13 72 26. Mail a hard copy of your BAS form to the ATO. Check out the ATO website to.

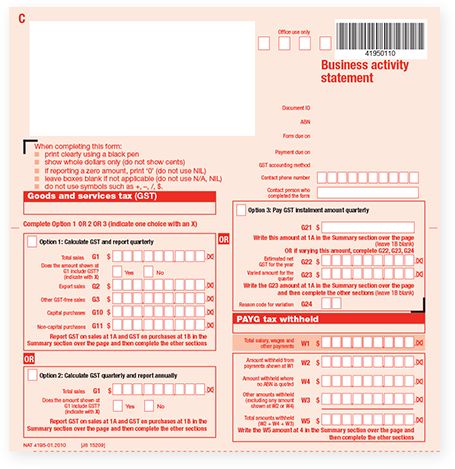

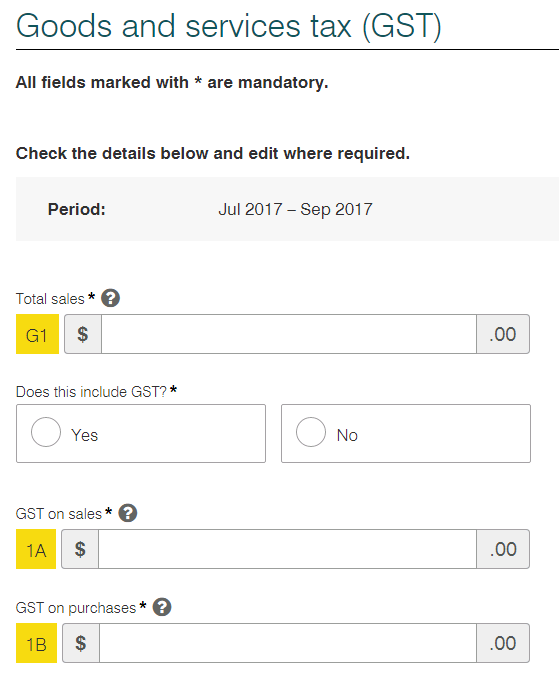

Completing Your Bas Australian Taxation Office

Completing Your Bas Australian Taxation Office

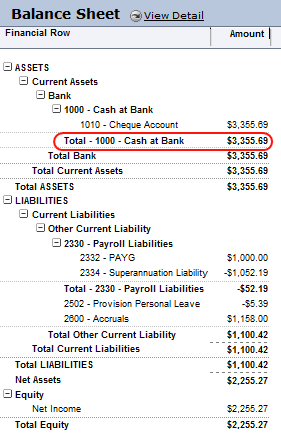

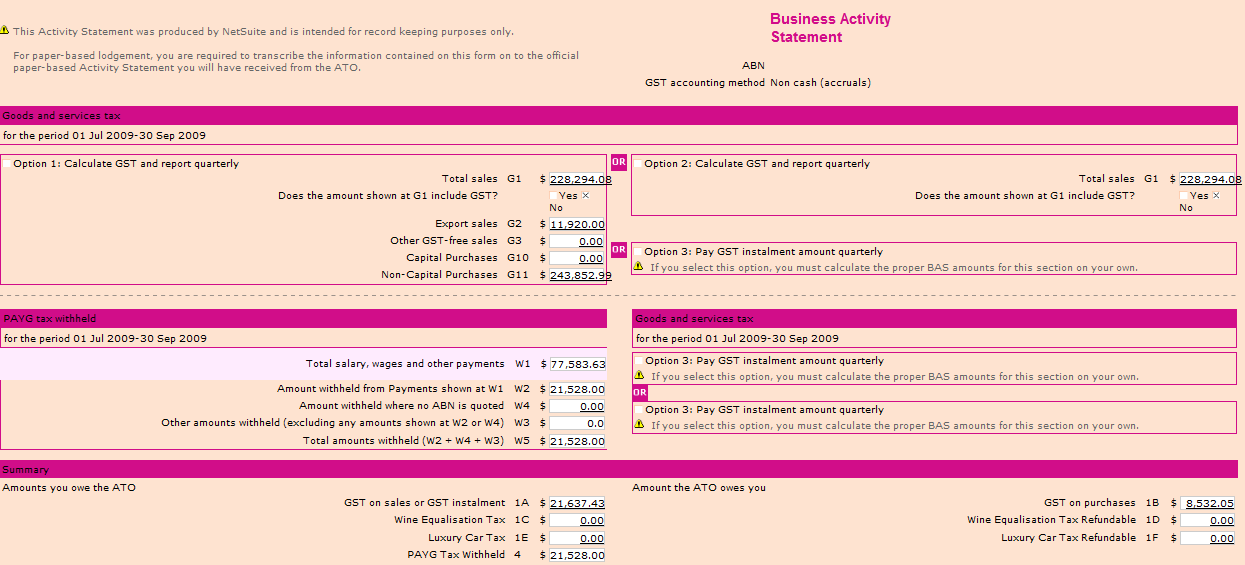

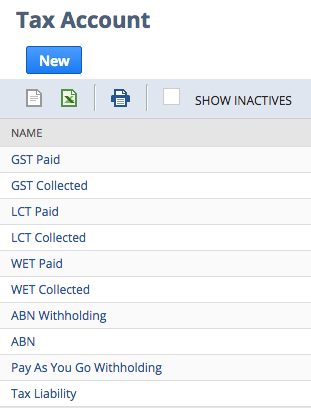

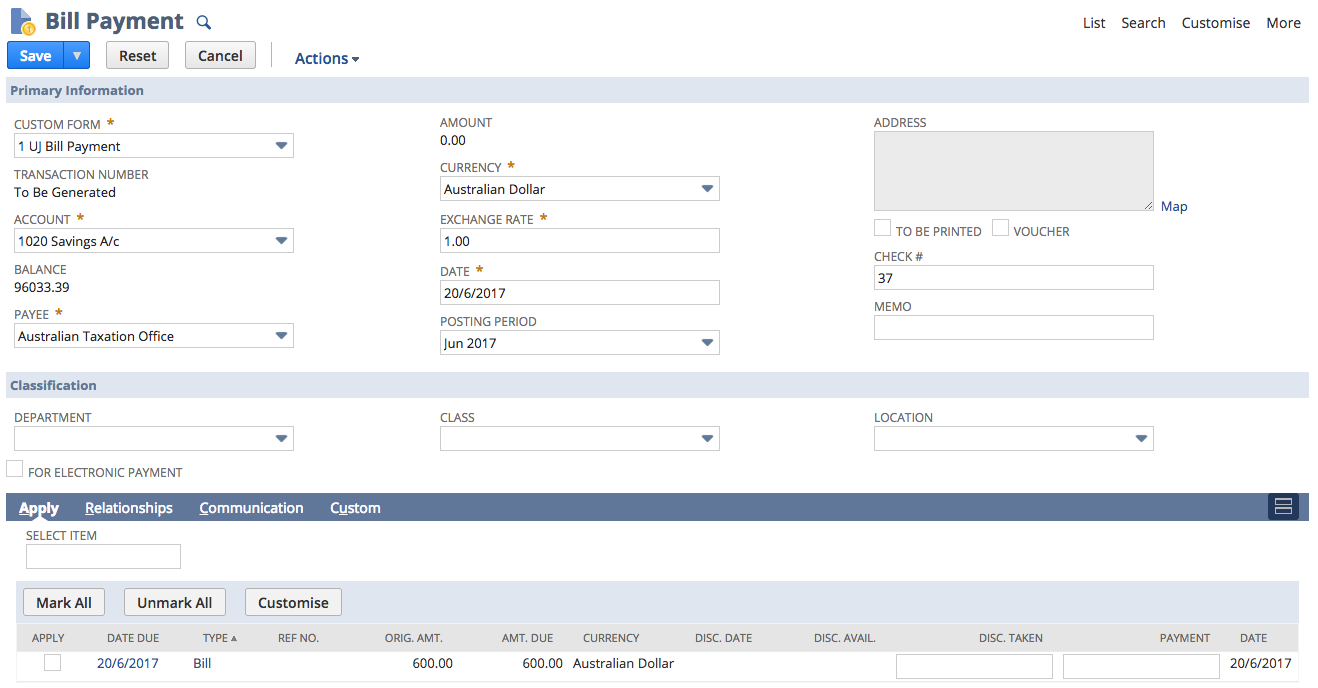

Bas Payment Of Gst Payg Jcurve Solutions

Bas Payment Of Gst Payg Jcurve Solutions

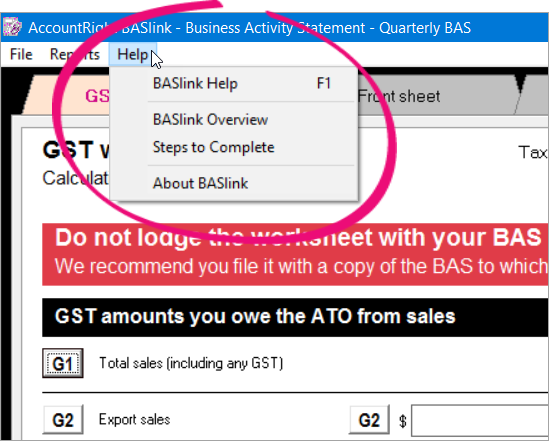

Lodge Your Activity Statement Australia Only Myob Accountright Myob Help Centre

Lodge Your Activity Statement Australia Only Myob Accountright Myob Help Centre

What Is A Bas Statement Small Business Guides Reckon Au

What Is A Bas Statement Small Business Guides Reckon Au

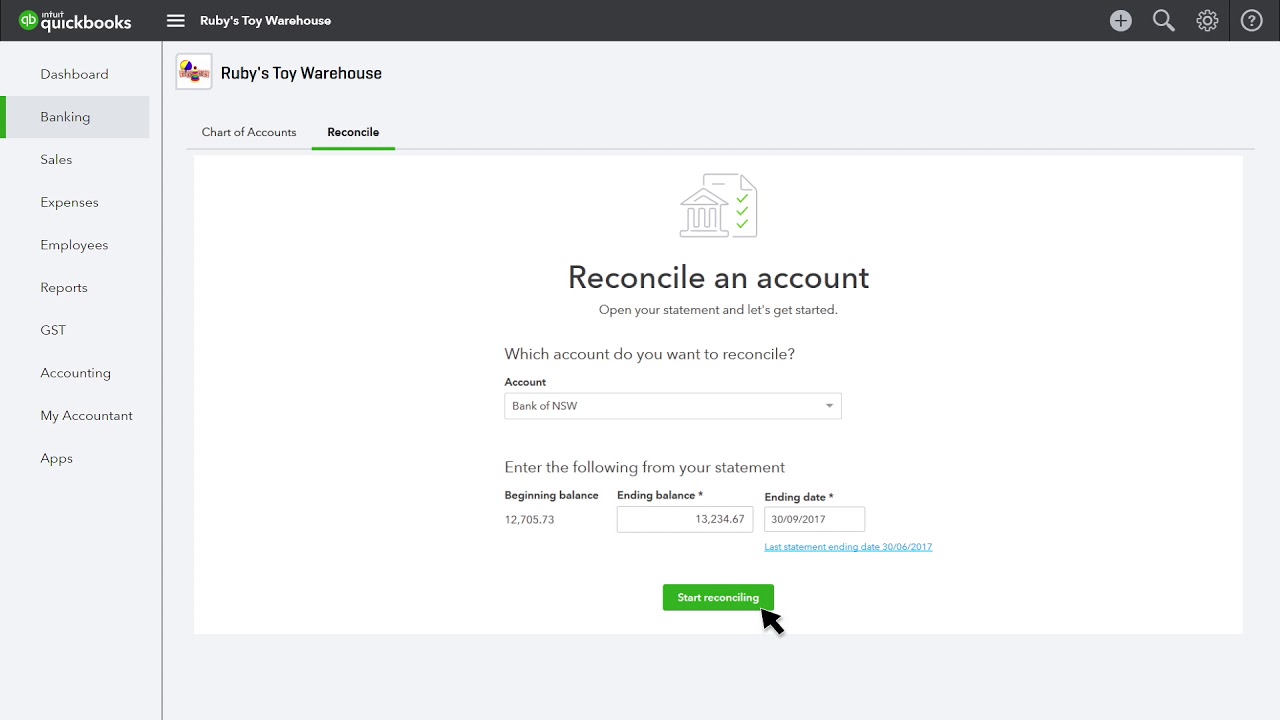

How To Prepare And Lodge Your Bas In Quickbooks Youtube

How To Prepare And Lodge Your Bas In Quickbooks Youtube

Prepare Your Activity Statement Manually Myob Accountright Myob Help Centre

Prepare Your Activity Statement Manually Myob Accountright Myob Help Centre

Example Activity Statement Australian Taxation Office

Example Activity Statement Australian Taxation Office

Bas Payment Of Gst Payg Jcurve Solutions

Bas Payment Of Gst Payg Jcurve Solutions

Lodging An Activity Statement Through The Business Portal Youtube

Lodging An Activity Statement Through The Business Portal Youtube

Bas Payment Of Gst Payg Jcurve Solutions

Bas Payment Of Gst Payg Jcurve Solutions

Completing Your Bas Australian Taxation Office

Completing Your Bas Australian Taxation Office

What Is A Bas Statement Small Business Guides Reckon Au

What Is A Bas Statement Small Business Guides Reckon Au

Bas Payment Of Gst Payg Jcurve Solutions

Bas Payment Of Gst Payg Jcurve Solutions

Bas Statement Exercise Youtube

Bas Statement Exercise Youtube

What Is A Bas Statement Small Business Guides Reckon Au

What Is A Bas Statement Small Business Guides Reckon Au

Prepare Your Activity Statement Online Myob Accountright Myob Help Centre

Prepare Your Activity Statement Online Myob Accountright Myob Help Centre

Example Activity Statement Australian Taxation Office

Example Activity Statement Australian Taxation Office