Form Sole Proprietorship New York

Report wages tips and other compensation and withheld income social security and Medicare taxes for employees. The owner is liable for all business operations.

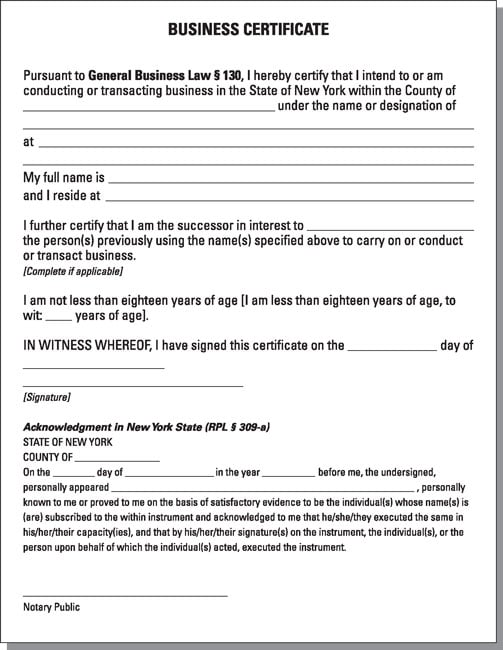

Blumberg Form X201 New York Business Certificate Dba Form

Blumberg Form X201 New York Business Certificate Dba Form

Where Do I File The Form.

Form sole proprietorship new york. This is a sole proprietorship having employees required to be covered under the NYS Workers Compensation Law. Here is an outline of the steps you should follow to get started as a sole proprietor in New York. Occupy have maintain or operate an office shop store warehouse factory agency or other place in New York State where the affairs of the business are systematically and regularly carried on.

An LLC that is treated as a sole proprietorship must report its business income and expenses on the individuals New York State personal income tax returns. The owner does business in their own name or with a trade name A business certificate is needed only if a trade name is used. This is a partnership as defined in Section 10 of the Partnership Law of New York State having employees required to be covered under the NYS Workers Compensation Law.

New York DBA Registration Form Sole Proprietorships and LLCs will get a DBA form from the County Clerks office in every county where the business operates Corporations and Limited Liability Companies httpswwwdosnygovformscorporations1338-f-lpdf How much does an Assumed Name cost in New York. Personal liability is full- a sole proprietor is personally responsible for all debts of his or her business. What Is a New York Sole Proprietor.

Estates and real estate investment companies are also required to file with the county. The filing of New York City Unincorporated Business Tax Return Form NYC-202 is required by individuals and single member LLCs that carry on a trade business profession or occupation wholly or partly within New York City and has a total gross income from all business regardless of where carried on of more than 95000. A sole proprietorship is a business run by an executive owner.

A sole proprietorship is a business owned by. Most counties require Partnerships to file a DBA certificate. Sole Proprietorship and Partnership formations are dictated by the county where the firm plans to practice.

Obtain licenses permits and zoning clearance. There are four simple steps you should take. Its easy to form a sole proprietorship in New York.

The sole proprietorship is a one-person business that is not considered to be a distinct entity from the person who owns it and it is frequently operated using the owners personal name. Use this form to -. As opposed to a corporation or limited liability company LLC the sole proprietorship is not a legal business entity.

However some people will need to obtain other licenses or permits and youll have to jump through more hoops if you intend to hire employees. An LLC or LLP that is treated as a partnership may be required to file a Form IT-204 Partnership Return. Heres what you need to do to get your New York-based business off the ground.

For sole proprietorships and general partnerships Business Certificates can be filed at the appropriate County Clerks Office. Typically you can just start working under your legal name and pay business taxes using your Social Security Number. W-2 Wage and Tax Statement and W-3 Transmittal of Wage and Tax Statements.

Firm owners are required to know the laws that apply in their respective counties. The Business Certificate form is X-74 for a partnership and X-201 for a sole proprietorship and they can be purchased at any commercial or. Sole proprietors and partnerships are required to file their NYS DBA with the County Clerk where their business is located.

Select a business name. File a fictitious name certificate with the county clerks office. Forms for Sole Proprietorship.

As a nonresident sole proprietor or partnership you carry on a business trade profession or occupation within New York State if you or your business. You should also read the general section for information applicable in any state. Like any new business venture a sole proprietorship in New York must follow certain steps outlined by the state.

Choose a business name. Selecting a name for the business is the first step in starting a sole proprietorship. Using some form of your own name is an option that does not require government.

An Assumed Name Certificate must be filed with the clerk of the countyies in which the business is conducted ONLY IF you are operating under a name other than the proprietors no formation document is required. This is not a limited partnership. Choose a business name for your sole proprietorship and check for availability.

A sole proprietorship only has one owner. The New York County Clerk accepts for filing pursuant to Section 130 of the General Business Law certificates of sole proprietorships partnerships and assumed names for businesses including DBA for businesses the address of which is in New York County. County Clerks Offices Bronx 851 Grand Concourse Room 118 Bronx NY 10451 Queens 88-11 Sutphin Blvd Room 106 Queens NY 11435 Brooklyn Supreme Court Building.

Sole Proprietorships and General Partnerships Sole proprietorships and general partnerships are the simplest business structures in New York and they have similar requirements for registering a business name. Not all counties require or allow a Sole Proprietorship to file a DBA certificate. In New York you can establish a sole proprietorship without filing any legal documents with the New York State Government.

Dba New York How To File A Dba In New York State

Dba New York How To File A Dba In New York State

How To Start A Sole Proprietorship In New York Legalzoom Com

How To Start A Sole Proprietorship In New York Legalzoom Com

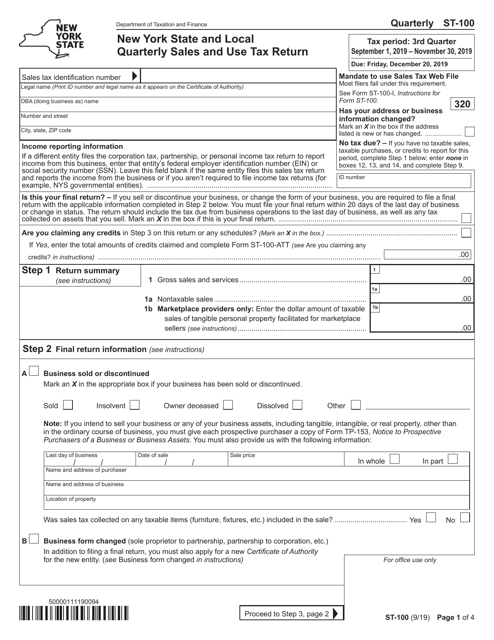

Form St 100 Download Printable Pdf Or Fill Online New York State And Local Quarterly Sales And Use Tax Return New York Templateroller

Form St 100 Download Printable Pdf Or Fill Online New York State And Local Quarterly Sales And Use Tax Return New York Templateroller

Sole Proprietorship And Your Import Export Business Dummies

Sole Proprietorship And Your Import Export Business Dummies

Blumberg Form X201 New York Business Certificate Dba Form

Blumberg Form X201 New York Business Certificate Dba Form

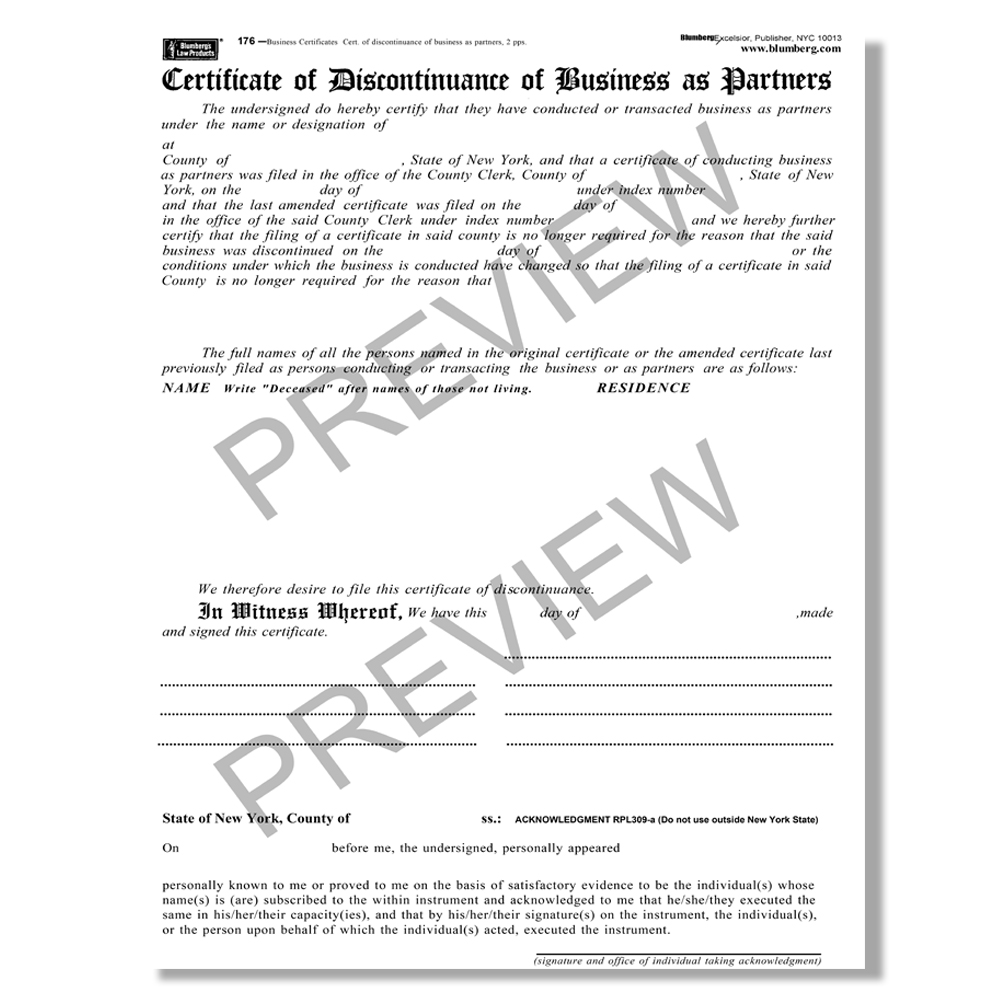

Certificate Of Discontinuance Of Business Fill Online Printable Fillable Blank Pdffiller

Certificate Of Discontinuance Of Business Fill Online Printable Fillable Blank Pdffiller

Blumberg Form X201 New York Business Certificate Dba Form

Blumberg Form X201 New York Business Certificate Dba Form

Stumped How To Form A New York Llc The Easy Way

Nys Division Of Corporations State Records And Ucc

Dba Rochester Ny Fill Online Printable Fillable Blank Pdffiller

Dba Rochester Ny Fill Online Printable Fillable Blank Pdffiller

Amazon Com New York Business Certificate Dba Form X201 8 5 X 11 Office Products

Amazon Com New York Business Certificate Dba Form X201 8 5 X 11 Office Products

3 Reasons Sole Proprietors Should Avoid Dbas

3 Reasons Sole Proprietors Should Avoid Dbas

How To Set Up A Small Business In New York Sole Proprietorship L H Frishkoff Company

How To Set Up A Small Business In New York Sole Proprietorship L H Frishkoff Company

Blumberg Form X201 New York Business Certificate Dba Form

Blumberg Form X201 New York Business Certificate Dba Form

Form Nys 100 New York State Employer Registration For Unemployment Insurance Withholding And Wage Reporting

How To Fill Out Certificate Of Assumed Name New York Fill Online Printable Fillable Blank Pdffiller

How To Fill Out Certificate Of Assumed Name New York Fill Online Printable Fillable Blank Pdffiller

Blumberg Form X201 New York Business Certificate Dba Form

Blumberg Form X201 New York Business Certificate Dba Form

Blumberg Form X201 New York Business Certificate Dba Form

Blumberg Form X201 New York Business Certificate Dba Form

Https Www Citybarjusticecenter Org Wp Content Uploads 2016 09 Cbjc Nelp Sole Proprietorship Fact Sheet Pdf