Does A Law Firm Get A 1099 Nec

Step 2 If a 1099-NEC is required see notes above then you as the business would prepare it. This also includes payments to a law firm or fish purchases.

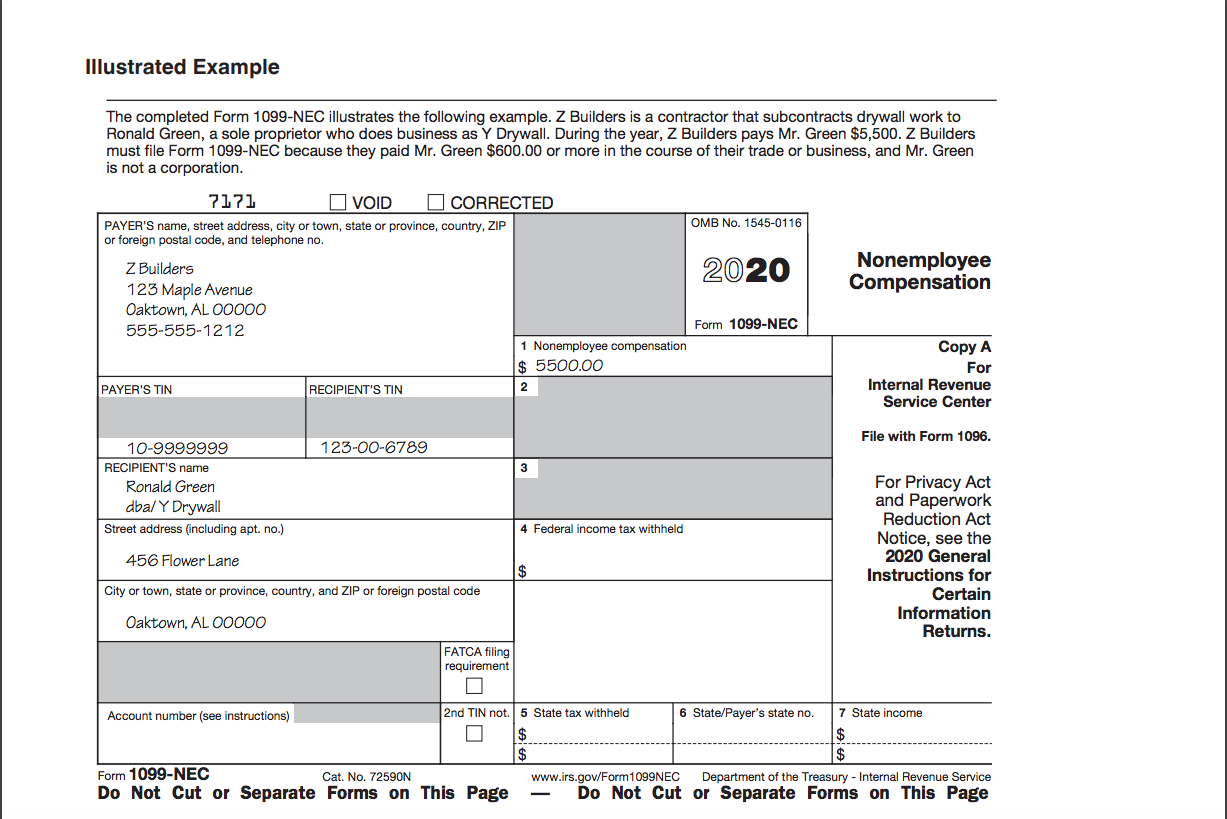

All Form 1099-NEC Revisions.

Does a law firm get a 1099 nec. In short - if a client paid more than 600 within the calendar year to a non-employee they must use Form 1099-NEC to report. Professional service fees to attorneys including law firms established as corporations accountants architects etc. The size of the law firm also doesnt matter.

A lawyer or law firm paying fees to co-counsel or a referral fee to a lawyer must issue a Form 1099 regardless of how the lawyer or law firm. The 1099-NEC will be the exclusive form business taxpayers will use to report payments to independent contractors starting from the tax year 2020. This means that Form 1099-NEC will replace box 7 on Form 1099-MISC which is where clients used to report non-employee compensation.

Use Form 1099-NEC to report nonemployee compensation. Fees paid by one professional to another fee-splitting for example. The primary change is that instead of reporting nonemployee compensation on Form 1099-MISC such payments should now be reported on Form 1099-NEC.

Rather than having different Form 1099-MISC due dates depending on whether NEC is reported the IRS created a new Form 1099-NEC beginning with tax year 2020. Settlement agreements or other legal payments that are not for the attorneys service use 1099-MISC instead. Under IRS guidance the term attorney includes a law firm or any other legal services provider on behalf of your business or trade.

However any payment made to a law firm in connection with legal services but not directly related to the attorneys services should be reported in box 10 on form 1099-MISC as net proceeds This is applicable for legal services like a settlement agreement. Some businesses will need to file both 1099-NEC and 1099-MISC forms. The term attorney includes a law firm or other provider of legal services.

So who gets a 1099-NEC. NEC stands for Nonemployee Compensation and Form 1099-NEC is taking the place of what used to be recorded in Box 7 of Form 1099-MISC. Step 1 Collect a W9 from all contractors you pay even if under 600 as it might get above that with future payments.

It might have one lawyer or thousands. Some examples of payments you must report on Form 1099-NEC include. It doesnt matter if the law firm is a corporation limited liability company limited liability partnership or general partnership.

None at this time. Way back in 2015 the Protecting Americans from Tax Hikes PATH Act of 2015 accelerated the due date for filing any Form 1099 that includes nonemployee compensation NEC from February 28 to January 31 and eliminated the automatic 30-day extension for forms that include NEC. Typically this form is issued to independent contractors janitorial services third-party accounts and any other worker paid for services who is not on the payroll.

Thus any payment for services of 600 or more to a lawyer or law firm must be the subject of a Form 1099. The 1099-MISC form can also report other payments like royalties excess golden parachute payments gross proceeds paid to an attorney and when direct sales of 5000 or more of consumer products are sold to a buyer for resale anywhere other than a permanent retail establishment. Payments made to a legal service provider should be reported on form 1099-NEC.

All information needed to prepare a 1099 would be found on the W9. Other Items You May Find Useful. As a general rule a business doesnt need to issue a 1099 to a corporation or an LLC organized as a corporation.

And as of tax year 2020 do not use Form 1099-MISC to report independent contractor payments thats where Form 1099-NEC. If your business paid an attorney or a law firm 600 or more for services related to your business then you will need to complete and file a Form 1099-NEC. Attorneys fees of 600 or more paid in the course of your trade or business are reportable in box 7 of Form 1099-MISC under section 6041A a 1.

Instructions for Form 1099-MISC and Form 1099-NEC Print Version PDF Recent Developments. Do not use Form 1099-MISC for W-2 employees. Do not use 1099-NEC to report gross proceeds to any attorney for example.

According to the IRS organizations must file form 1099-NEC for each person who is not classified as an employee to whom they have paid at least 600 for services performed. It is important to understand the differences. Payments to an attorney for legal services NOT fees Section 409A deferrals.

According to the IRS 1099 instructions attorney fees for legal services must be reported on a Form 1099 regardless of whether the law firm or legal service is incorporated or not. There are a few exceptions to that rule however. Do use 1099-NEC to report attorney fees for services.

Thus any payment for services of 600 or more to a lawyer or law firm must be the subject of a Form 1099 and it does not matter if the law firm is a corporation LLC LLP or general partnership nor does it matter how large or small the law firm may be. Gross proceeds paid to attorneys. Here is the typical process.

Irs Introduces New Ish Form To Replace Parts Of Form 1099 Misc Taxgirl

Irs Introduces New Ish Form To Replace Parts Of Form 1099 Misc Taxgirl

What Is Form 1099 Nec For Nonemployee Compensation Blue Summit Supplies

What Is Form 1099 Nec For Nonemployee Compensation Blue Summit Supplies

Introducing The New 1099 Nec For Reporting Nonemployee Compensation Asap Accounting Payroll

Introducing The New 1099 Nec For Reporting Nonemployee Compensation Asap Accounting Payroll

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

Irs Form 1099 Misc Irs Form 1099 Nec Lancaster Cpa Firm

Irs Form 1099 Misc Irs Form 1099 Nec Lancaster Cpa Firm

Form 1099 Nec Requirements Deadlines And Penalties Efile360

Form 1099 Nec Requirements Deadlines And Penalties Efile360

Form 1099 Nec Instructions And Tax Reporting Guide

Form 1099 Nec Instructions And Tax Reporting Guide

Filing Form 1099 Nec Beginning In Tax Year 2020 Leone Mcdonnell Roberts Professional Association Certified Public Accountants

Filing Form 1099 Nec Beginning In Tax Year 2020 Leone Mcdonnell Roberts Professional Association Certified Public Accountants

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

1099 Misc And 1099 Nec Deadline Feb 1 2021 Tax Practice Advisor

1099 Misc And 1099 Nec Deadline Feb 1 2021 Tax Practice Advisor

Irs 1099 Misc Vs 1099 Nec Inform Decisions

Irs 1099 Misc Vs 1099 Nec Inform Decisions

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

New Irs Form 1099 Nec Used To Report Payments To Nonemployee Service Providers

New Irs Form 1099 Nec Used To Report Payments To Nonemployee Service Providers

What Is Form 1099 Nec How Do I File Form 1099 Nec Gusto

What Is Form 1099 Nec How Do I File Form 1099 Nec Gusto

Ready For The 1099 Nec White Nelson Diehl Evans Cpas

Ready For The 1099 Nec White Nelson Diehl Evans Cpas

How To Use The New 1099 Nec Form For 2020 Dynamic Tech Services

How To Use The New 1099 Nec Form For 2020 Dynamic Tech Services

Do I Need To File 1099s Deb Evans Tax Company

Do I Need To File 1099s Deb Evans Tax Company

Questions And Answers About Form 1099 Nec

Questions And Answers About Form 1099 Nec