Can A Partner In An Llc Receive A 1099

Conversely failing to issue a 1099 can lead to severe Internal Revenue Service IRS penalties and fines--including the possible. Instead such payments should be treated as guaranteed payments and reported on the appropriate line of that partners K-1.

How To Read Your 1099 Robinhood

How To Read Your 1099 Robinhood

A domestic LLC with at least two members is classified as a partnership for federal income tax purposes unless it files Form 8832 and elects to be.

Can a partner in an llc receive a 1099. Required information includes the following. A partnership does not pay income taxes the partners receive a form K-1 which is created as part of the form 1065. Because the IRS does not permit a partner to be both a partner and an employee continuing to treat an employee who has received an unvested profits interest as an employee for employment tax purposes by issuing the partner a Form W-2 Wage and Income Statement etc presumably runs afoul of the above requirement.

Set up and file 1099 forms. An alternative to collateralizing the loan is creating a right of setoff where the LLC can keep any cash distributions or capital allocable to the borrower if there is a default on the loan. For the owner of a limited liability corporation or LLC deciphering who is to receive a 1099 form can be confusing.

Its conceivable I suppose that a pship could issue a 1099-R form to a retired partner. If an LLC has more than one member the Internal Revenue Service IRS taxes the company as a partnership. I am attempting to serve it to you less boring and more concise manner.

Partners in a limited liability company LLC also known as members arent considered employees. So LLCs can and will receive 1099s when they are either a single-member LLC or taxed as a partnership. Guaranteed Payments If however a partner provides services other than in his official capacity as partner he can be compensated for those services in.

If youre referring to recording the income and payments as owners draw heres an. Heres an article for more details. That K-1 provides each partner with the amounts of income and expenses for the business allocated to the partner and he uses that information to fill out his personal income tax return.

Depending on elections made by the LLC and the number of members the IRS will treat an LLC either as a corporation partnership or as part of the owners tax return a disregarded entity. One of the benefits of an LLC is that the business entity does not pay taxes. If the LLC is taxed as a normal LLC its members cannot be employees or receive salaries.

The partners can not file their personal returns until after the business has completed its partnership returned and issued W-2s and any other income reporting documents as appropriate. The Rules for Paying LLC Owners. The get a 1065 K-1 with Guaranteed payments in box 4.

Thus any partner who is treated as an employee at any time after receipt of an unvested. When you are one of the owners of an LLC you are called a member. Your Income as a Partner in an LLC.

Issuing a 1099 to a supplier employee or other stakeholder who should not receive one can cause frustration and trigger tax problems for the recipient. LLCs Taxed as Partnerships. Proprietors social security number which may act as a tax identification number.

The partners receive their shares of the companys annual income or profits throughout the year often called. Form 1099 goes out to independent contractors if you pay them 600 or more to do work for your company during the tax year. Additionally under no circumstances will a partnership that is filing a 1065 partnership return issue any partner or owner a 1099-MISC or W-2.

Additionally those whom you pay at least 10 in royalties or broker payments in lieu of dividends or tax-exempt interest should also receive a 1099. Given this a partner generally cannot receive a salary. A Limited Liability Company LLC is an entity created by state statute.

Yes you can send a 1099 to a single member dpic44. A pship should not issue a 1099-MISC to a partner for services. In this standard default scenario the members of a multi-member LLC cant be paid on a salaried basis.

Sole Proprietorships and Partnerships. An LLC will not receive a 1099 if taxed as an s-corporation. If an LLC operates as a sole proprietorship it has to file a 1099 with specific information required by the IRS.

A partner or member of an LLC taxed as a partnership must pay self-employment tax on the income derived from business. The LLC records should reflect whether collateral spousal guarantee and similar issues were addressed before the loan was made. 1099s are given to independent contractors or single vendors that youve paid 600 or more in a year.

An LLC should generally account for services rendered by a member as guaranteed payments A guaranteed payment is a specific term in the Internal Revenue Code defined as payments to a partner in his or her partner capacity for services or in some cases use of capital that is calculated and without regard to the income of the partnership. That means that while you will still get the limited liability protection of being a member of an LLC you and your partners also bear the full brunt of the taxes payable on your LLCs income. An LLC member can not be a 1099 contractor or W-2 employee of the business either.

Since the payments were under this persons name then you can issue and file a 1099.

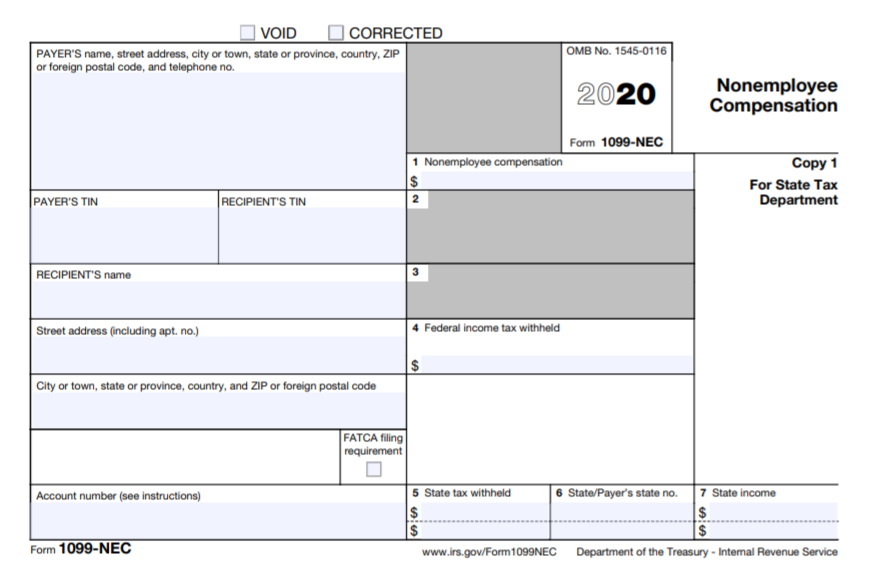

How To Fill Out A 1099 Nec Box By Box Guide On Filling Out The Form

How To Fill Out A 1099 Nec Box By Box Guide On Filling Out The Form

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

Does An S Corp Get A 1099 Misc Or 1099 Nec Infographic

Does An S Corp Get A 1099 Misc Or 1099 Nec Infographic

Irs Form 1099 R Box 7 Distribution Codes Ascensus

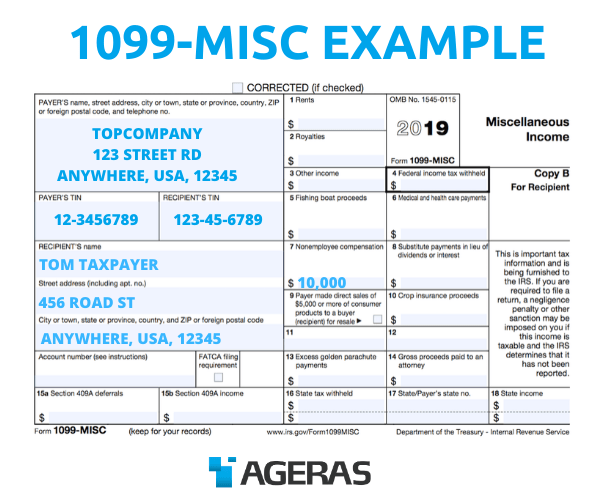

Irs Tax Form 1099 How It Works And Who Gets One Ageras

Irs Tax Form 1099 How It Works And Who Gets One Ageras

Here Is The Difference Between The Form 1099 Nec And Form 1099 Misc Forbes Advisor

Here Is The Difference Between The Form 1099 Nec And Form 1099 Misc Forbes Advisor

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Do Llcs Get A 1099 During Tax Time Incfile

Do Llcs Get A 1099 During Tax Time Incfile

Irs Tax Form 1099 How It Works And Who Gets One Ageras

Irs Tax Form 1099 How It Works And Who Gets One Ageras

I Received A Form 1099 Misc What Should I Do Godaddy Blog

I Received A Form 1099 Misc What Should I Do Godaddy Blog

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Airbnb 1099 Forms Everything You Need To Know Shared Economy Tax

Airbnb 1099 Forms Everything You Need To Know Shared Economy Tax

Upcoming 1099 Changes Escape Technology

Income Report By Using The Irs 1099 Misc Form 1099 Tax Form Irs Forms Irs

Income Report By Using The Irs 1099 Misc Form 1099 Tax Form Irs Forms Irs

Choosing 1099 Box Types 1099 Nec And 1099 Misc

Choosing 1099 Box Types 1099 Nec And 1099 Misc