Business Travel Tax Deduction 2019

Operation and maintenance of an automobile like. You can deduct most aspects of your travel--transportation lodging car rental and even the costs associated with visiting attractions.

Tax Write Offs For Freelancers Freshbooks Blog

Tax Write Offs For Freelancers Freshbooks Blog

The IRS allows business travelers to deduct business-related meals and hotel costs as long as they are reasonable considering the circumstancesnot lavish or extravagant.

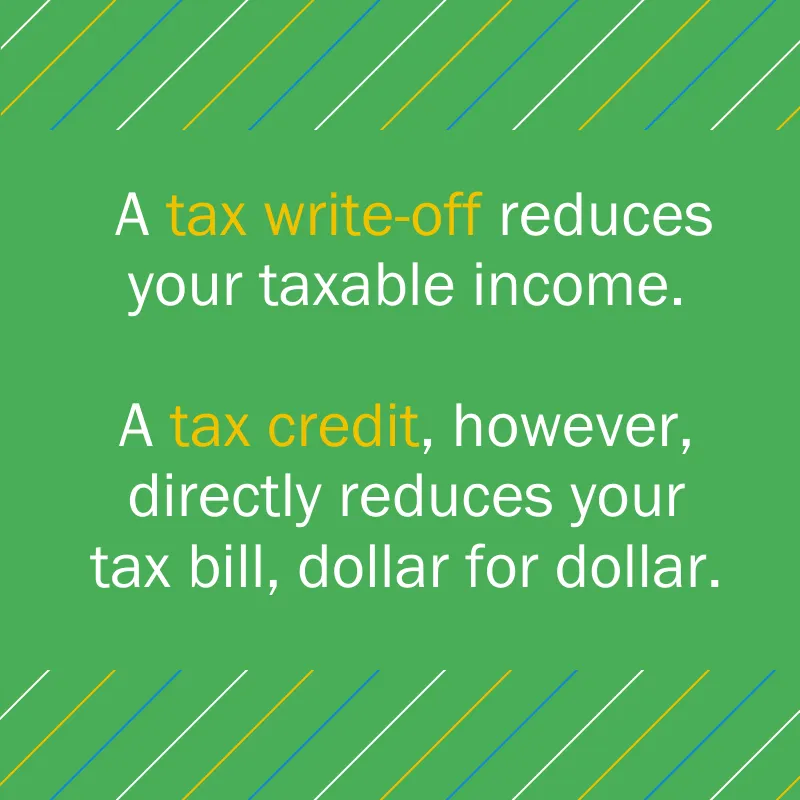

Business travel tax deduction 2019. 511 Business Travel Expenses. Standard mileage is where you keep track of the business miles you drove during the tax year and then you claim the standard mileage rate for the 2019 tax year its 058 per mile driven. While it can painful to wonder how you spent so much money youll want to write off as much of it that you can.

For every mile you drive for business you can currently deduct 545 cents. Airline train or bus fares This includes first-class. Compulsory for sole traders and partners in a partnership to.

What follows is a look at the basics you need to know for deducting business travel costs. Please also consult with your tax advisor or CPA before claiming a deduction on your tax return as not all deductions will apply to your small business. If it was 50 for business during the tax year youd multiply your total car costs by 50 and thatd be the amount you deduct.

It pays to learn the nuances of mileage deductions buying versus leasing and depreciation of vehicles. Actual expenses or standard mileage rate. If you use vehicles in your small business how and when you deduct for the business use of those vehicles can have significant tax implications.

IRS Issues Per Diem Rates 2019 for deductible business travel expenses Special transportation industry rate the rate for the incidental expenses only deduction and the list of high-cost localities and rates for that for purposes of the high-low substantiation method. You would have to eat if you were home so this might explain why the IRS limits meal deductions to 50 of either the. Claiming a tax deduction for business travel expenses As a business owner the general rule is that you can claim deductions for expenses if you or your employee are travelling for business purposes.

The primary purpose of the trip must be related to your profession as a travel agent. Travel to and from your destination by plane train bus or car Using your car while at a business location Parking and toll fees The cost of taxis and other methods of transportation used. If for example your trip was ten days long with four of them business days and six devoted to non-business pursuits youd divide four by ten ie 410 which gets you 040 - this means 40 of your days were business days You could accordingly deduct 40 of the cost of your round-trip travel expenses.

Special rules for business vehicles can deliver healthy tax. You can deduct the cost of travel by plane train bus or car between your home and your business destination. For travel by ship see the section on cruise ships below.

Actual cost of the meal. Youre traveling away from home if your duties require you to be away from the general area of your tax home for a period. If you travel away from home overnight on business you can deduct these travel expenses.

Travel expenses are the ordinary and necessary expenses of traveling away from home for your business profession or job. Lets talk about self-employed tax deductions that you can write off for 2019. You cant deduct the cost of a free ticket.

You can deduct costs to travel by train bus or airplane between your tax home and your business destination. Travel A significant benefit of being a travel agent rests in the reality that you can deduct travel as a business expense. You cant deduct expenses that are lavish or extravagant or that are for personal purposes.

This offsets what you spend on gas and upkeep on the car it counts whether its your own car or a rental. Taxi rides count too so make sure to get a receipt. The Tax Cuts and Jobs Act TCJA made some major changes to tax requirements for businesses and the self-employed including what are considered deductible business travel expenses.

Deductible IRS approved business travel expenses include. A travel diary is.

Tax Write Offs For Freelancers Freshbooks Blog

Tax Write Offs For Freelancers Freshbooks Blog

Instructions For Form 2106 2020 Internal Revenue Service

Instructions For Form 2106 2020 Internal Revenue Service

Self Employed Travel Deductions What Can You Claim The Official Blog Of Taxslayer

Self Employed Travel Deductions What Can You Claim The Official Blog Of Taxslayer

Tax Deductions And Write Offs For Sole Proprietors Fifth Third Bank

Tax Deductions And Write Offs For Sole Proprietors Fifth Third Bank

Tax Write Offs For Freelancers Freshbooks Blog

Tax Write Offs For Freelancers Freshbooks Blog

Rental Property Tax Deductions The Ultimate Tax Guide 2021 Edition Stessa

Rental Property Tax Deductions The Ultimate Tax Guide 2021 Edition Stessa

Small Business Tax Deductions Tax Deductible Business Expenses

Small Business Tax Deductions Tax Deductible Business Expenses

Small Business Tax Deductions For 2021 Llc S Corp Write Offs

Small Business Tax Deductions For 2021 Llc S Corp Write Offs

List Of Tax Deductions Page 1 Line 17qq Com

List Of Tax Deductions Page 1 Line 17qq Com

The Epic Cheat Sheet To Deductions For Self Employed Rockstars

The Epic Cheat Sheet To Deductions For Self Employed Rockstars

Small Business Tax Deductions Tax Deductible Business Expenses

Small Business Tax Deductions Tax Deductible Business Expenses

What Is The Definition Of Business Travel It Ll Surprise You

What Is The Definition Of Business Travel It Ll Surprise You

What Can Independent Contractors Deduct

Small Business Tax Deductions Tax Deductible Business Expenses

Small Business Tax Deductions Tax Deductible Business Expenses

Sole Proprietorship Vs Llc A Guide To Tax Benefits Liabilities

Sole Proprietorship Vs Llc A Guide To Tax Benefits Liabilities

Rental Property Tax Deductions The Ultimate Tax Guide 2021 Edition Stessa

Rental Property Tax Deductions The Ultimate Tax Guide 2021 Edition Stessa

.svg)

Safety Tracking Spreadsheet Business Tax Deductions Small Business Tax Deductions Spreadsheet Business

Safety Tracking Spreadsheet Business Tax Deductions Small Business Tax Deductions Spreadsheet Business