Independent Contractor Mileage Deduction 2020

IR-2020-220 September 23 2020. January 23 2020 449 PM Yes you can deduct mileage because you are an independent contractor and your primary place of business is your home.

What Can Independent Contractors Deduct

As we start gearing up for tax season you may be wondering what has changed for tax year 2019 filed in 2020.

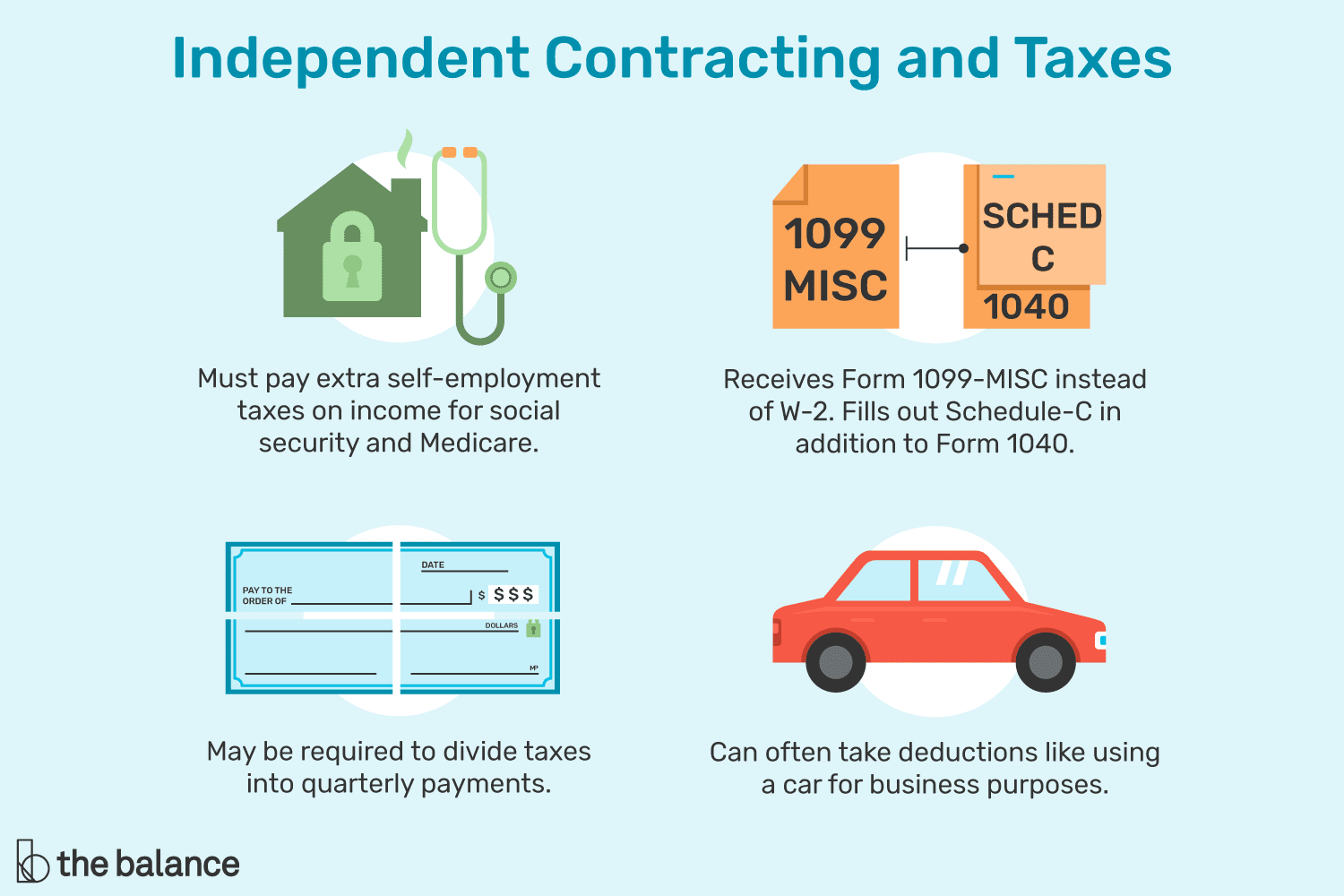

Independent contractor mileage deduction 2020. You cannot use the standard mileage rates if you claim vehicle depreciation. You can claim 575 cents per mile for 2020 plus the cost of parking and any tolls you paid. As an independent contractor you can deduct reasonable and necessary expenses related to running your business.

Instead a portion of the rate is applied equaling 27 cents-per-mile. But if you are self-employed and your home is your principal place of business you can deduct the cost of driving from home to see a client or to go to another work location. The benefit may allow taxpayers working from home to deduct certain expenses on their tax return.

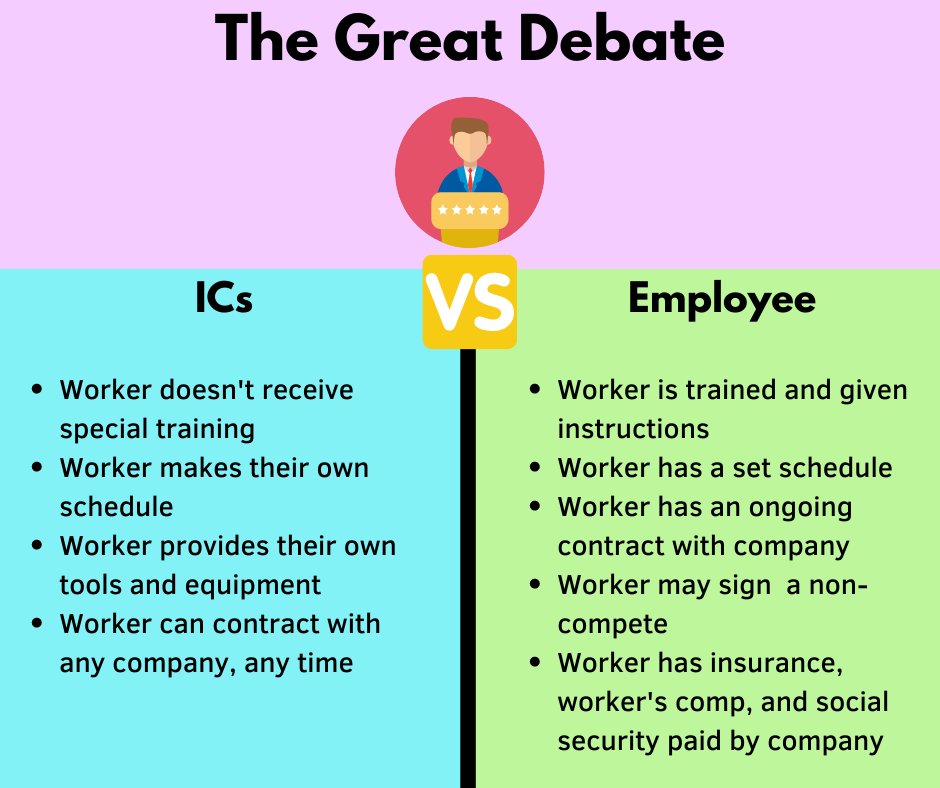

The standard mileage rates may not be used for vehicles used as equipment or for more than four vehicles used simultaneously. If you work as an independent contractor or are self-employed it is important to stay up to date on the latest tax changes. Form 1099-NEC replaces 1099-MISC for this purpose starting in 2020.

If youre questioning this too keep reading to learn what commuting is which expenses are not deductible and what may be an exception to the rule. WASHINGTON During Small Business Week September 22-24 the Internal Revenue Service wants individuals to consider taking the home office deduction if they qualify. Alternately you can use the actual expense method to deduct the business portion of costs like gas repairs and maintenance auto insurance registration and car loan interest or lease payments.

Employees are not allowed to deduct the cost of driving to and from home to work. Deduct your mileage. Say Thanks by clicking the thumb icon in a post.

With the passage of the Tax Cuts and Jobs Act a lot of tax changes were implemented last year like an increase in the standard deduction and an increase in. Updated February 28 2020 A common question with business owners employees and independent contractors who drive for business is whether they can deduct commuting expenses on their tax returns. For 2020 tax returns you can use the standard mileage rate to take a deduction of 0575 per business mile.

The home office deduction is available to qualifying self-employed taxpayers independent contractors. Also if you take either standard or section 179 depreciation you cant use the standard mileage method to deduct car expenses you can only use the exact expense method where you keep track of all vehicle expenses for the year. Since your home is your primary place of business going to and from the worksite would not be considered commuting miles.

Standard Mileage Rate Restrictions.

Independent Contractor Expenses Spreadsheet Business Tax Deductions Business Tax Small Business Tax Deductions

Independent Contractor Expenses Spreadsheet Business Tax Deductions Business Tax Small Business Tax Deductions

Uber Tax Filing Information Alvia Uber Filing Taxes Uber Driving

Uber Tax Filing Information Alvia Uber Filing Taxes Uber Driving

How To File Taxes With A 1099 K Or 1099 Misc Filing Taxes Tax Help Business Tax

How To File Taxes With A 1099 K Or 1099 Misc Filing Taxes Tax Help Business Tax

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

Top 10 1099 Tax Deductions Zipbooks

For Rideshare Drivers Mileage Is One Of The Biggest Deductions You Can Take Find Out Which Tools Wil Mileage Tracker Mileage Tracker App Free Mileage Tracker

For Rideshare Drivers Mileage Is One Of The Biggest Deductions You Can Take Find Out Which Tools Wil Mileage Tracker Mileage Tracker App Free Mileage Tracker

Independent Contractor Tax Help Taxhub

Independent Contractor Tax Help Taxhub

3 Important Hiring Questions Independent Contractor Versus Employee This Or That Questions Small Business Entrepreneurship How To Get Money

3 Important Hiring Questions Independent Contractor Versus Employee This Or That Questions Small Business Entrepreneurship How To Get Money

What Can Independent Contractors Deduct

What To Know About Independent Contractor Mileage Reimbursement

What To Know About Independent Contractor Mileage Reimbursement

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

Guide To Taxes As An Independent Contractor Tax Deductions

Guide To Taxes As An Independent Contractor Tax Deductions

Business Mileage The Holy Grail Of Tax Deductions

Business Mileage The Holy Grail Of Tax Deductions

Employee Vs Independent Contractor Stapley Accounting Services Llc

Employee Vs Independent Contractor Stapley Accounting Services Llc

Independent Contractors Vs Employees A Guide For Pet Sitters And Dog Walkers Time To Pet

Independent Contractors Vs Employees A Guide For Pet Sitters And Dog Walkers Time To Pet

The Tax Deduction List For Self Employed Professionals Elorus Blog

The Tax Deduction List For Self Employed Professionals Elorus Blog

Top 25 1099 Deductions For Independent Contractors

Top 25 1099 Deductions For Independent Contractors

Independent Contractor Taxes Guide 2021

Independent Contractor Taxes Guide 2021