How To Give Out A 1099 Form

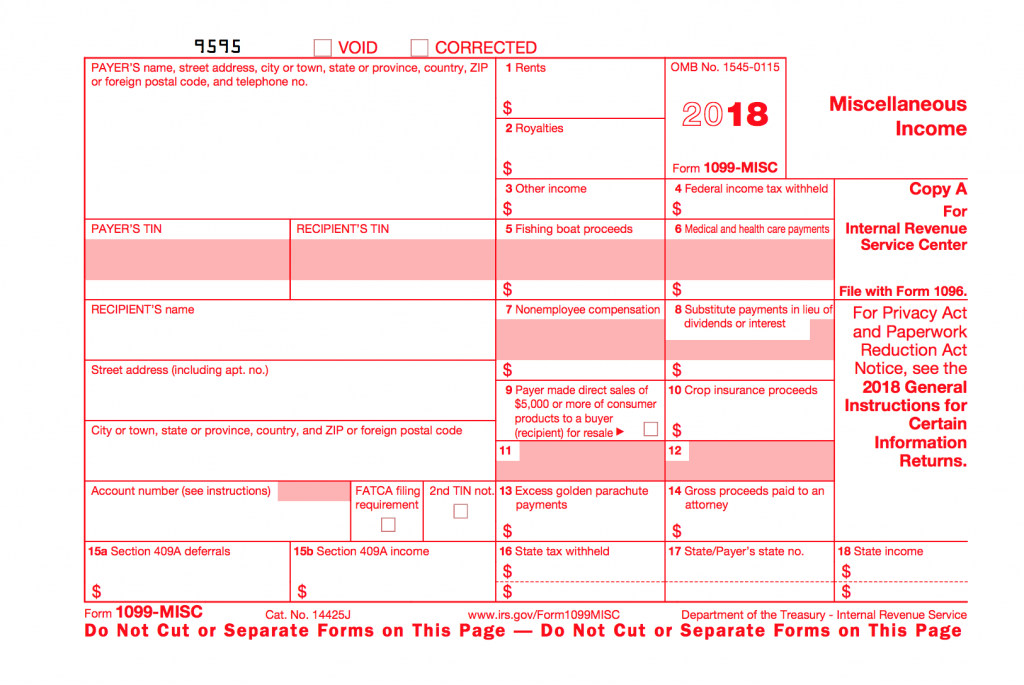

If you hire an independent contractor you must report what you pay them on Copy A and submit it to the IRS. Ride-sharing drivers will also receive a Form 1099.

Printable And Fileable Form 1099 Misc For Tax Year 2017 This Form Is Filed By April 15 2018 Fillable Forms Irs Forms 1099 Tax Form

Printable And Fileable Form 1099 Misc For Tax Year 2017 This Form Is Filed By April 15 2018 Fillable Forms Irs Forms 1099 Tax Form

Once you have the information in hand you can fill out the 1099-NEC form and submit it directly to the IRS.

How to give out a 1099 form. Additonally you must give attorneys a 1099 when you paid them 600. For example employers will send out W-9 forms when they first begin working with an independent contractor to collect their tax information but they will also complete a 1099 at the end of the year to record the total payments they made to that contractor. At least 600 in.

You can download and print the form you need Copy B of 1099-MISC from the IRS website. If you do not receive the missing form in sufficient time to file your tax return timely you may use the Form 4852 to complete your return. Copy A of the 1099-NEC is sent to the IRS.

In addition to giving independent contractors 1099-Misc forms you need to give a 1099-Misc for services rent of office space or machinery prizes and awards and pension-sharing plans. In most cases a copy must be submitted to the IRS by the end of January. If you receive the missing or corrected Form W-2 or Form 1099-R after you file your return and a correction is needed use Form 1040X PDF Amended US.

Remember some businesses dont issue these forms until the January 31st deadline. You must report the same information on Copy B and send it to the contractor. Fill in the totals in the applicable boxes.

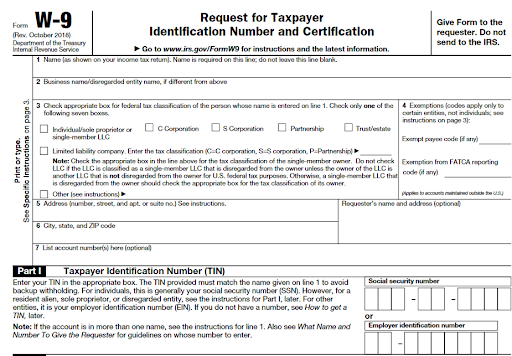

Individuals need to fill out the W-9 if they work as a freelancer or independent contractor. Also if the filer uses paper filing then the filer must file the Form 1099-. Copy A and Copy B.

How to file a 1099 form There are two copies of Form 1099. Before you start the 1099 process make sure you have all the correct information on your contractors and vendors. If the IRS comes calling have a record of this request at hand.

A very active Airbnb listing for which hosts have more than 200 guest bookings per year would be an example of side income that would lead to issuance of a 1099-K. If the filer uses electronic filing then the filer must file the Form 1099-Misc to the IRS by March 31st 2021. File Form 1099-MISC for each person to whom you have paid during the year.

To whom you paid amounts reportable in boxes 1 3 and 8 of at least 10. This form is issued if you made 200 or more transactions and you received payments of 20000 or more for goods or services via third-party services such as credit card processors or merchant card services. You should receive four versions of the above form to be printed out for each contractor.

Youll need to either file online or order the forms you need Copy A of 1099-MISC and Form 1096. What forms do you give a 1099 employee. Filers must file the 1099-Misc Form before the due date with the IRS.

One is for the IRS. For more information about filling out Form 1099-MISC check out the IRSs Form 1099-MISC Instructions. Both companies and individuals may need to fill out a 1099.

1099 Employee Checklist FAQ Style Question. Next you must submit your 1099-MISCs to the IRS. Here are six simple steps to help you prepare your 1099s while adhering to IRS guidelines and filing requirements.

About Form 1099-INT Interest Income. From whom you withheld and did not refund any federal income tax under the backup withholding rules regardless of the amount of the payment. The easiest way to do this is to call your paying company and request the Form 1099.

Individual Income Tax Return. They will also need to file a 1099. To fill out Form 1099-MISC follow the steps below.

Input your information aka payers information Add in the recipients information. At least 10 in royalties or broker payments in lieu of dividends or tax-exempt interest. File Form 1099-INT for each person.

The 1099-NEC form has replaced what used to be recorded on Form 1099-MISC Box 7. These forms include a 1099-MISC form W-9 and a written contract signed by both parties. If youve failed to obtain the information you need to properly issue a 1099 form youll have no choice but to reach out to the contractor and ask for it.

You will complete and send a 1099-NEC form to any independent contractors or businesses to whom you paid over 600 in fees commissions prizes awards or other forms of compensation for services performed for your business. For whom you withheld and paid any foreign tax on interest. Our partner Vensure Employer Services has created a quick chartinfographic for the forms employers need for a 1099 employee.

An Employer S Guide To Filing Form 1099 Nec The Blueprint

An Employer S Guide To Filing Form 1099 Nec The Blueprint

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

How To Fill Out Irs 1099 Misc 2019 2020 Form Pdf Expert

How To Fill Out Irs 1099 Misc 2019 2020 Form Pdf Expert

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

Instant Form 1099 Generator Create 1099 Easily Form Pros

Instant Form 1099 Generator Create 1099 Easily Form Pros

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.57.10AM-8cc0d5ec189e43f7a9c6ff164db34d2c.png) Form 1099 K Payment Card And Third Party Network Transactions Definition

Form 1099 K Payment Card And Third Party Network Transactions Definition

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

An Employer S Guide To Filing Form 1099 Nec The Blueprint

An Employer S Guide To Filing Form 1099 Nec The Blueprint

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

/ScreenShot2020-02-03at12.11.14PM-13bca5b544274295ba7589b5618201fb.png) Form 1099 Patr Taxable Distributions Received From Cooperatives Definition

Form 1099 Patr Taxable Distributions Received From Cooperatives Definition

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Do Llcs Get A 1099 During Tax Time Incfile

Do Llcs Get A 1099 During Tax Time Incfile

2018 Forms 1099 Misc Due January 31 2019 Miami Cpa Bay Pllc

2018 Forms 1099 Misc Due January 31 2019 Miami Cpa Bay Pllc