How To Get My 1099 G Form Online Iowa

Request a Copy of Your Form 1099G Follow these steps. Information about Form 1099-G Certain Government Payments Info Copy Only including recent updates related forms and instructions on how to file.

Iowa Unemployment 1099 G Online Fill Online Printable Fillable Blank Pdffiller

Iowa Unemployment 1099 G Online Fill Online Printable Fillable Blank Pdffiller

Federal state or local governments file Form 1099-G if they made certain payments or if they received Commodity Credit Corporation loan payments.

How to get my 1099 g form online iowa. If you cant download your 1099-G online or you have technical issues with it contact your states Department of Revenue. Click to Continue your returnTake me to my return. I received a 1099 G from the Iowa Dept of Revenue.

Look for the 1099-G form youll be getting online or in the mail. Ill choose what I work on if offered. Many who received unemployment benefits last year are now depending on tax returns but some are still waiting to get their 1099-G forms from the Colorado Department of Labor and Employment CDLE.

Select Print to print your Form 1099G information. Welcome to the Missouri Department of Revenue 1099-G inquiry service. You must complete all fields to have your request processed.

The lookup service option is only available for taxpayers with United States addresses. Log in to your TurboTax Online account or open your TurboTax CDDownload program. Form 1099-G reports the amount of income tax refunds including credits or offsets that we paid to you in a tax year if you itemized your federal deductions.

The 1099-G includes any unemployment insurance benefits issued December 29 2018 through December 30 2019 and any federal andor state taxes that were withheld. How to Get Your 1099-G online. Log in to your NYGov ID account.

The Department of Revenues 1099-G only applies to individuals who itemize their. Please fill out the following form to request a new 1099 form. Form 1099-G reports the amount of refunds credits and other offsets of state income tax during the previous year.

To access this form please follow these instructions. Visit the Department of Labors website. If its convenient consider stopping by the state unemployment office.

If the 1009-G was state tax refund then you need to contact your states department of revenue or taxation office and request they send you another copy. If you do not have an online account with NYSDOL you may call. If you have additional questions about accessing your 1099-G form please call IDES at 800 244-5631.

The form will be mailed to the address we have on file for you. A 1099G is issued if you received 10 or more in gross unemployment insurance payments. The Department is required by federal law to send these forms to taxpayers who meet the reporting criteria.

Select Request Duplicate to request an official copy. The Department is required by federal law to send these forms to taxpayers who meet the reporting criteria. You may owe Uncle Sam if you didnt withhold taxes.

In January of each year the Iowa Department of Revenue mails to certain taxpayers federal forms 1099-G and 1099-INT. The department is now providing Form 1099-G online instead of mailing them. Log in to Benefit Programs Online and select UI Online.

The 1099s reflecting unemployment benefits paid in 2020 will be mailed to the last address on file no later than January 29 2021. Applicant Services 1099 Information. In January of each year the Iowa Department of Revenue mails to certain taxpayers federal forms 1099-G and 1099-INT.

1-888-209-8124 This is an automated phone line that allows you to request your 1099-G via US. Printer Friendly Version Iowa Workforce Development will begin mailing form 1099-G on Jan 21 2020. IDES began sending 1099-G forms to all claimants via their preferred method of correspondence email or mail in late January.

These forms are available online from the NC DES or in the mail. If you live outside of the United States please email us at email protected to mail your form 1099-G. The Internal Revenue Service and the State Department of Revenue and Finance will also be provided this information.

Regardless of the initial method of delivery all claimants can access copies of their 1099-G form in multiple ways. Click on Federal Taxes choose the option. Federal Form 1099-G Certain Government Payments is filed with the Internal Revenue Service IRS by New York State for each recipient of a New York State income tax refund of 10 or more.

Some states only issue the form by mail so youll have to request it and wait for it to arrive if you never received a copy. Email alerts will be sent to the claimants that elected to receive electronic notifications advising that they can view and print their 1099G online. Select Unemployment Services and ViewPrint 1099-G.

The Department is now providing 1099-G information online over a secure server that is available anytime. You would enter the State or local refund information reported on the 1099-G in TurboTax by doing the following. If you are requesting your 1099G to be sent to another address than what we have on file you will be required to submit proof.

In addition to providing them to taxpayers the information on the 1099s is furnished to the Internal Revenue Service. They can get you one that you should be able to pick up. If the 1099-G is to report unemployment compensation you should contact your local unemployment office.

Where Can I Physically Pick Up 1099 And W 2 Forms Quora

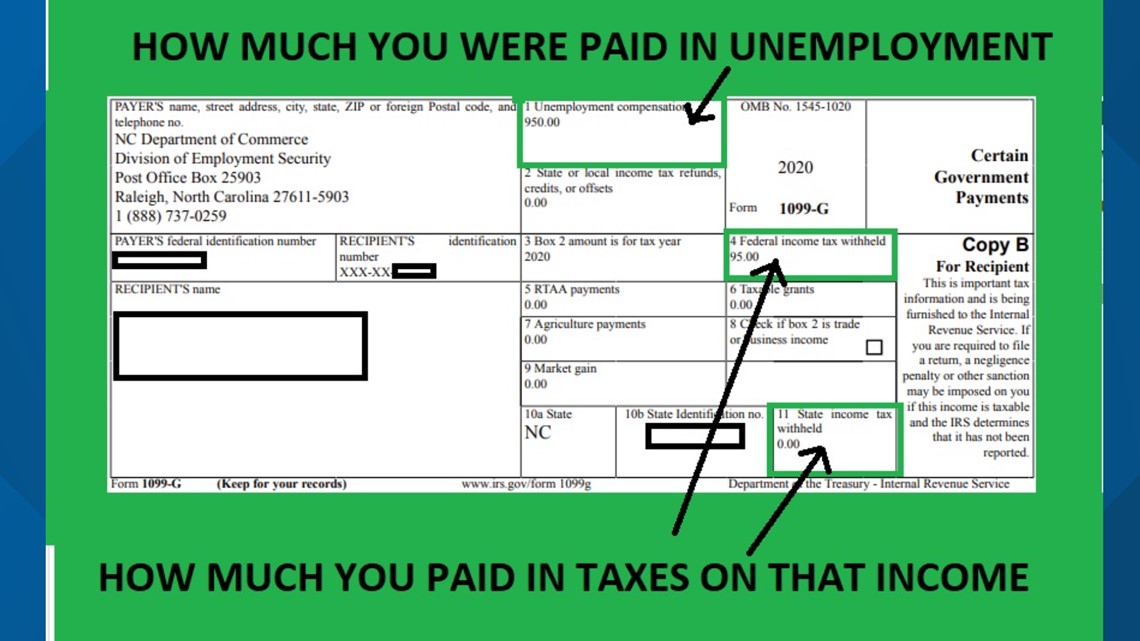

That Extra 600 A Week In Unemployment Benefits Is Taxable Weareiowa Com

That Extra 600 A Week In Unemployment Benefits Is Taxable Weareiowa Com

Unemployment Benefits Are Taxable Look For A 1099 G Form Weareiowa Com

Unemployment Benefits Are Taxable Look For A 1099 G Form Weareiowa Com

File 5498 Form Online Print Mail E File As Low As 0 50 Form

File 5498 Form Online Print Mail E File As Low As 0 50 Form

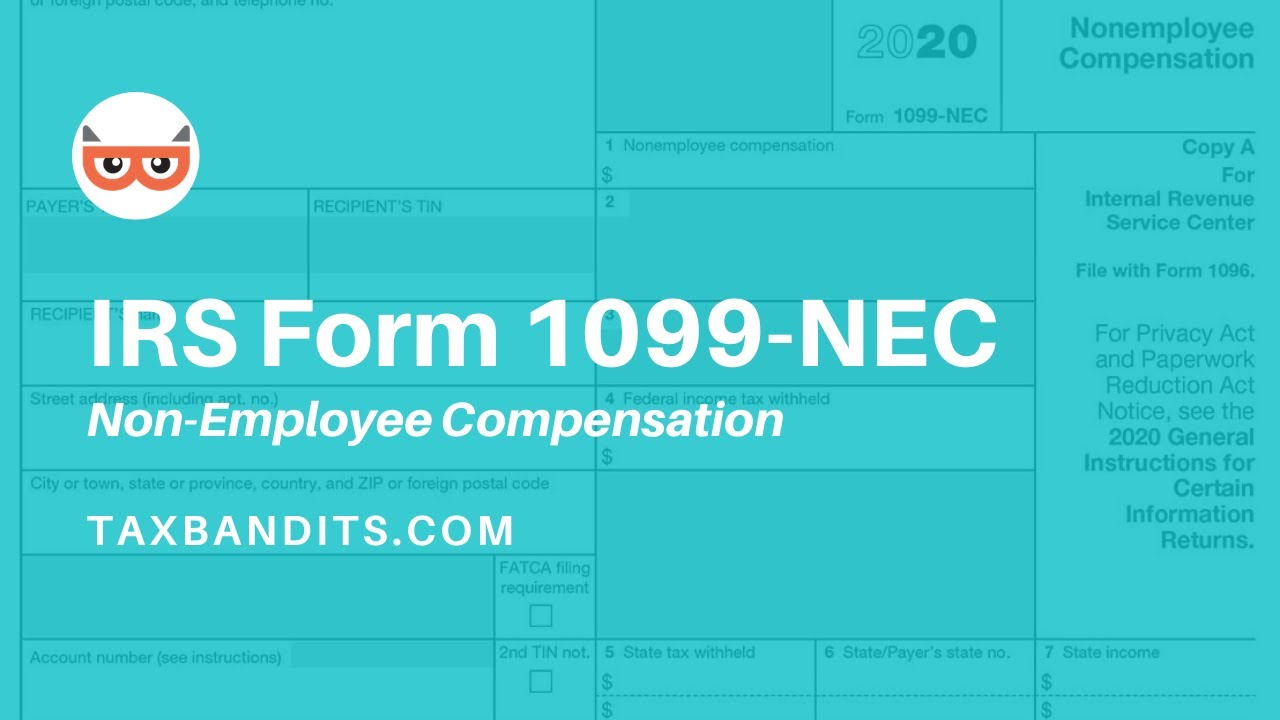

Form 1099 Nec Instructions Reporting Non Employee Compensation For 2020 Taxbandits Youtube

Form 1099 Nec Instructions Reporting Non Employee Compensation For 2020 Taxbandits Youtube

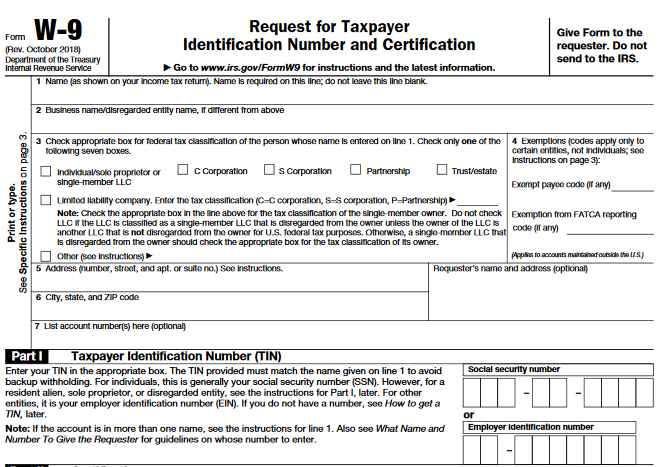

How To Complete An Irs W 9 Form Youtube

How To Complete An Irs W 9 Form Youtube

1215 The Year Of Magna Carta Paperback Magna Carta Gillingham Trial By Ordeal

1215 The Year Of Magna Carta Paperback Magna Carta Gillingham Trial By Ordeal

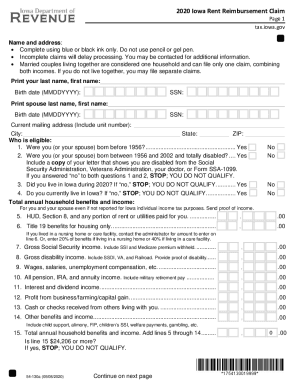

Fillable Online Rent Reimbursement Claim 54 130 Fax Email Print Pdffiller

Fillable Online Rent Reimbursement Claim 54 130 Fax Email Print Pdffiller

Fill Free Fillable Forms State Of Iowa Ocio

Fill Free Fillable Forms State Of Iowa Ocio

A Zwater For Elephants A 20101 Amazing Facts Sponsored Amazing Facts Download Water Ad Water For Elephants Facts Fun Facts

A Zwater For Elephants A 20101 Amazing Facts Sponsored Amazing Facts Download Water Ad Water For Elephants Facts Fun Facts

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back Tax Credits For People Who Work

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back Tax Credits For People Who Work

W 9 Vs 1099 Learn The Differences And When To Use Each The Blueprint

W 9 Vs 1099 Learn The Differences And When To Use Each The Blueprint

2015 Irs W9 Form Downloadable Us Gov Forms W9 Free Tax Irs Forms Printable Job Applications Rental Agreement Templates

2015 Irs W9 Form Downloadable Us Gov Forms W9 Free Tax Irs Forms Printable Job Applications Rental Agreement Templates

Irs Approved 1099 Misc 4 Part Continuous Tax Form Walmart Com Walmart Com

Irs Approved 1099 Misc 4 Part Continuous Tax Form Walmart Com Walmart Com