How Do I File A Corrected 1099 Electronically

If you are submitting 24 or fewer Forms W-2 1099-MISC 1099-R or W-2G you are encouraged to file electronically but may file paper forms. Enter X in the CORRECTED box at the top of the form.

Account Abilitys W 2c User Interface Corrected Wage And Tax Statement Data Is Entered Onto Windows That Resemble The Business Tax Tax Accountant Irs Forms

Account Abilitys W 2c User Interface Corrected Wage And Tax Statement Data Is Entered Onto Windows That Resemble The Business Tax Tax Accountant Irs Forms

Click the Ready To Transfer link above.

How do i file a corrected 1099 electronically. Include date which is optional. Get to this screen in the software. August 12 2019 1031.

You can select the form from the list of forms you have already processed and choose the appropriate option based on what information you need to correct. Comma Separated Value CSV File Format - Filers can upload W-2 and 1099 reports from correctly formatted CSV files. If you want to void the transaction make the money amounts 0.

To file a corrected 1099 use the IRS website forms and instructions for corrections. Enter the information about the payer recipient and account number that you have entered in the incorrect. Or if you provide the recipients email address we can offer the recipient the option to.

On the Select the File line click on the Browse button to locate the file on your PC or network. For tax year 2020 or a prior year entities or people who have paid you money during the year but who are not your employer will mail you a 1099-MISC form for. And select 1-Step as the file type.

However if it has been accepted you need to wait until your original return is processed by the IRS and file an amended return. If you already mailed or eFiled your form 1099s to the IRS and now need to make a correction you will need to file by paper copy a Red Copy A and 1096 fill out and mail to the IRS if you need further assistance preparing your corrected paper copy please contact your local tax provider or call the IRS at 800 829-3676. You can also use the IRS website for forms and instructions.

Put a check in the corrected box not void and change the money amounts. E-File Direct can be used to file an unlimited number of corrected 1099 forms where dollar amounts have been corrected. Once the original e-filing is accepted.

Put together a new file with just the money amount corrections that you want to correct. File Form 1099-MISC by March 1 2021 if you file on paper or March 31 2021 if you file electronically. For bulk filers or developers please see our updated 1099 File Specifications for field.

Locate your Form W-2 1099 or W-2G file on your PC or network. There are two new Forms 1099 required to be filed electronically. Only fields that are required are enterable.

Our system creates the Type 1 or Type 2 correction form. Form 1099-NEC Non Employee Compensation Form 1099-K Payment Card and Third Party Network Transactions These new forms will be available for manual entry through Revenue Online and have been added to the iWire import template. Section 6071c requires you to file Form 1099-NEC on or before February 1 2021 using either paper or electronic filing procedures.

Select the appropriate option from the drop down box. You can create corrected 1099 at eFile360 by logging into your account and clicking on the Create Correction Forms button. Fixed Width Field File Format - Filers can submit Kansas withholding reports in the same file formats.

Find out the incorrect return that is transmitted to the IRS. Make a new information return. If your efiled return was rejected you can go back into TurboTax and fix the mistake on your 1099-MISC and then submit the corrected return.

You will need to register with the IRS and obtain a Transmitter Control Code TCC by filing out form 4419 and upload the file to the IRS through the FIRE system. Click Transfer to submit your file. Specific Instructions for Form 1099-MISC File Form 1099-MISC Miscellaneous Income for each.

To file a corrected W-2 go to the SSA website and file the corrected form W-2C electronically. Forms W-2 1099-MISC 1099-R and W-2G are required to be filed electronically with DRS. Once you have finished your corrected form check out and select E-File Print Mail and then we will print and mail a corrected form to the recipient and e-file the correction with the IRSSSA.

E File 1094 1095 1099 And W 2 Forms Quickly And Easily

E File 1094 1095 1099 And W 2 Forms Quickly And Easily

Form 2290 Online Filing Irs Forms Tax Forms Filing Taxes

Form 2290 Online Filing Irs Forms Tax Forms Filing Taxes

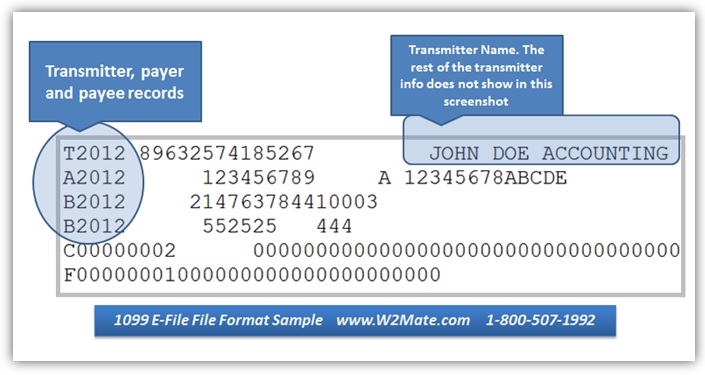

1099 E File Format Specification File Layout

1099 E File Format Specification File Layout

Form 2290 Due Date Irs Forms Irs Filing Taxes

Form 2290 Due Date Irs Forms Irs Filing Taxes

1099 Electronic Filing Software 289 To Efile

1099 Electronic Filing Software 289 To Efile

1099 Nec Software To Create Print E File Irs Form 1099 Nec

1099 Nec Software To Create Print E File Irs Form 1099 Nec

Client Required Contractor Details For Irs 1099 Tax Form E Filing 1099 Tax Form Tax Forms Irs Forms

Client Required Contractor Details For Irs 1099 Tax Form E Filing 1099 Tax Form Tax Forms Irs Forms

How To Efile Original 1099 Data Irs Fire

How To Efile Original 1099 Data Irs Fire

Form 1099 Nec Requirements Deadlines And Penalties Efile360

Form 1099 Nec Requirements Deadlines And Penalties Efile360

1099 Combined Federal State Program E Filing Das 1099

1099 Combined Federal State Program E Filing Das 1099

Online 1099 Correction Made Easy With Efile4biz

Online 1099 Correction Made Easy With Efile4biz

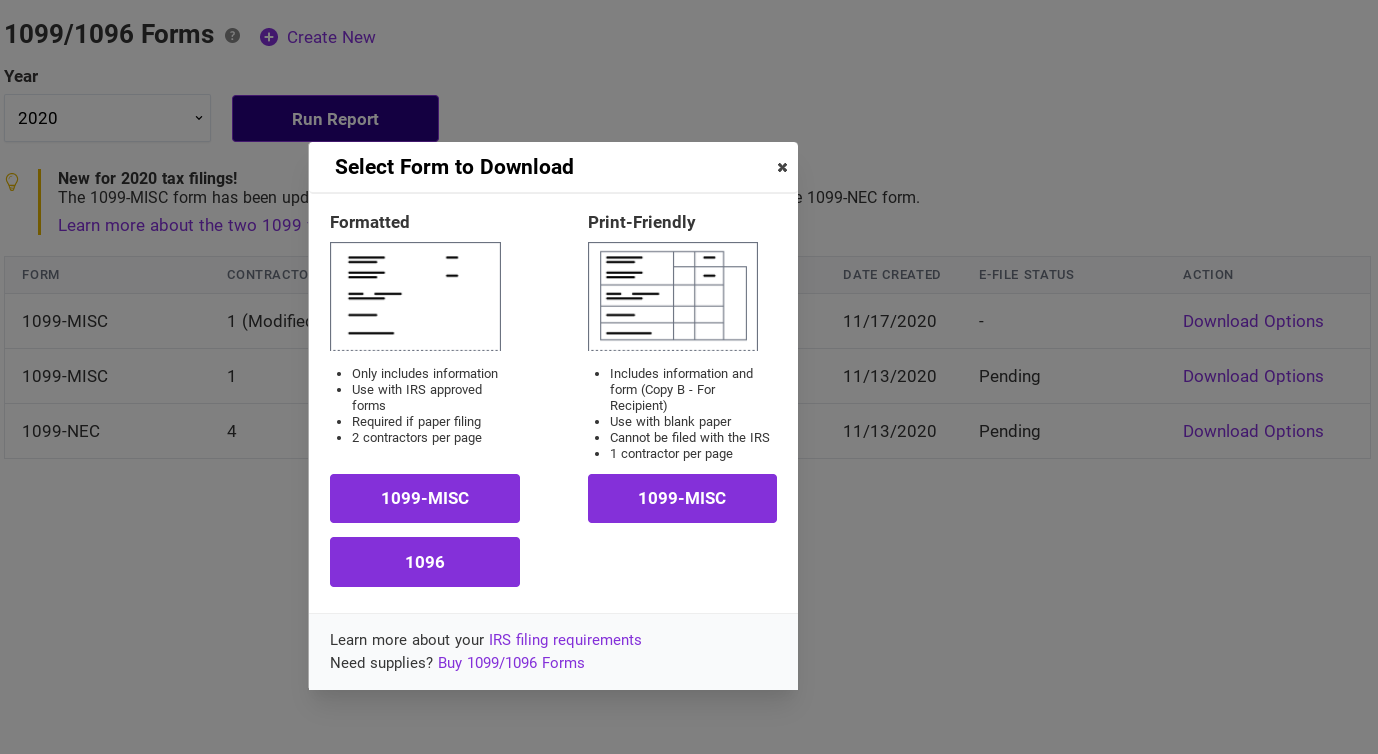

Electronically File 1099s Patriot Software

Electronically File 1099s Patriot Software

How To File Form 1099 Nec Electronically Youtube

How To File Form 1099 Nec Electronically Youtube

Irs Approved 1099 K Tax Forms File Form 1099 K When Working With Payment Card And Third Party Network Transactions A Payment Settleme Tax Forms W2 Forms Form

Irs Approved 1099 K Tax Forms File Form 1099 K When Working With Payment Card And Third Party Network Transactions A Payment Settleme Tax Forms W2 Forms Form

1099 Electronic Filing How To Efile 1099 Misc And 1096 Forms

1099 Electronic Filing How To Efile 1099 Misc And 1096 Forms

Report Year End Information On 1099s Returns

Report Year End Information On 1099s Returns

1099 Electronic Filing How To Efile 1099 Misc And 1096 Forms

1099 Electronic Filing How To Efile 1099 Misc And 1096 Forms

Account Ability Includes Electronic Filing The Irs And Social Security Administration Ssa Require Filers Of Efile Accounting Social Security Administration

Account Ability Includes Electronic Filing The Irs And Social Security Administration Ssa Require Filers Of Efile Accounting Social Security Administration