Can You Have A W2 And 1099 From Same Company

Some legitimate examples that we have seen of this circumstance are. In some situations the same person can receive both a 1099 and a W-2.

2019 Review Of W2 And 1099 Systems Cpa Practice Advisor

2019 Review Of W2 And 1099 Systems Cpa Practice Advisor

However there may be instances where a worker may be serving as an independent contractor and an employee for the same entity.

Can you have a w2 and 1099 from same company. When youre paid as a freelancer taxes arent taken out for you. 1099Misc is usually for self employment income. Notify the contractor in writing of the immediate need to convert him to an employee and what identification information.

You just have to check that it isnt the same income on both. See this article on worker classification for more information. I assume that you mean for the same employer.

If both are the same amount and it matches what you got they just screwed up and sent the 1099. Entities provide a Form 1099-Misc to independent contractors and Form W-2 to employees. For example if an individual who is an officer and employee of a corporation also serves on the board of directors this person may receive a W-2 for employee compensation as well as a 1099 for fees received as a corporate director a non-employee position.

All contractors who worked for you that will receive a 1099 at the end of the tax year and need to be converted to a W-2 under the same guidelines. A workers role determines which information return an entity would provide. If you got 1500 and one is for 800 and one is for 700 probably youll find the EIN is different meaning they made some change to their company during the year that required getting a new EIN.

If you have both a W2 and a 1099 form to file chances are you wont owe as much as someone who only receives 1099 forms. It also takes unusual circumstances for this type of dual filing to be legitimate. Those rules tend to favor treating somebody as a W2 employee so your employer may have problems convincing the IRS that you really are a 1099 independent contractor and not a W2 employee.

And as your question explains the services that were performed are different. In many ways the answer to can an employee receive a w2 and a 1099 is a simple one. You can enter W2 into all versions.

When a taxpayer does not treat a worker as an employee the examination of whether compensation is subject to employment taxes is considered a worker classification issue. Thats because this type of situation is a red flag and frequently results in a response from the IRS seeking further information. You enter the W-2 in the W-2 section as you would for any other job and you enter the 1099-MISC as business income which will go on Schedule C.

Otherwise an employer can pay you a wage for some things and a commission on others. Form W-2 and Form 1099-MISC Filed for the Same Year. Both W2 and 1099 income.

There are very specific situations where this would be acceptable to the IRS and the unemployment and workers compensation programs. There are a lot of rules and requirements for switching a W2 employee to a 1099 independent contractor. Yes someone can be both types of employee in the same company.

According to IRS guidelines it is possible to have a W-2 employee who also performs work as a 1099 independent contractor so long as the individual is performing completely different duties that would qualify them as an independent contractor. Yes an employee can receive a W2 and a 1099 but it should be avoided whenever possible. If you were an employee and a contractor at different times you enter the W-2 and the 1099-MISC as if they are unrelated.

There are two situations in which an independent contractor can receive both Forms 1099 and W2 from the same employer. Technically yes you can receive both forms from the same employer. It is uncommon but there are times when an individual will receive a Form W-2 and Form 1099 from the same business.

However when a taxpayer files both Form W-2 and Form 1099-MISC for a worker for the same year there is a worker classification issue based on facts of the case. You have to enter all your income on the same tax return. You can be both a 1099 and a W-2 employee at the same time only if y.

This usually happens when a business has paid a regular employee to work on a side project unrelated to his or her regular work. For example if you work a regular 40-hour week under a contract you would receive a W-2. That means that for each job its up to you to calculate how much you owe.

As long as you and company agree on which hours and pay type are performed on what type of job there is not a problem. But this is usually rare. The first is if the worker performed duties as.

They can also be the same type of services and still be paid either on a 1099 or W2. 0 found this answer helpful 2 lawyers agree.

1099 Vs W2 Be Better At Business Podcast Eagle Employer Services

1099 Vs W2 Be Better At Business Podcast Eagle Employer Services

What S The Difference Between A W2 Employee And A 1099

What S The Difference Between A W2 Employee And A 1099

W2 Or 1099 Employee Or Contractor What S The Difference Loganville Ga Patch

W2 Or 1099 Employee Or Contractor What S The Difference Loganville Ga Patch

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

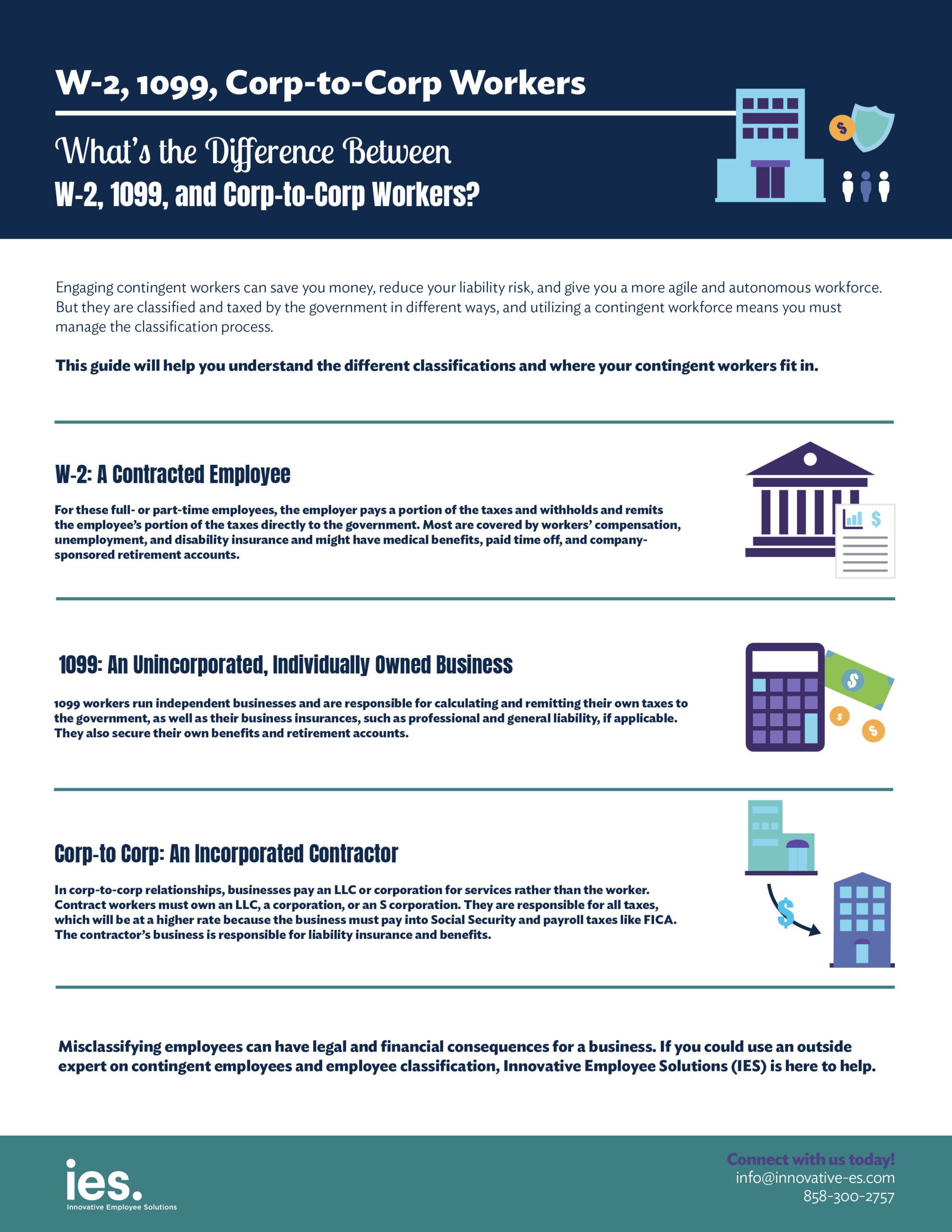

What S The Difference Between W 2 1099 And Corp To Corp Workers

What S The Difference Between W 2 1099 And Corp To Corp Workers

When To Switch Employees From A W2 To A 1099

When To Switch Employees From A W2 To A 1099

What Is The Difference Between A W 2 And 1099 Aps Payroll

What Is The Difference Between A W 2 And 1099 Aps Payroll

1099 Workers Vs W 2 Employees In California A Legal Guide 2021

1099 Workers Vs W 2 Employees In California A Legal Guide 2021

2020 Reviews Of W2 And 1099 Compliance Programs Cpa Practice Advisor

2020 Reviews Of W2 And 1099 Compliance Programs Cpa Practice Advisor

W 2 1099 Tax Reporting Deadline Approaches Rocket Lawyer

W 2 1099 Tax Reporting Deadline Approaches Rocket Lawyer

W 2 And A 1099 Here S What To Know Trinity Global Financial Group

How W2 Employees Are Taxed Differently Than 1099 Contractors

How W2 Employees Are Taxed Differently Than 1099 Contractors

Can The Same Person Be An Employee And An Independent Contractor

Can The Same Person Be An Employee And An Independent Contractor

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

/1099-form-36a7b4ad438c4c1cbd53efb8e944cc6f.jpg) Reporting 1099 Misc Box 3 Payments

Reporting 1099 Misc Box 3 Payments

What Happens If I Have Form 1099 And A Form W 2 Income In The Same Year

What Happens If I Have Form 1099 And A Form W 2 Income In The Same Year

1099 Vs W2 Put More Money In Your Pocket Team Eternal Fit

16 Criteria To Determine Your Worker Status 1099 Or W 2 Independent Contractor Tax Advisors

16 Criteria To Determine Your Worker Status 1099 Or W 2 Independent Contractor Tax Advisors

1099 Workers Vs W 2 Employees In California A Legal Guide 2021

1099 Workers Vs W 2 Employees In California A Legal Guide 2021