Business Relief Request Form

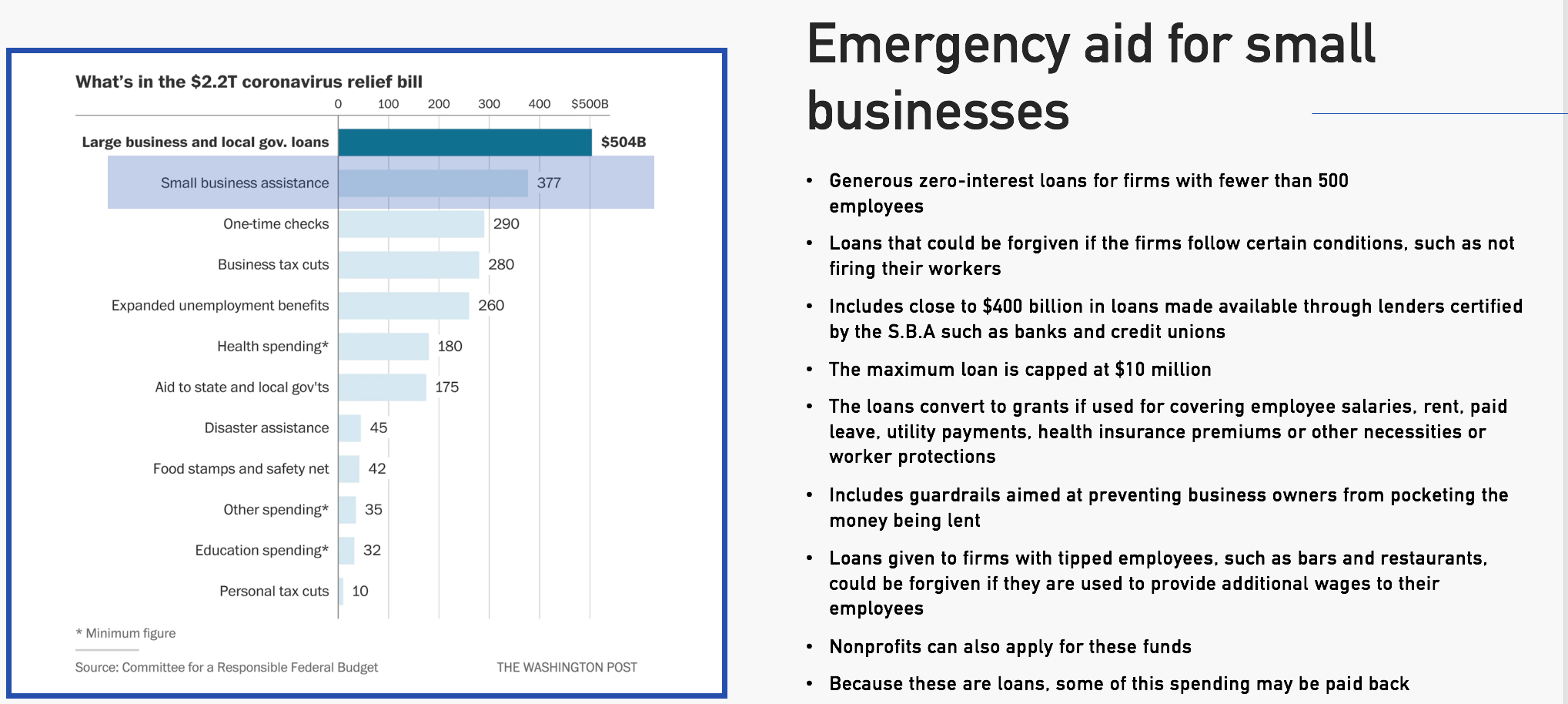

Name Email. The Paycheck Protection Program established by the CARES Act is implemented by the Small Business Administration with support from the Department of the Treasury.

How To Get An Sba Disaster Loan Eidl Bench Accounting

How To Get An Sba Disaster Loan Eidl Bench Accounting

The landlord may want to request financial information from the tenant as well as request information as to whether business interruption insurance is available to the tenant in order to evaluate the tenants request and determine who should or should not be granted rent relief.

Business relief request form. Small Business and Self-Employed Tax Center. IRS Form 9465 Installment Agreement Request. The request for relief option is located under the.

SMME Debt Finance Relief. You may now request relief from penalty collection cost recovery fees andor interest using CDTFAs online services at onlineservicescdtfacagov_. When an individual files an application for UC benefits Form UC-44FR Request for Relief from Charges is sent along with Form UC-44F 3 Notice of Financial Determination to each base-year employer that is eligible to request relief from charges.

To submit a request for relief login with your username and password and select the account you want to request relief for. Online resources for taxpayers who file Form 1040 or 1040-SR Schedules C E F or Form 2106 as well as small businesses with assets under 10 million. There are very few things which must be populated in the form for the form to begin its process of approvals.

Please fill out the recaptcha. Write your business plan. Interim Relief Request Form Business Banking Standard Chartered Brunei Darussalam For Bank Use Only Client Relationship ID To be filled in by Client Client Information Client Name insert FULL legal name exactly as it appears in the Constitutional document Business Vintage Years Average Monthly Income before Covid-19.

While offices are closed there will be delays in processing incoming and outgoing US. Buy an existing business or franchise. Pick your business location.

Collection Information Statement for Businesses. Required fields are marked Comment. Eligible Client Centre applicants will receive relief via secure Interac e.

Once logged in select the appropriate sales and use tax account then select Request an Interest Deferred Payment Plan under the I Want To section to begin your request. If you received a notice be sure to check that the information in your notice is correct. Relief Request Form Explained The PRR form is composed of multiple sections.

Agricultural enterprises are not eligible. COVID-19 RELIEF APPLICATION FORM. Apply for licenses and permits.

Unlike the paper form the electronic form automatically populates the CFs for. All applicants may be asked to provide an IRS Form 4506-T to allow SBA to request tax return information on the applicants behalf. Posted in Alerts News.

Filing and Paying Business Taxes. Business entities normally eligible for the EIDL program are eligible including sole proprietors independent contractors and private nonprofit organizations. Direct Debit Installment Agreement.

SMME Business Growth Resilience Facility. Were committed to the well-being of our customers and communities. Please read this in conjunction with.

If youre using the Intact Insurance App make sure its updated with the latest version in order to access the relief request. This program provides small businesses with funds to pay up to 8 weeks of payroll costs including benefits. IRS Form 433-D Direct Debit Installment Agreement form.

You must log into your online services account using your username and password to make the request. Services are available online and our call center agents are ready to assist by phone or chat. You may qualify for relief from penalties if you made an effort to comply with the requirements of the law but were unable to meet your tax obligations due to circumstances beyond your control.

This includes things such as general correspondence processing paper tax returns applications andor permit requests petitions or request for. Collection Information Statement for Wage Earners and Self-Employed Individuals or IRS Form 433-B. Request For Payment Form For Local Governments Only Final Report Form For Local Governments Only Small businesses please apply for funding through your counties councils of government economic development districts or if a county is unable or unwilling to.

An employer that wishes to request relief from charges should complete and retun Form UC-44FR. Your email address will not be published. The request cannot be made using a limited access code.

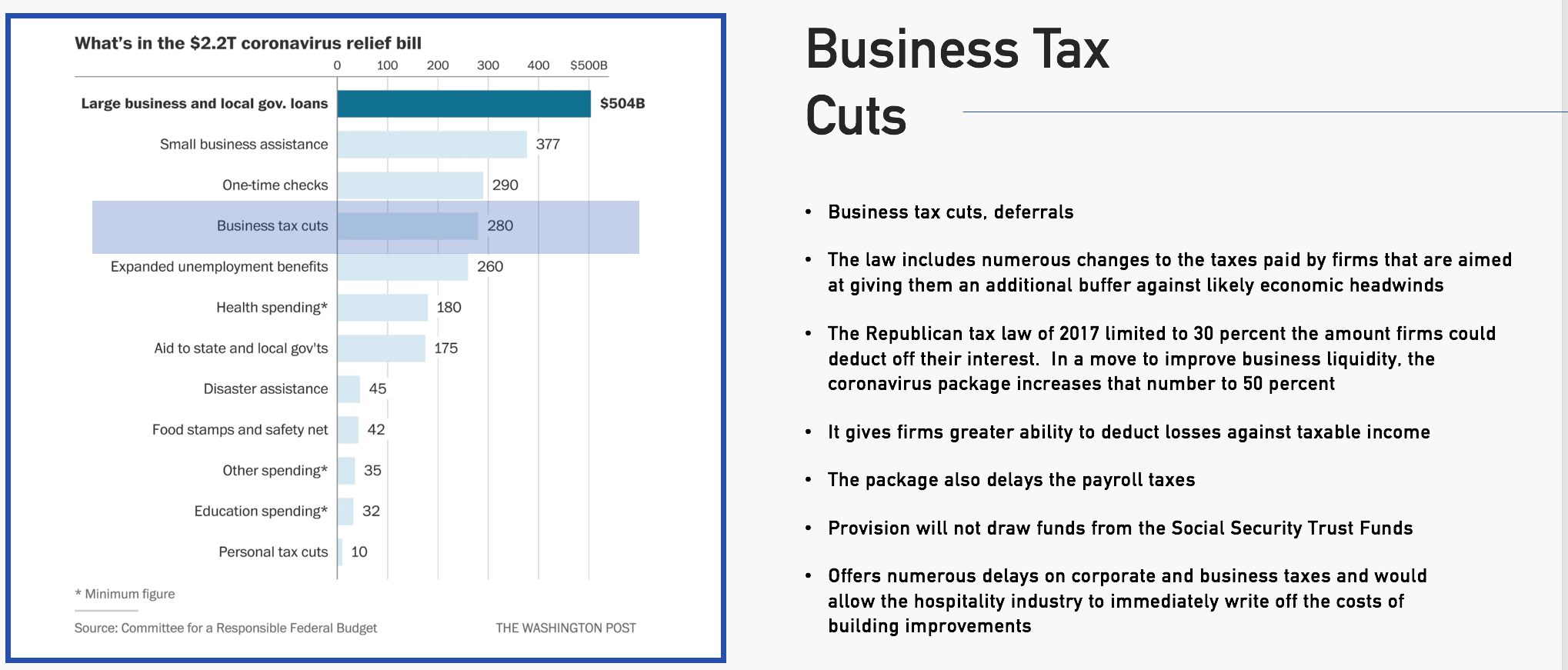

Open a business bank account. If you can resolve an issue in your notice a penalty might not be applicable. Business Relief During COVID-19 Pandemic.

Leave a Reply Cancel reply. To request relief Intact Insurance customers can simply visit Client Centre or contact their broker. Choose your business name.

Choose a business structure. Get federal and state tax ID numbers. Your information is encrypted with the Secure Socket Layer SSL security protocol.

Financial Hardship Relief Request. If youve been financially impacted by COVID-19 and would like to discuss your options for relief with respect to your personal loans at INTRUST complete the form below. The Village Foundation of Blowing Rock P O Box 2716 132 Park Avenue.

Calculate your startup costs.

Coronavirus Covid 19 Tax Relief Taxpayer Advocate Service

Coronavirus Covid 19 Tax Relief Taxpayer Advocate Service

Coronavirus Covid 19 Small Business Guidance Loan Resources Representative Tim Burchett

Coronavirus Covid 19 Small Business Guidance Loan Resources Representative Tim Burchett

Small Business Resiliency Fund Coronavirus

Small Business Resiliency Fund Coronavirus

Coronavirus Response Page At Laedc Los Angeles County Economic Development Corporation

Coronavirus Response Page At Laedc Los Angeles County Economic Development Corporation

Coronavirus Covid 19 Tax Relief Taxpayer Advocate Service

Coronavirus Covid 19 Tax Relief Taxpayer Advocate Service

Paycheck Protection Program How It Works Funding Circle

Coronavirus Response Page At Laedc Los Angeles County Economic Development Corporation

Coronavirus Response Page At Laedc Los Angeles County Economic Development Corporation

Https Www Sba Gov Sites Default Files Articles Eidl And P3 4 8 2020 2 Pm Pdf

Covid Small Business Resources Page Colorado Small Business Development Center Network

Covid Small Business Resources Page Colorado Small Business Development Center Network

Coronavirus Covid 19 Donations Novel Coronavirus Covid 19 County Of Santa Clara

Covid Small Business Resources Page Colorado Small Business Development Center Network

Covid Small Business Resources Page Colorado Small Business Development Center Network

Coronavirus Response Page At Laedc Los Angeles County Economic Development Corporation

Coronavirus Response Page At Laedc Los Angeles County Economic Development Corporation

Https Www Sba Gov Sites Default Files Articles Eidl And P3 4 8 2020 2 Pm Pdf

Covid Small Business Resources Page Colorado Small Business Development Center Network

Covid Small Business Resources Page Colorado Small Business Development Center Network

Coronavirus Response Page At Laedc Los Angeles County Economic Development Corporation

Coronavirus Response Page At Laedc Los Angeles County Economic Development Corporation

Covid 19 Economic Relief Programs Easier Registration And Payments Citybase

Covid Small Business Resources Page Colorado Small Business Development Center Network

Covid Small Business Resources Page Colorado Small Business Development Center Network

Are You Qualified For The 2021 Sba Targeted Eidl Advance

Are You Qualified For The 2021 Sba Targeted Eidl Advance

7 A Loan Application Checklist The U S Small Business Administration Sba Gov

7 A Loan Application Checklist The U S Small Business Administration Sba Gov