Ato Jobkeeper Monthly Declaration Dates

31 May is your final date to complete steps 1 and 2 if you want to claim for JobKeeper fortnights in April and May. Eligible employersbusiness participantssole traders can lodge claims via the ATO portal MyGov for Sole traders.

Step 2 Identify Your Eligible Employees Australian Taxation Office

Step 2 Identify Your Eligible Employees Australian Taxation Office

From 28 September 2020 the.

Ato jobkeeper monthly declaration dates. 28 January 2021 The December 2020 monthly declaration is due to be submitted to the ATO for JobKeeper Extension 1 fortnights 18 20. To be reimbursed for JobKeeper Payments in May you will need to complete your declaration between 1-14 June 2020. In order to receive the first round of payments you will need to make this declaration beforehand.

As such the business monthly declaration for reimbursement of JobKeeper payments for the month of May will now need to be completed by 14 June. You must do this in the first 14 days after the month you are claiming for. The Monthly Declaration is essentially a Reimbursement Claim and it must be completed and filed with the ATO before the ATO will pay the employer the JobKeeper subsidy and for April JobKeeper subsidy the due date is 31 May 20.

The JobKeeper first monthly claim is now open. Pay your employees 1500 for each fortnight to claim JobKeeper payments for April. For an entitlement in the first or second JobKeeper fortnights ie.

The Commissioner of Taxation has now granted a deferral of the due date for the JobKeeper scheme monthly declaration to the 14th of each month commencing from June. You will also need to provide us with information about. Monthly business declarations for JobKeeper Fortnights in March need to be completed by 14 April 2021 to receive final JobKeeper payments.

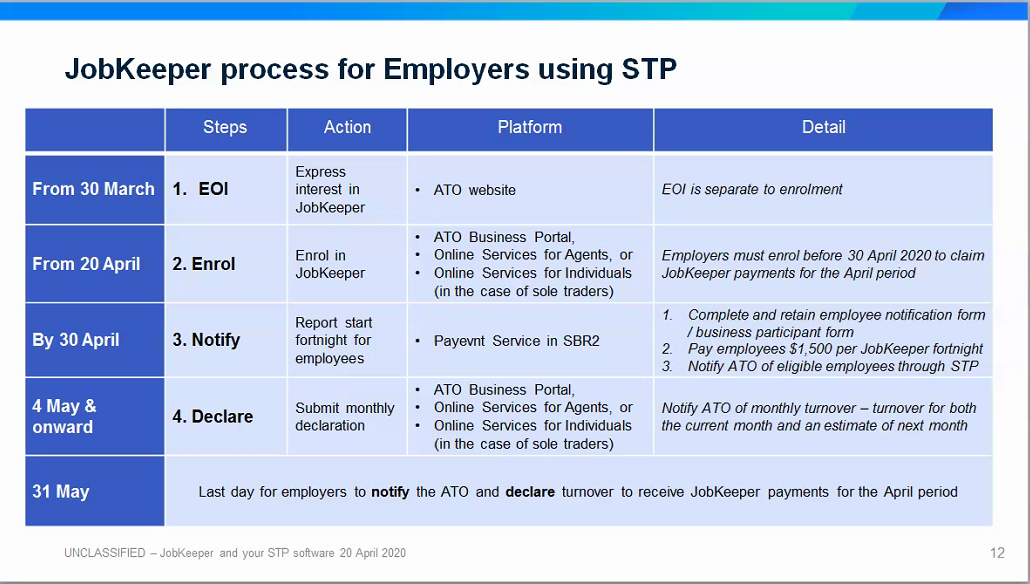

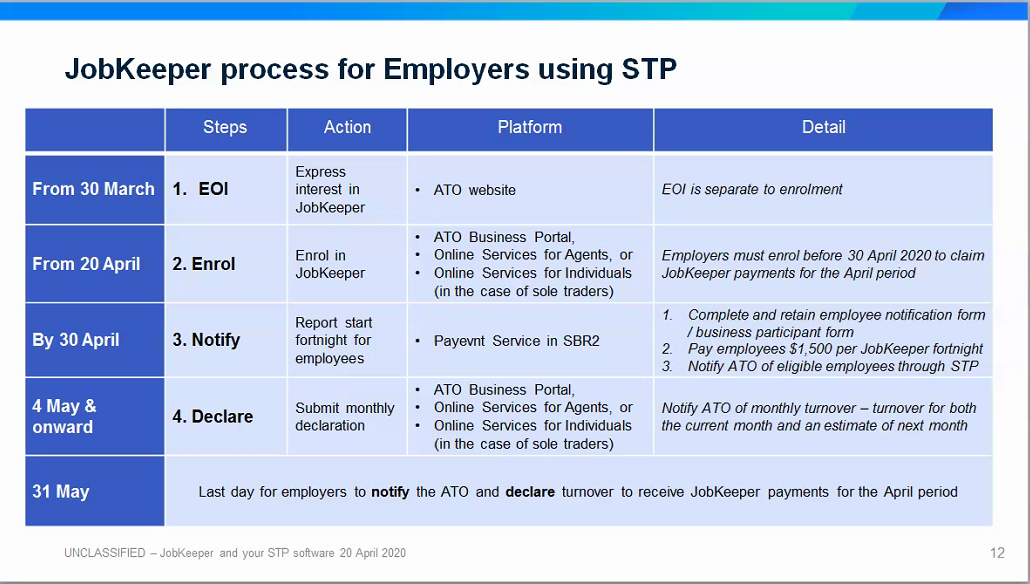

This declaration needs to be completed for each month between the 1st and the 14th of following month. The JobKeeper Payment scheme finished on 28 March 2021. JobKeeper guide employers reporting through STP You can create a PDF or print this guide using the buttons at the top-right of your screen.

Employers currently enrolled in JobKeeper must ensure that employees have been paid 1200 or 750 depending on the employees tier for the fortnight ending 3rd January 2021. Your tax or BAS agent can also make the business monthly declaration for you. Each month complete Step 3.

For example to be reimbursed for JobKeeper payments paid to your employees in March 2021 you should complete your declaration by 14 April 2021. If you require assistance please contact this office. Make a business monthly declaration.

Final date to enrol to claim for JobKeeper fortnights in April and May. Ending 12 April and 26 April 2020 the end of the second JobKeeper fortnight ie. Business monthly declarations for JobKeeper fortnights 18 19 and 20 are now due 28 January 2021.

Note the original date was 14 January 2021 however the ATO extended this date to 28 January 2021. Important past key dates 28 September 2020 JobKeeper extension 1 starts. Key dates provided by the ATO include.

The ATO has granted a deferral of the due date for the monthly declaration to the 14th of each month under the JobKeeper scheme commencing from June. The JobKeeper Payment scheme finished on 28 March 2021. The Commissioner has the power to.

For an entitlement arising in any other fortnight the end of the fortnight. Businesses will now have an additional seven days to make the JobKeeper business monthly declaration. JobKeeper fortnights 21 and 22 starting Monday 4 January 2021 and Monday 18 January 2021 You have until Sunday 31 January 2021 to meet the wage condition for your eligible employees.

The Commissioner of Taxation has now granted a deferral of the due date for the JobKeeper scheme monthly declaration to the 14th of each month commencing from June. Each month you must complete a business monthly declaration to keep claiming JobKeeper payments. The next monthly declaration for JobKeeper is NOW DUE.

We will ask you to re-confirm the business participant details and your eligible employees. Due 28 January 2021 The ATO has extended the due date for the December monthly declaration to 28 January 2021. Monthly business declarations for JobKeeper Fortnights in March need to be completed by 14 April 2021 to receive final JobKeeper payments.

Make a business monthly declaration to reconfirm your eligibility. JobKeeper Claim Monthly Declaration. Enrol for JobKeeper payment.

How to file the Monthly Declaration. Please note the JobKeeper payment wont be processed until the monthly report is submitted to the ATO. Make your business monthly declaration between the 1st and 14th day of each month to claim JobKeeper payments for the previous month.

Sep 2020 Jobkeeper Extension 1 Kuyamaito

Sep 2020 Jobkeeper Extension 1 Kuyamaito

Jobkeeper Payment Setup Entirerecruit Help Centre

Jobkeeper Payment Setup Entirerecruit Help Centre

Http Www Absoluteaccountingservices Com Au Static Uploads Files Jk Guide Employers Stp Wfpbnlusfayk Pdf

Jobkeeper Mta Queensland Motor Trades Association Of Queensland

Jobkeeper Mta Queensland Motor Trades Association Of Queensland

Step 3 Make A Business Monthly Declaration Australian Taxation Office

Step 3 Make A Business Monthly Declaration Australian Taxation Office

Ato Gov Au On Twitter Businesses Rushing To Do Your Monthly Jobkeeper Declaration In Time The Dec Due Date Has Been Extended To 28 Jan 2021 Read More Https T Co C1meqpojnz Https T Co Zrtd5cvwrx

Ato Gov Au On Twitter Businesses Rushing To Do Your Monthly Jobkeeper Declaration In Time The Dec Due Date Has Been Extended To 28 Jan 2021 Read More Https T Co C1meqpojnz Https T Co Zrtd5cvwrx

Jobkeeper 2 0 Key Dates And Actions What Do I Do Now

Jobkeeper 2 0 Key Dates And Actions What Do I Do Now

Processing Jobkeeper Payments In The Pay Run Payroll Support Au

Processing Jobkeeper Payments In The Pay Run Payroll Support Au

Ato Extends Jobkeeper Monthly Declaration Deadline The Field Group Accountants Business Advisors

Ato Extends Jobkeeper Monthly Declaration Deadline The Field Group Accountants Business Advisors

Jobkeeper Payment Important Next Steps

Jobkeeper Payment Important Next Steps

Jobkeeper Payments Astute Payroll Help Centre

Jobkeeper Payments Astute Payroll Help Centre

Jobkeeper Ongoing Monthly Declaration Dates And Guidance Plus Key Dates Infinite Accounting Solutions

Jobkeeper Ongoing Monthly Declaration Dates And Guidance Plus Key Dates Infinite Accounting Solutions

Managing The Jobkeeper Payment Payroll Support Au

Managing The Jobkeeper Payment Payroll Support Au

How To Complete The Monthly Jobkeeper Report Illumin8 Xero Accountants Mount Eliza Mornington Peninsula

How To Complete The Monthly Jobkeeper Report Illumin8 Xero Accountants Mount Eliza Mornington Peninsula

Step 2 Identify Your Eligible Employees Australian Taxation Office

Step 2 Identify Your Eligible Employees Australian Taxation Office

Step 2 Identify Your Eligible Employees Australian Taxation Office

Step 2 Identify Your Eligible Employees Australian Taxation Office