What Documents Are Required For Sba Disaster Loan

Most recent 3 Years of Business Tax Returns 5. Covers collateral of 80 of the insurable value of the business.

Sba Disaster Loan Credit Requirements Canterbury Law Group

Sba Disaster Loan Credit Requirements Canterbury Law Group

The interest rate for EIDLs due to COVID-19 is a fixed rate of 375 for for-profit.

What documents are required for sba disaster loan. Httpwwwsbagovdisaster August 2017 Required Documentation The following documents are required to process your application and reach a loan decision. Questions on SBA Form 2202. SBA Form 2202 is for all liabilities that company owes.

Required documents for independent contractors and self-employed Individuals can be found here. The SBA disaster assistance program only will provide funding for damage that isnt covered by insurance. If you have an existing SBA 7a loan the SBA would pay the principal and interest for 6 months.

Your Loan Officer and Case Manager will assist you to ensure that you submit the proper documentation. ESignature and Documents Exchange. What are the SBA Disaster Loan Terms.

To remit this information you must reply to the email you received from the SBA Rep assigned to your account. With this program the SBA pays the principal and interest on new SBA 7a loans that are funded before September 25 2020. SBA Disaster Home Sole Proprietor Loan Application paper forms Please see attachments below to download corresponding forms.

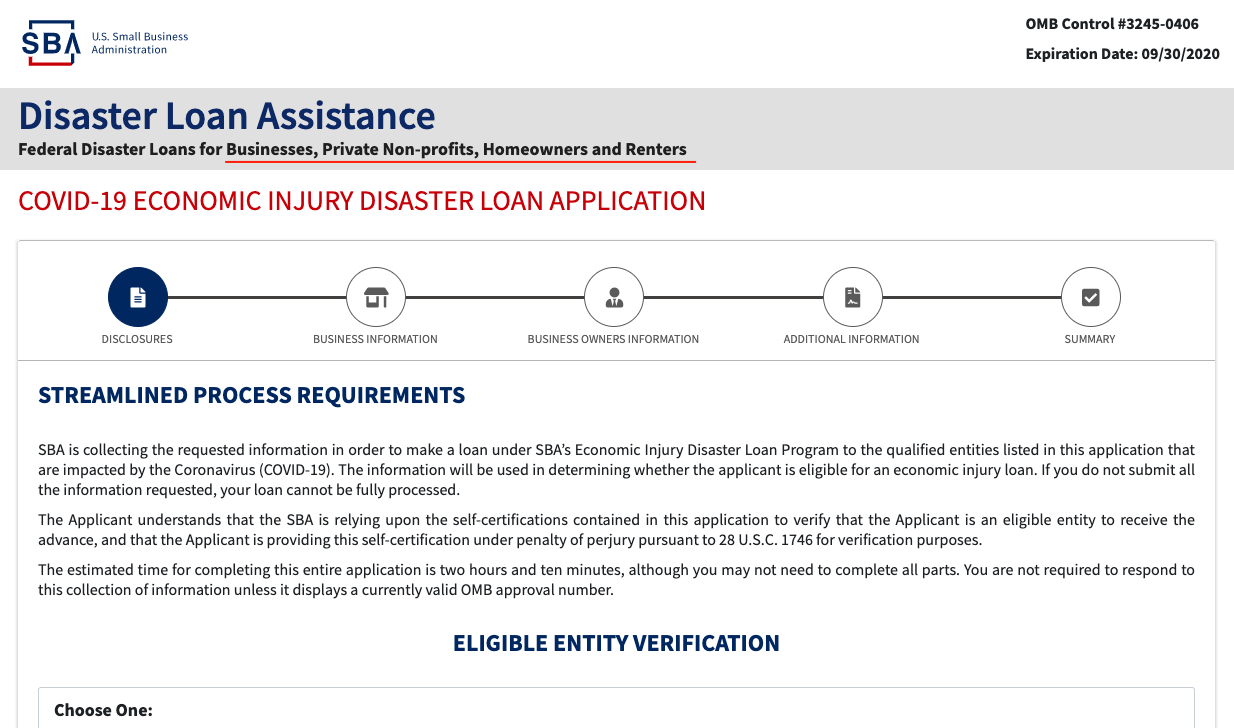

Download Print form and complete or complete version online and print. The APPLICANT must establish that the claimed economic injury is substantial and is. Basic Filing Requirements 8 SBA Loan Application SBA Form 5 or 5C Tax Information Authorization IRS Form 4506T Complete copies of the most recent Federal Income Tax Return Schedule of Liabilities SBA Form 2202 Personal Financial Statement SBA Form 413 Although a paper application and forms are acceptable filing.

Download print loan application and complete. SBA Debt Relief. Electronic Loan Application SBA Form 5 2.

Business Address as indicated on the loan application. You should review your current balances and the original loan documents to complete this section. Personal Financial Statement SBA Form 413 20.

Youll have to show proof of the economic damage that the disaster has caused to be eligible. Use these documents to prepare your disaster loan servicing action request package. F Statement of Personal History - SBA Form 912 If required after completing Form 1919 F Personal Financial Statement - SBA Form 413 Not required but available for lenders to use Business Financial Statement To support a small business owners application and demonstrate ability to repay the a loan the following statements must be prepared.

You can apply for a disaster loan online. Tax Authorization IRS Form 4506-T 20 OwnersGP50 Affiliate 4. Electronic Loan Application SBA Form 5C Sole Proprietorship Only 3.

Hard-of-hearing or by sending an email to disastercustomerservicesbagov EIDL Filing Requirements 1. MUST HAVE BPP COVERAGE Business Personal Property Please return all required documents in PDF format. Approval decision and disbursement of loan funds is dependent on receipt of your documentation.

In cases where businesses seek funding for repairing physical damage applicants must first file an insurance claim. Paying the guaranty fee in a timely manner. Interest rates are fixed for the entire life of the loan are determined by formulas set by law and may vary from disaster to disaster with market conditions.

For either application you must submit the completed loan application and a signed and dated IRS Form 4506-T giving permission for the IRS to provide SBA your tax return information. As part of the application process you will receive emails from DocuSignDocuSign is a secure tool that is used to upload share and sign documents. Loan applications can be downloaded from the SBAs website at sbagovdisaster.

SBA Disaster Loans carry low fixed interest rates and generally feature low fixed monthly payments. SBA Form 5C en Español IRS Form 4506-T. The SBA offers disaster assistance in the form of low interest loans to businesses nonprofit organizations homeowners and renters located in regions affected by declared disasters.

Disaster loan information and application forms may also be obtained by calling the SBAs Customer Service Center at 800-659-2955 800-877-8339 for the deaf and hard-of-hearing or by sending an email to DisasterCustomerServicesbagov. You may also apply in person at any Disaster Recovery Center and receive personal one-on-one help from an SBA representative. Evidence of Hazard Insurance NOT Homeowners or Liability Insurance which must include.

Business Name or Name of the Applicant as indicated on the loan application. You may be required to provide statements and the loan documents as a condition of approval. Note that this benefit is limited to SBA 7a loans and wouldnt be applicable for PPP loans or EIDLs.

Additional Filing Requirements Economic Injury Disaster Loan and Military Reservist Economic Injury Disaster Loan. SBA also provides eligible small businesses and nonprofit organizations with working capital to help overcome the economic injury of a declared disaster. Must Include Policy Number Applicants Name Business Name Business Address and Dates of Coverage.

Complying with the SBA Loan Guaranty Agreement SBA Form 750 SBA Form 750B for short-term loans and any other required supplemental guaranty agreements between Lender and SBA.

Step By Step Guide To The Sba S Economic Injury Disaster Loans For Coronavirus Related Economic Disruptions Ihcc Business

Step By Step Guide To The Sba S Economic Injury Disaster Loans For Coronavirus Related Economic Disruptions Ihcc Business

Sba Loan Application Is Lengthy But Worth Getting Started Right Away Bus Motorcoach News

Sba Loan Application Is Lengthy But Worth Getting Started Right Away Bus Motorcoach News

Sba Disaster Loans Benicia Business

Sba Disaster Loans Benicia Business

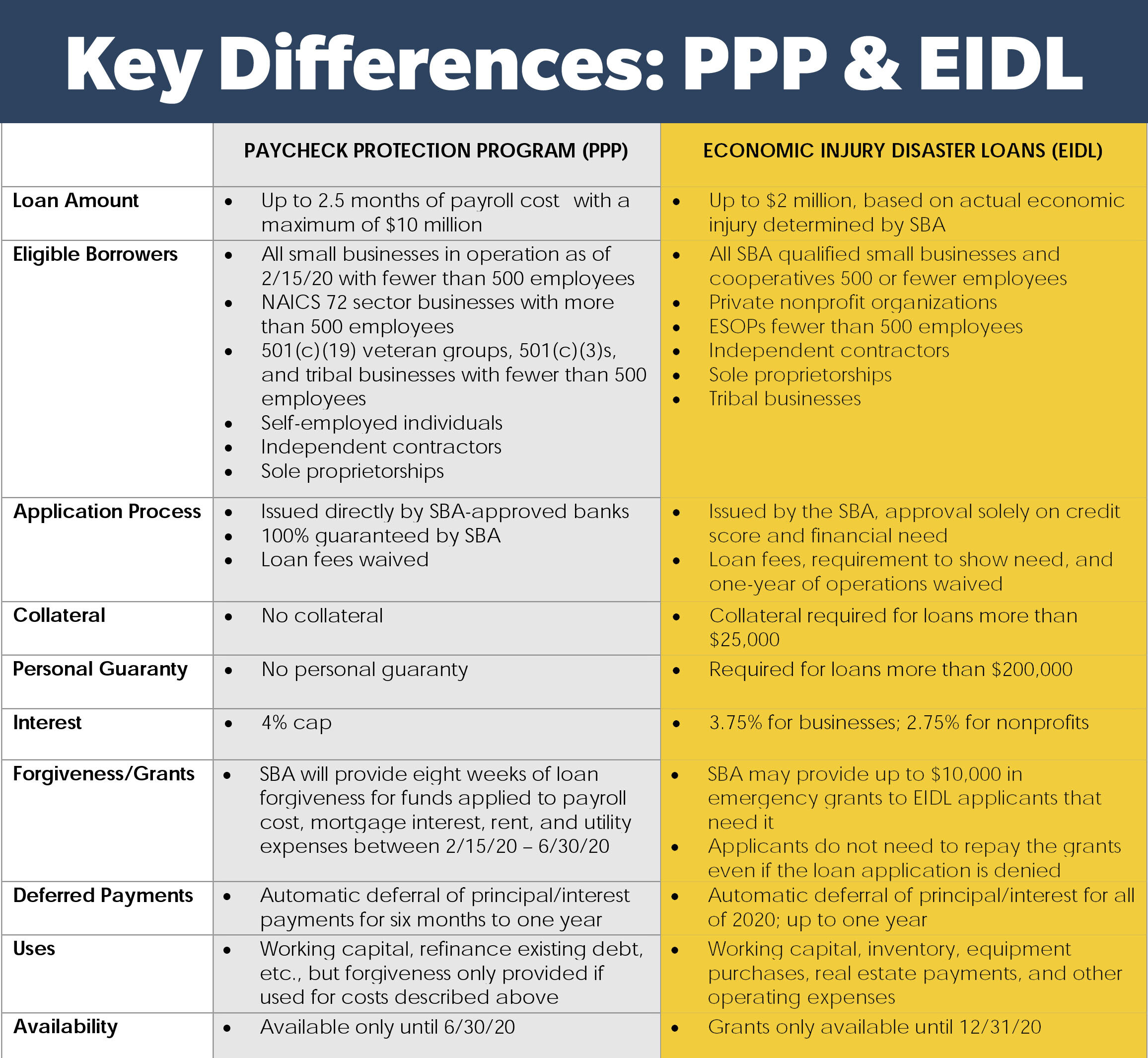

Https Www Sba Gov Sites Default Files Articles Eidl And P3 4 8 2020 2 Pm Pdf

How To Apply For An Sba Disaster Loan

How To Apply For An Sba Disaster Loan

Sba Reopens Online Applications For Disaster Loans Newsday

Sba Reopens Online Applications For Disaster Loans Newsday

Small Business Administration Sba Disaster Loan Faq

Small Business Administration Sba Disaster Loan Faq

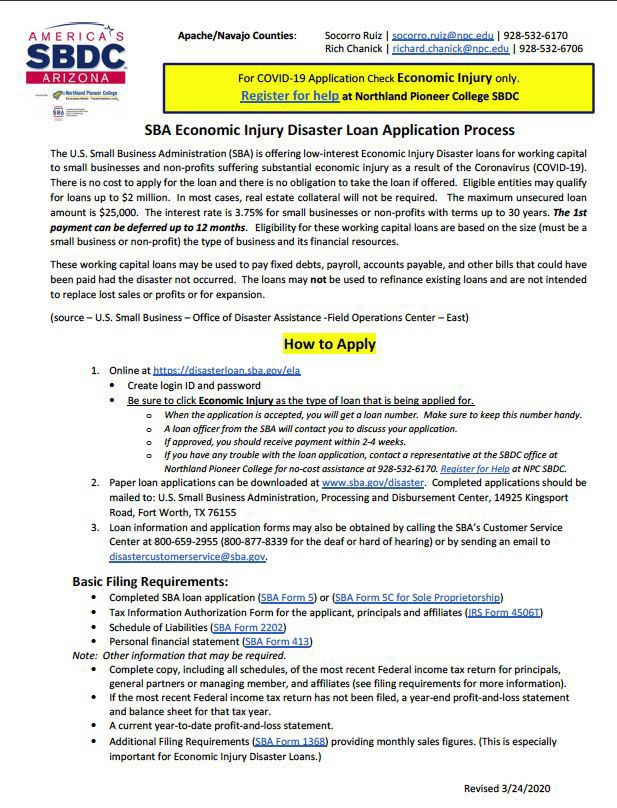

Https Www Sba Gov Sites Default Files Articles Eidl Information And Documentation 3 27 2020 Final Pdf

Quick Guide Sba Disaster Loan Application Specific To Coronavirus Covid 19 Youtube

Quick Guide Sba Disaster Loan Application Specific To Coronavirus Covid 19 Youtube

Sba Disaster Loans And Emergency Grants Artist S Edition What You Need To Know

Sba Disaster Loans And Emergency Grants Artist S Edition What You Need To Know

Sba Disaster Loan Requirements Assistance Eligibility

Sba Disaster Loan Requirements Assistance Eligibility

Sba Economic Injury Disaster Loans Are Still Available Br Startup Junkie

Sba Economic Injury Disaster Loans Are Still Available Br Startup Junkie

Sba Economic Injury Disaster Loan Process Loudoun County Economic Development Va

Sba Economic Injury Disaster Loan Process Loudoun County Economic Development Va

Sba Disaster Loan Process Walkthrough For Home Service Businesses Youtube

Sba Disaster Loan Process Walkthrough For Home Service Businesses Youtube

How To Apply For The Sba Economic Injury Disaster Loan Rapid Finance

How To Apply For The Sba Economic Injury Disaster Loan Rapid Finance

Understanding The Sba Economic Injury Disaster Loan Application Process Startup Junkie

Understanding The Sba Economic Injury Disaster Loan Application Process Startup Junkie

Sba Economic Injury Disaster Loan Application Process Latest News Wmicentral Com

Sba Economic Injury Disaster Loan Application Process Latest News Wmicentral Com

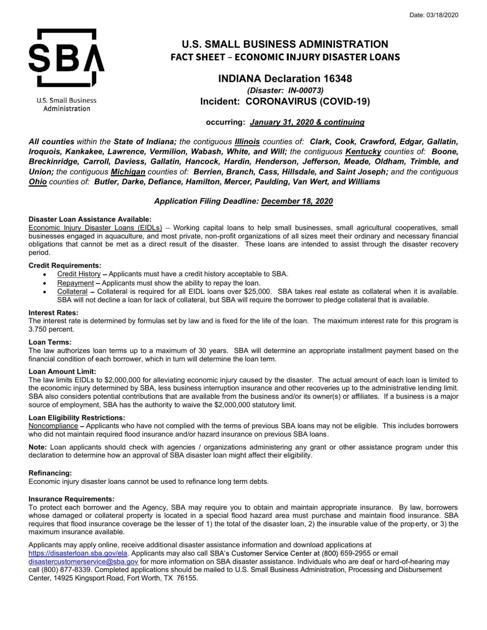

Sba Offers Loans To Help Counter Covid 19 Impact News Tribstar Com

Sba Offers Loans To Help Counter Covid 19 Impact News Tribstar Com

Sba Disaster Loans And Emergency Grants Artist S Edition What You Need To Know

Sba Disaster Loans And Emergency Grants Artist S Edition What You Need To Know