Business Central 1099 Update

The additions are relevant for the reporting year 2020. It will be released in the December 2020 Update and you will need to update the Report.

2020 Irs 1099 Changes Impact On Microsoft Dynamics Gp Rand Group

2020 Irs 1099 Changes Impact On Microsoft Dynamics Gp Rand Group

To update the magnetic media format change the code in the Vendor 1099 Magnetic Media report 10115.

Business central 1099 update. For customers using Business Central online check the Business Central Admin center to see whether the tenants have been updated. Additionally you can set up 1099-G and 1099-S amounts on this page but still wont be able to track and print 1099-G or 1099-S vendor. Importantly this update contains Microsofts changes to the IRS Form 1099-MISC and the release of the 1099-NEC Form.

For example the S-5 field is omitted because its used for real estate taxes and an IRS minimum amount doesnt apply. This function is very useful for tagging transactions for a vendor where we missed initially setting 1099 on. Some fields are intentionally omitted.

Before you submit your reporting for 2020 you must first upgrade your Business Central to handle the new requirements. Before you can update 1099 information for multiple vendors the feature must be turned on in the Feature management workspace. A cumulative update is a cumulative set of files that includes hotfixes and regulatory features for Business Central.

We recommend applying the latest cumulative update. Additionally a new form Vendor 1099 NEC has been added. Each cumulative update is intended mainly for solutions that are experiencing the.

This article lists cumulative updates which have been released for Microsoft Dynamics 365 Business Central. It will be released in the December 2020 Update and you will need to update the Report. Hi Readers This is a quick article about changes in IRS 1099 Form in Dynamics NAV and Business Central.

To make the processing simpler we have provided the following information on how you can set up process and. Select Process Update Form Boxes. The Update 1099 button updates all records.

With every new year processing 1099 statements become a necessity for every accounting team. In Business Central the new 1099 Form Box codes NEC-01 and MISC-14 and a new form Vendor 1099 Nec have been added. Please marl your calendars.

The steps below need to be ran by a user with admin permissions 1. With latest cumulative update Microsoft have released update for North America version which includes a Application change related to IRS 1099 Form. Microsoft Dynamics 365 Business Central 1099 Processing.

It does not contain changes for electronic filing. Delete the following line. Regulatory 1099 Format Changes December 2020.

To do this go to Accounts payable Vendors All vendors Vendor tab Update 1099. Select Update tax 1099 information for. Business Central supports the new 1099 changes and we have provided the steps below on how you can update the forms.

By Bond Consulting Services. Thank you for your information and it is highly appreciated. Dole and all BC users - Here is the latest on the 1099-NEC update from Microsoft.

In the Global Search enter 1099 Form Boxes and select the option in red. Watch this video to learn more about Vendor 1099s in Dynamics 365 Business Central. In order to access the updated forms youll need to upgrade your Business Central environment.

The amount reported on the 1099-G will be for the aggregate amount of all three BWC payments received in the calendar year 2020. Please marl your calendars. Change the code in the Data Item Number 2 - A Record as follows.

According to BWC the forms will be mailed to employers in March 2021 at the latest and BWC will make every effort to issue them as soon as it is possible to do so they are still in the process of collecting W-9s from employers. In Dynamics 365 Business Central the new 1099 Forms includes Box codes NEC-01 and MISC-14. I tried to start installation and found there are more models in updates list than I expected for 1099-NEC KB4598528.

Business Central has added new 1099 Form Box codes NEC-01 MISC-14 and a new Vendor 1099 NEC form all of which are relevant for the reporting year 2020. Contact us for a personalized demo. If we have already tagged records as only partially 1099 reportable on this vendor this will retag all records.

Thanks and Stay Safe Steve. In ERP Microsoft Dynamics How-to Technical Dynamics 365. Before users submit their reporting for 2020 users must first upgrade their Business Central to handle the new requirements by running the action Update Form Boxes on the 1099 Form-Boxes page.

Dole and all BC users - Here is the latest on the 1099-NEC update from Microsoft. To help you find the right files for your version we compiled this short blog post pointing you to each currently supported version of Business Central and NAVs update. In this article we will understand about the update and How partners should apply this hotfix for customers using 1099.

Thanks and Stay Safe Steve. Businesses are required to register with the Ohio Secretary of State to legally conduct business in the State of Ohio this is commonly called a business license. BEGIN MISC InvoiceEntrySETRANGE1099 CodeMISC-MISC-99.

Ohio Business Central 100 of all filings needed to start or maintain a business in Ohio may now be submitted online. You can update the default minimum amounts for 1099-G or 1099-S form fields if they are included. An updated 1099 form must be sent to vendors each year on or before the last day of January.

To do this follow these steps. Latest Update for IRS 1099 Form - msdynav msdyn365bc. A cumulative update is a cumulative set of files that includes all hotfixes and regulatory features that have been released for Microsoft Dynamics 365 Business Central.

The Company Need To E File 1099 Int Form To Show The Interest To The Irs Http Www Onlinefiletaxes Com Income Tax Bookkeeping Services Accounting Services

The Company Need To E File 1099 Int Form To Show The Interest To The Irs Http Www Onlinefiletaxes Com Income Tax Bookkeeping Services Accounting Services

Filing Form 1099 Nec Beginning In Tax Year 2020 Leone Mcdonnell Roberts Professional Association Certified Public Accountants

Filing Form 1099 Nec Beginning In Tax Year 2020 Leone Mcdonnell Roberts Professional Association Certified Public Accountants

Irs Webinar For Small Business Tax Changes 2018 Tax Reform Basics For Small Businesses And Pass Through Entities Thursday Irs Taxes Income Tax Payroll Taxes

Irs Webinar For Small Business Tax Changes 2018 Tax Reform Basics For Small Businesses And Pass Through Entities Thursday Irs Taxes Income Tax Payroll Taxes

Best 50 Online Job Search Websites Pouted Com Online Job Search Job Search Websites Online Job Websites

Best 50 Online Job Search Websites Pouted Com Online Job Search Job Search Websites Online Job Websites

2020 Irs 1099 Changes Impact On Microsoft Dynamics Gp Rand Group

2020 Irs 1099 Changes Impact On Microsoft Dynamics Gp Rand Group

2015 W2 Fillable Form Fillable Form Ir 25 City In E Tax Return For Fillable Forms Power Of Attorney Form 1099 Tax Form

2015 W2 Fillable Form Fillable Form Ir 25 City In E Tax Return For Fillable Forms Power Of Attorney Form 1099 Tax Form

2020 Irs 1099 Changes Impact On Microsoft Dynamics Gp Rand Group

2020 Irs 1099 Changes Impact On Microsoft Dynamics Gp Rand Group

2020 Information Reporting Reminders Bkd Llp

1099 Form Fillable What Is Irs Form 1099 Q Turbotax Tax Tips Videos Tax Forms 1099 Tax Form Irs Forms

1099 Form Fillable What Is Irs Form 1099 Q Turbotax Tax Tips Videos Tax Forms 1099 Tax Form Irs Forms

Setting Up 1099s In Dynamics 365 Finance Supply Chain Management Encore Business Solutions

Setting Up 1099s In Dynamics 365 Finance Supply Chain Management Encore Business Solutions

Have You Been Blowing Off Your Small Business Bookkeeping Check Out This List Of Small Business Bookkeepi Diy Crafts To Sell Diy For Teens Christmas Decor Diy

Have You Been Blowing Off Your Small Business Bookkeeping Check Out This List Of Small Business Bookkeepi Diy Crafts To Sell Diy For Teens Christmas Decor Diy

What Is Form 1099 Nec How Do I File Form 1099 Nec Gusto

What Is Form 1099 Nec How Do I File Form 1099 Nec Gusto

2020 Irs 1099 Changes Impact On Microsoft Dynamics Gp Rand Group

2020 Irs 1099 Changes Impact On Microsoft Dynamics Gp Rand Group

Setting Up 1099s In Dynamics 365 Finance Supply Chain Management Encore Business Solutions

Setting Up 1099s In Dynamics 365 Finance Supply Chain Management Encore Business Solutions

/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png) Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

Microsoft Dynamics Gp Fall 2020 Add Dba Name Field On Vendor Maintenance Window For 1099 Vendors Microsoft Dynamics Gp Community

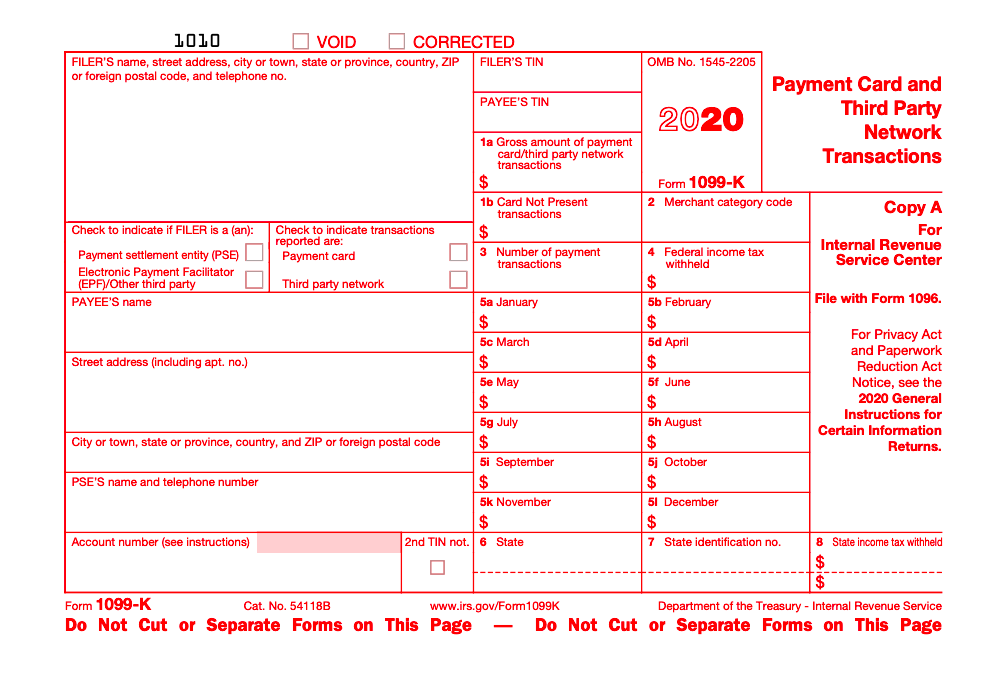

Form 1099 K Everything You Need To Know Bench Accounting

Form 1099 K Everything You Need To Know Bench Accounting

Microsoft Dynamics Gp Fall 2020 Add Dba Name Field On Vendor Maintenance Window For 1099 Vendors Microsoft Dynamics Gp Community